The Ppp Loan Company That Went Bankrupt

Hundreds Of Companies That Got Ppp Loans Later Went Bankrupt Daily The justice department announced today that now bankrupt financial technology company kabbage inc., doing business as kservicing, has agreed to resolve allegations that it violated the false claims act (fca) by knowingly submitting thousands of false claims for loan forgiveness, loan guarantees, and processing fees to the u.s. small business administration (sba) in connection with its. Small business loan servicer kservicing filed for bankruptcy tuesday amid allegations it was too lax in its issuing of government backed covid 19 relief loans, according to court documents. the firm, formerly known as kabbage, processed more than $7 billion worth of paycheck protection program (ppp) loans before the company’s technology and a.

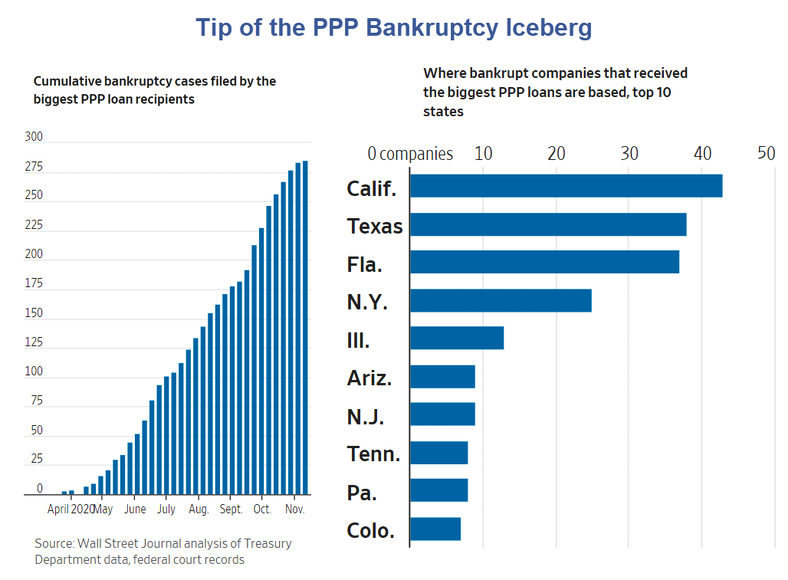

Hundreds Of Companies That Got Ppp Loans Later Went Bankrupt Daily Yet nearly three years after the rollout of ppp, the vast majority of loans have been forgiven. an npr analysis of data released on jan. 8 by the small business administration found that 92% of. Bankrupt loan servicer kabbage inc. won court approval of a chapter 11 liquidation plan that will transfer the company’s pandemic assistance loan servicing obligations to a third party. kabbage will work with its banking partners, the small business administration, and the federal reserve bank of san francisco to transition its loan servicing. Half of the 285 companies that the journal found went bankrupt had filed for bankruptcy since august. these firms come from almost every state, and many said the pandemic served as the catalyst. Loans awarded to businesses that went bust amounted to between $228 million and $509 million, the analysis found. the companies that filed for bankruptcy employed a total of 23,400 people visit.

Hundreds Of Companies That Got Ppp Loans Have Gone Bankrupt More Half of the 285 companies that the journal found went bankrupt had filed for bankruptcy since august. these firms come from almost every state, and many said the pandemic served as the catalyst. Loans awarded to businesses that went bust amounted to between $228 million and $509 million, the analysis found. the companies that filed for bankruptcy employed a total of 23,400 people visit. Now, companies on the road out of bankruptcy — which usually takes years to complete — can apply for ppp loans before the program’s may 31 deadline. with $50 billion left after several. Loan forgiveness. loan forgiveness is attractive to borrowers of the ppp loan, and people today are still eligible. business owners can be forgiven for the entire loan if they prove they spent 60% of the funds on payroll costs. those generally include gross pay, wages, bonuses, etc. the two requirements for the full loan forgiveness were that.

Comments are closed.