Tax Introduction To Income Taxation

Ppt Introduction To Income Taxes Powerpoint Presentation Free When income taxes were first introduced, in 1917, single people had a personal exemption of $29,757 in today’s dollars, while married people had an exemption of $59,514. over those amounts, they were taxed just 4%. now, married and single people have identical federal personal exemptions, at around $15,000. the top federal tax rate is 33%. This item: introduction to federal income taxation in canada, 44th edition (2023 2024) canadian income tax act with regulations, 115th edition, 2023.

Income Tax Introduction Youtube Cfe tax: a guide to understanding the basics of canadian income taxation, 9th edition is an easy to read text on federal income taxation in canada mainly focusing on giving students a basic understanding of income taxation and is designed to introduce readers to the basics of income taxation using plain language.< p>. Today, approximately one half of the federal government ’s revenue is derived from personal income tax, a significant increase from 2.6 per cent in 1918. in 1938, 2.3 per cent of canada’s population filed tax returns. that figure dramatically increased over the years, and today it sits at almost 80 per cent. first world war. The birth of income tax in canada. although taxation has existed in various forms for centuries, the first instance of income tax in canada was by the government of sir robert borden during world war i. canada’s minister of finance at the time, sir thomas white, introduced the income war tax act as a temporary measure to finance the war. Just as bridges connect parts of canada together, canadian income taxation: planning and decision making connects tax law and its application, to business and investment transactions and decision making. taxation is more exciting and interesting—and less complex—than it is reputed to be. this 2024 2025 edition of canadian income taxation: planning and decision making is written in a manner.

2 Introduction To Income Tax Introduction To Income Taxation Income The birth of income tax in canada. although taxation has existed in various forms for centuries, the first instance of income tax in canada was by the government of sir robert borden during world war i. canada’s minister of finance at the time, sir thomas white, introduced the income war tax act as a temporary measure to finance the war. Just as bridges connect parts of canada together, canadian income taxation: planning and decision making connects tax law and its application, to business and investment transactions and decision making. taxation is more exciting and interesting—and less complex—than it is reputed to be. this 2024 2025 edition of canadian income taxation: planning and decision making is written in a manner. The constitution act, 1867 gave parliament unlimited taxing powers and restricted those of the provinces to mainly direct taxation (taxes on income and property, rather than on activities such as trade). personal income tax and corporate taxes were introduced in 1917 to help finance the first world war (see income tax in canada). 2024 2025 introduction to federal income taxation in canada with study guide, 45th edition. by wolters kluwer tax canada. $230.00. isbn: 9781773792514 author:.

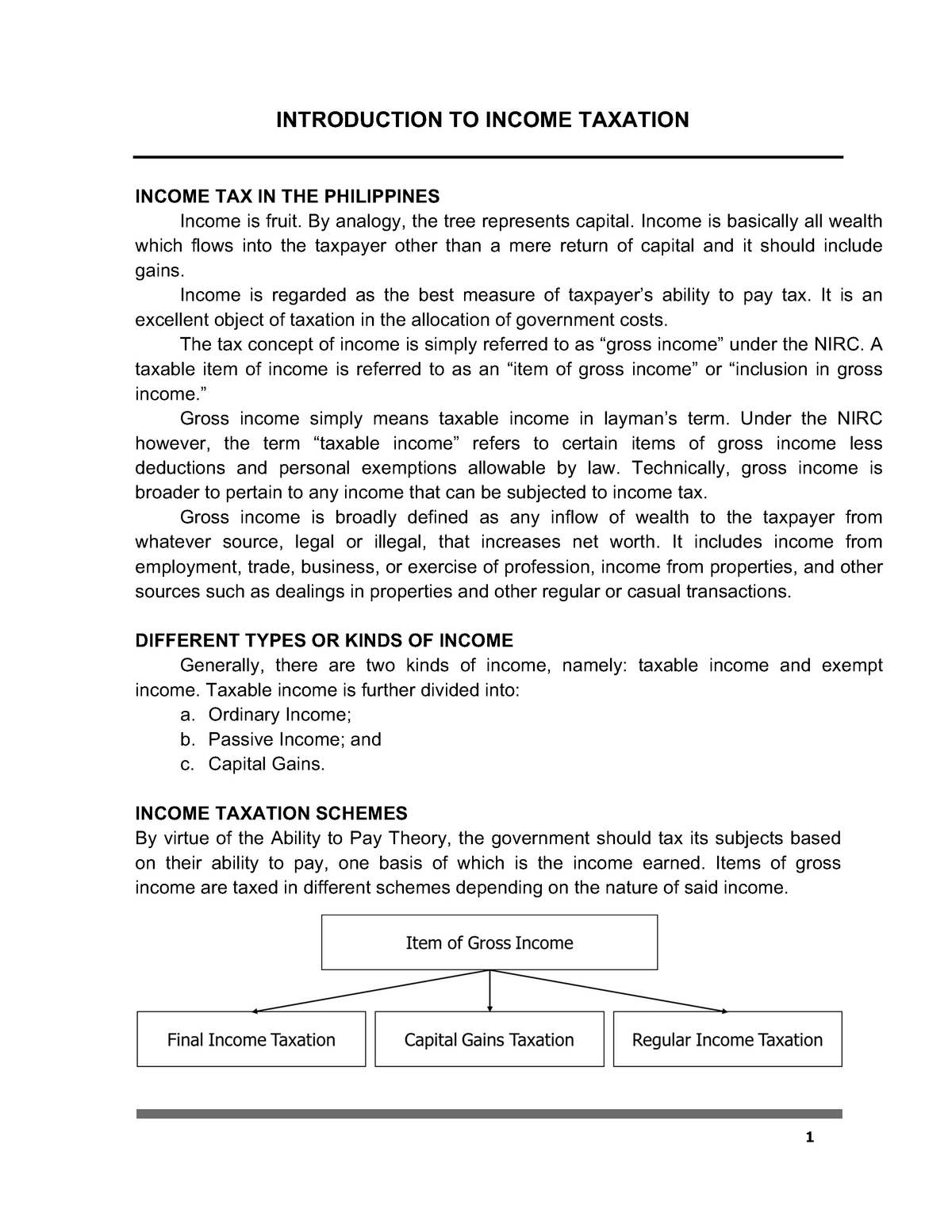

Comments are closed.