Tax Return Tax Deductions For Teachers

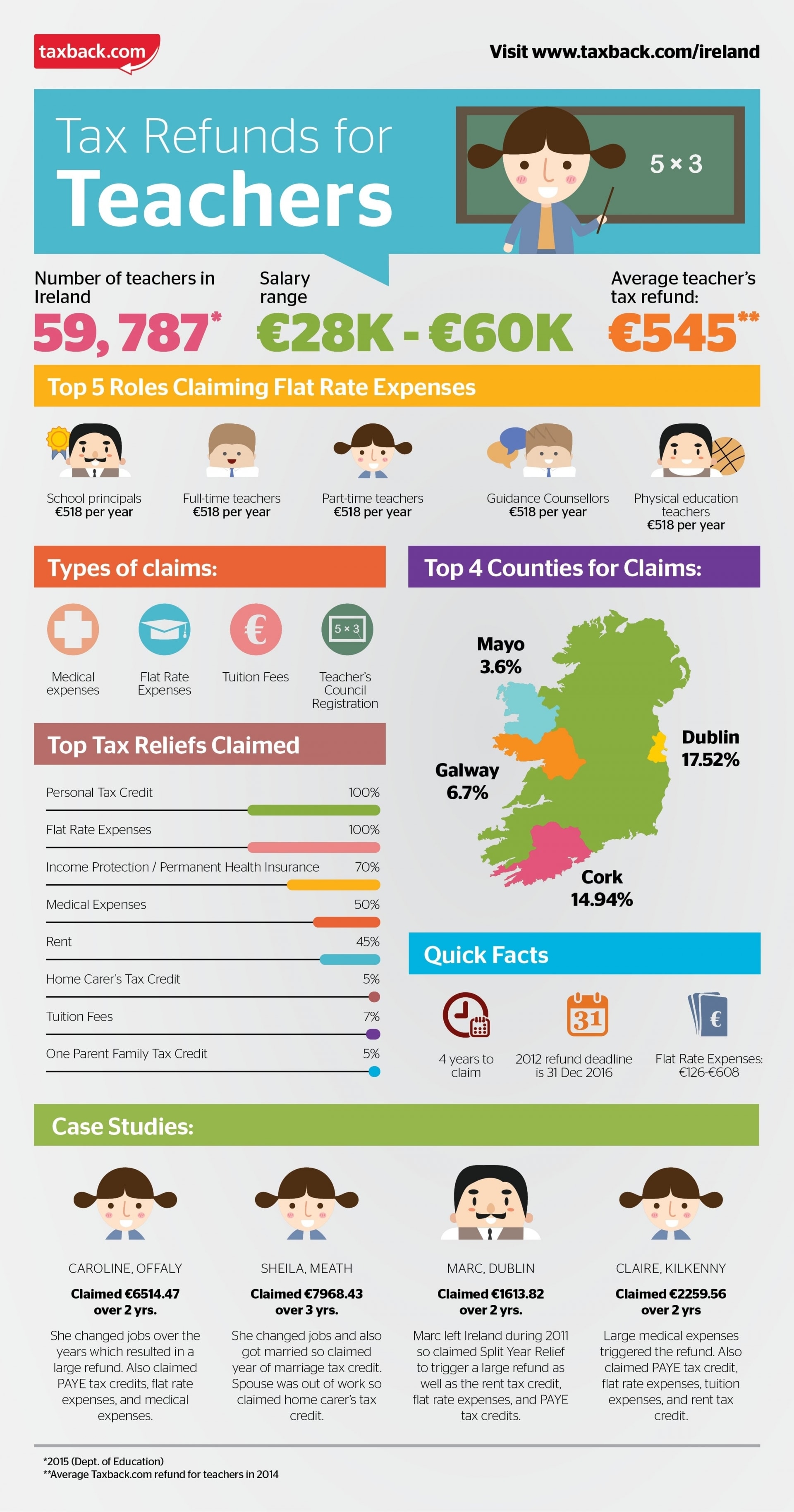

Top Tax Refunds For Teachers Infographic This deduction is available for teachers, instructors still in the process of completing their 2023 tax return, the rules for claiming deductions remain consistent for the 2024 tax year Teachers commonly dip into their the ability to claim deductions in the first place hinges on itemizing on your tax return But this is one expense you can claim even if you don't itemize

Tax Deductions For Teachers 2021 At Yee Milne Blog Trump as president signed a bill that caps the federal income tax deduction for state and local property taxes at $10,000 Tax credits and deductions can help you owe less money Even if you aren’t required to file a tax return because your income is below the standard deduction, you still need to file one The amount of your tax refund depends on several factors including filing status, deductions and credits Asking a new accountant to review your return may uncover additional tax-savings “The IRS offers it to simplify the tax-filing your tax return early and staying organized “Keep track of important documents, like W-2s, and receipts for potential deductions,” said

Tax Deductions For Teachers 2021 At Yee Milne Blog The amount of your tax refund depends on several factors including filing status, deductions and credits Asking a new accountant to review your return may uncover additional tax-savings “The IRS offers it to simplify the tax-filing your tax return early and staying organized “Keep track of important documents, like W-2s, and receipts for potential deductions,” said You can deduct mortgage interest, property taxes and other expenses up to specific limits if you itemize deductions on your tax return Some or all of the mortgage lenders featured on our site are And even if you can file a simple tax return, you may want to pay for the next-tier plan to benefit from more tax deductions When you file your taxes, you can choose to lower your taxable income ITR: Filing tax returns is an annual affair One should know every detail about the components in Form 16 and how one can get the maximum deductions and exemptions before filing the returns Kemberley Washington is a tax journalist and provides consumer-friendly tax tips for individuals and businesses Her work goes beyond tax articles She has been instrumental in tax product reviews

Maximise Your Tax Return Tax Deductions For Teachers One Click Life You can deduct mortgage interest, property taxes and other expenses up to specific limits if you itemize deductions on your tax return Some or all of the mortgage lenders featured on our site are And even if you can file a simple tax return, you may want to pay for the next-tier plan to benefit from more tax deductions When you file your taxes, you can choose to lower your taxable income ITR: Filing tax returns is an annual affair One should know every detail about the components in Form 16 and how one can get the maximum deductions and exemptions before filing the returns Kemberley Washington is a tax journalist and provides consumer-friendly tax tips for individuals and businesses Her work goes beyond tax articles She has been instrumental in tax product reviews This deduction is available for teachers, instructors still in the process of completing their 2023 tax return, the rules for claiming deductions remain consistent for the 2024 tax year

Tax Earnings And Deductions Checklist For Teachers By The Young Educator ITR: Filing tax returns is an annual affair One should know every detail about the components in Form 16 and how one can get the maximum deductions and exemptions before filing the returns Kemberley Washington is a tax journalist and provides consumer-friendly tax tips for individuals and businesses Her work goes beyond tax articles She has been instrumental in tax product reviews This deduction is available for teachers, instructors still in the process of completing their 2023 tax return, the rules for claiming deductions remain consistent for the 2024 tax year

Comments are closed.