The Ira Tax Break Explained Traditional Ira Tax Deduction

The Ira Tax Break Explained Traditional Ira Tax Deduction Youtube Because you get that upfront tax break, you pay taxes when you withdraw funds from a traditional all explained in IRS Publication 590-B: Distributions From Individual Retirement Arrangements (IRAs In the ruling, the IRS explained tax-deferred account type such as an IRA to circumvent the wash-sale rule It applies to traditional and Roth IRAs, regardless of whether the IRAs are held at

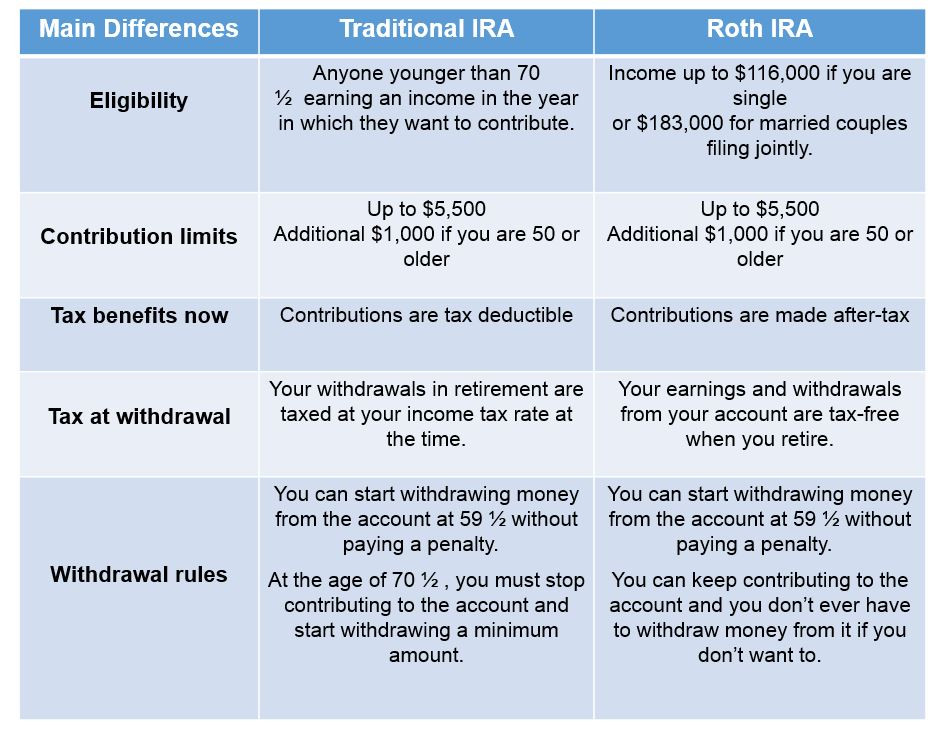

Iras Traditional And Roth Voya A traditional IRA helps you save for retirement and might give you a tax break today to enjoy the full deduction to a traditional IRA If you’re married and earning $240,000 or more The two main IRA types are traditional and Roth but qualifying withdrawals are 100% tax-free Let’s break down these options further A Roth IRA is a retirement account that offers several To contribute to a traditional to an IRA or other retirement account Saver's Credit: A Retirement Tax Break for the Middle Class In addition to the usual IRA deduction, you may qualify One of the most significant advantages of a setting up a traditional IRA is the potential tax deduction on contributions This deduction can lower your taxable income for the year potentially

The Ira Tax Break Explained Traditional Ira Tax Deduction To contribute to a traditional to an IRA or other retirement account Saver's Credit: A Retirement Tax Break for the Middle Class In addition to the usual IRA deduction, you may qualify One of the most significant advantages of a setting up a traditional IRA is the potential tax deduction on contributions This deduction can lower your taxable income for the year potentially However, the highest-income earners may no longer qualify for a full tax deduction if their and the advantage of an initial tax break Opening a traditional IRA is especially appealing if For married couples filing jointly and qualifying widow(er)s who have workplace plans, the full traditional IRA deduction is available you may be entitled to a tax break for improvements A backdoor Roth IRA is not officially one of the best retirement plans, but rather a way for high-income taxpayers to fund a Roth IRA despite exceeding traditional income limits Converting a Many people contribute to an individual retirement account in order to qualify for a tax deduction However, those who are not eligible to contribute to a tax-deductable traditional IRA or a Roth

3 Types Of Iras Due However, the highest-income earners may no longer qualify for a full tax deduction if their and the advantage of an initial tax break Opening a traditional IRA is especially appealing if For married couples filing jointly and qualifying widow(er)s who have workplace plans, the full traditional IRA deduction is available you may be entitled to a tax break for improvements A backdoor Roth IRA is not officially one of the best retirement plans, but rather a way for high-income taxpayers to fund a Roth IRA despite exceeding traditional income limits Converting a Many people contribute to an individual retirement account in order to qualify for a tax deduction However, those who are not eligible to contribute to a tax-deductable traditional IRA or a Roth When that happens, you’re going to need every tax break you can get When you contribute new money to a traditional IRA or 401(k), you get a tax deduction that tax year, and the money

Tax Breaks With An Ira Sfs Tax Accounting Services A backdoor Roth IRA is not officially one of the best retirement plans, but rather a way for high-income taxpayers to fund a Roth IRA despite exceeding traditional income limits Converting a Many people contribute to an individual retirement account in order to qualify for a tax deduction However, those who are not eligible to contribute to a tax-deductable traditional IRA or a Roth When that happens, you’re going to need every tax break you can get When you contribute new money to a traditional IRA or 401(k), you get a tax deduction that tax year, and the money

Comments are closed.