The Fair Credit Reporting Act Of 1970 Module 2 Of 5

The Guide To Understanding The Fair Credit Reporting Act Fcra Visit us at lawshelf to earn college credit for only $20 a credit! we now offer multi packs, which allow you to purchase 5 exams for the price of. The fcra is part of a group of laws contained in the federal consumer credit protection act, 15 u.s.c. § 1601 et seq. congress amended fcra with the fair and accurate credit transactions act of 2003 (fact act). [1] the fact act created new responsibilities for consumer reporting agencies and users of consumer reports.

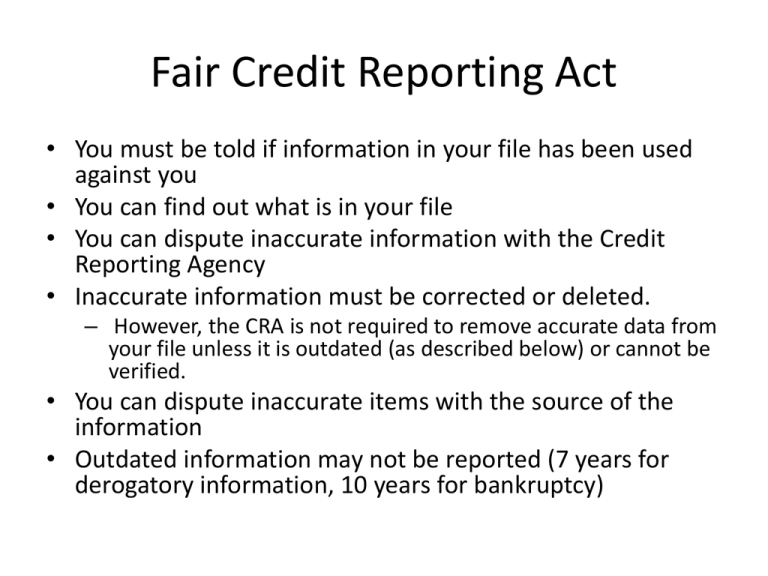

Fair Credit Reporting Act U S Government Bookstore Fcra may2023 508.pdf (652.93 kb) the act (title vi of the consumer credit protection act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. information in a consumer report cannot be provided to anyone who does not have a purpose specified in the act. This title may be cited as the fair credit reporting act. § 602. congressional findings and statement of purpose [15 u.s.c. § 1681] (a) accuracy and fairness of credit reporting. the congress makes the following findings: (1) the banking system is dependent upon fair and accurate credit reporting. inaccurate credit. This title may be cited as the “fair credit reporting act.” § 602. congressional findings and statement of purpose [15 u.s.c. § 1681] (a) accuracy and fairness of credit reporting. the congress makes the following findings: (1) the banking system is dependent upon fair and accurate credit reporting. Information in your credit report. unsolicited “prescreened” offers for credit and insurance must include a toll free phone number you can call if you choose to remove your name and address form the lists these offers are based on. you may opt out with the nationwide credit bureaus at 1 888 5 optout (1 888 567 8688).

The Impact Of The Fair Credit Reporting Act A Comprehensive Guide This title may be cited as the “fair credit reporting act.” § 602. congressional findings and statement of purpose [15 u.s.c. § 1681] (a) accuracy and fairness of credit reporting. the congress makes the following findings: (1) the banking system is dependent upon fair and accurate credit reporting. Information in your credit report. unsolicited “prescreened” offers for credit and insurance must include a toll free phone number you can call if you choose to remove your name and address form the lists these offers are based on. you may opt out with the nationwide credit bureaus at 1 888 5 optout (1 888 567 8688). The fair credit reporting act, as originally enacted, was title vi of pub. l. tooltip public law (united states) 91–508, 84 stat. 1114, enacted october 26, 1970, entitled an act to amend the federal deposit insurance act to require insured banks to maintain certain records, to require that certain transactions in united states currency be. Edit reporting actnan728 shutterstock the fair credit reporting act (fcra) is a widely used statute governing the collection, maintenance, and disc. osure of consumers’ personal information. in addition to regulating consumer reporting agencies, the statute imposes a number of obligations on parties that supply consumer informatio.

Fair Credit Reporting Act The fair credit reporting act, as originally enacted, was title vi of pub. l. tooltip public law (united states) 91–508, 84 stat. 1114, enacted october 26, 1970, entitled an act to amend the federal deposit insurance act to require insured banks to maintain certain records, to require that certain transactions in united states currency be. Edit reporting actnan728 shutterstock the fair credit reporting act (fcra) is a widely used statute governing the collection, maintenance, and disc. osure of consumers’ personal information. in addition to regulating consumer reporting agencies, the statute imposes a number of obligations on parties that supply consumer informatio.

Comments are closed.