Tax Deductions For Teachers And Educators Taxbiz Usa

Tax Deductions For Teachers And Educators Taxbiz Usa Educators can take advantage of tax deductions for qualified out of pocket expenses related to their profession such as classroom supplies, training, and travel. as such, as the new school year begins, teachers, administrators, and aides should remember to keep track of education related expenses that could help reduce the amount of tax owed. Topic no. 458, educator expense deduction. topic no. 458, educator expense deduction. if you're an eligible educator, you can deduct up to $300 ($600 if married filing jointly and both spouses are eligible educators, but not more than $300 each) of unreimbursed trade or business expenses. qualified expenses are amounts you paid or incurred for.

Tax Deductions For Teachers Educator Expenses Money Instructor Deducting teachers' educational expenses. an eligible educator can deduct up to $300 of any unreimbursed business expenses for classroom materials, such as books, supplies, computers (including related software and services) or other equipment that the eligible educator uses in the classroom. supplies for courses on health and physical. For the upcoming tax season (i.e., the 2024 tax year, returns filed in early 2025), the maximum educator expense deduction is $300. if you are an eligible educator (more on that later), you can. The teachers on the teach starter team have compiled the latest updates to the teacher deductions allowed by the irs, along with some tips for teachers on maximizing the 2024 educator expense credit and a teacher tax deduction list. plus, we’ve answered some of our community’s most asked questions about filing taxes when you work in education!. Key points: educator expense deduction: teachers can deduct up to $300 for unreimbursed school related expenses on their federal tax returns, or up to $600 if both spouses are educators filing jointly. this is an above the line deduction, so it doesn’t require itemizing. eligible educators and expenses: the deduction is available to educators.

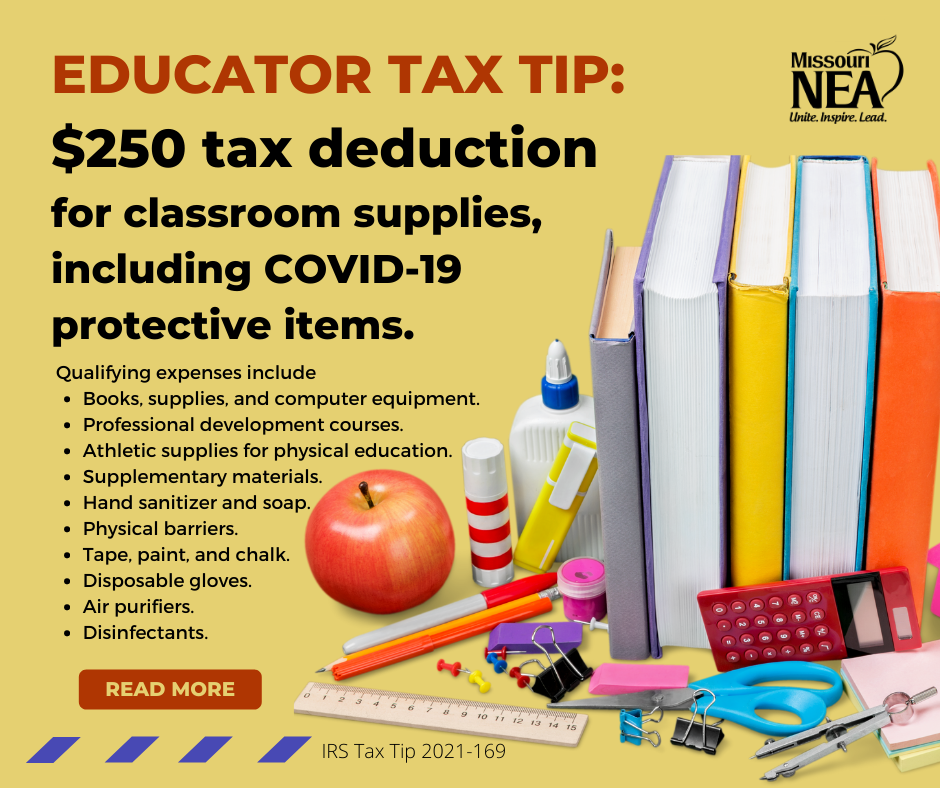

2021 Tax Tip 250 Educator Expense Deduction Mnea Missouri National The teachers on the teach starter team have compiled the latest updates to the teacher deductions allowed by the irs, along with some tips for teachers on maximizing the 2024 educator expense credit and a teacher tax deduction list. plus, we’ve answered some of our community’s most asked questions about filing taxes when you work in education!. Key points: educator expense deduction: teachers can deduct up to $300 for unreimbursed school related expenses on their federal tax returns, or up to $600 if both spouses are educators filing jointly. this is an above the line deduction, so it doesn’t require itemizing. eligible educators and expenses: the deduction is available to educators. The big tax news for educators this year is that the internal revenue service has expanded the educator expense deduction, from $250 to $300. the change marks the first increase since the. The educator expense deduction allows eligible educators to deduct up to $300 worth of qualified expenses from their income for 2023 and 2024. qualified expenses include books, classroom supplies, and technology and computer software used in the classroom during the process of teaching students. eligible educators have to work as a teacher.

Comments are closed.