The Role Of Capital Flows To Sustainable Growth In Emerging Markets

The Role Of Capital Flows To Sustainable Growth In Emerging Markets The contribution of capital flows to sustainable growth in em. rging marketsthank you for the honour of inviting me to give this lecture. considering the people who have previously spoken at this forum, considering the stature of the audience here today, and also considering the legacy of michel camdessus, who led the international. monetary. Lesetja kganyago: the contribution of capital flows to sustainable growth in emerging markets. text of the 2023 michel camdessus central banking lecture by mr lesetja kganyago, governor of the south african reserve bank, at the international monetary fund, washington dc, 11 july 2023.

Total Emerging Market Capital Flows 1978вђ 2014 Download Scientific After years of success, however, emerging markets—as a group—are now facing a new, harsh reality. growth rates are down, capital flows have reversed, and medium term prospects have deteriorated sharply. last year, for example, emerging markets saw an estimated $531 billion in net capital outflows, compared with $48 billion in net inflows in. Abstract. we examine the association between capital inflows and industry growth in a sample of 22 emerging market economies from 1998 to 2010. we expect more external finance dependent industries, in countries that host more capital inflows, to grow disproportionately faster. this is indeed the case in the pre crisis period of 1998–2007. The empirical evidence is structured based on the recognition that the drivers of capital flows vary over time and across different types of capital flows. the drivers are classified using the traditional distinction between ‘push’ and ‘pull’ drivers, which continues to serve as a useful framework. Emerging markets are increasingly becoming a source of growth in the complex global economy. brazil, russia, india, indonesia, china and south korea are projected to account for approximately 45 percent of the global output by the year 2025, up from 37 percent in 2011, according to a report from the international monetary fund. 1.

Ppt Managing Capital Flows In Emerging Market Economies Powerpoint The empirical evidence is structured based on the recognition that the drivers of capital flows vary over time and across different types of capital flows. the drivers are classified using the traditional distinction between ‘push’ and ‘pull’ drivers, which continues to serve as a useful framework. Emerging markets are increasingly becoming a source of growth in the complex global economy. brazil, russia, india, indonesia, china and south korea are projected to account for approximately 45 percent of the global output by the year 2025, up from 37 percent in 2011, according to a report from the international monetary fund. 1. 3, we discuss the growth and evolution of the sustainable finance markets for ems focusing on the overall 5 financial markets and climate transition opportunities, challenges and policy implications, 2021, oecd 6 costs or benefits? assessing the economy wide effects of the electricity sector's low carbon transition—the role of capital costs. Foreign direct investment across the many sectors impacting (or impacted by) climate change —“green fdi” for short—is the most important segment of these much needed private capital flows. with sectors ranging from agriculture and forestry to energy and infrastructure, it is difficult to track green fdi investment flows comprehensively.

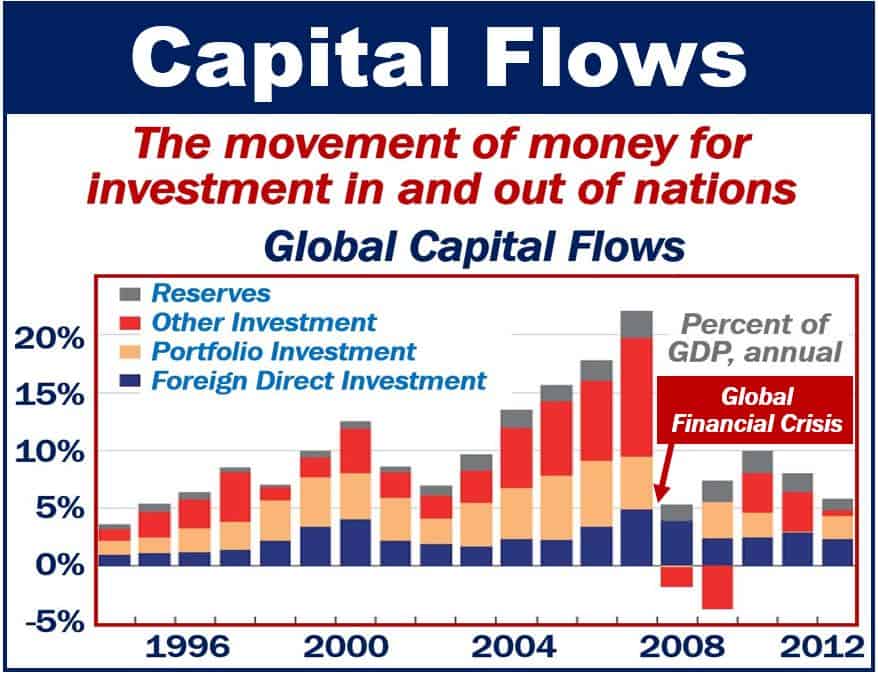

What Are Capital Flows Definition And Examples Market Business News 3, we discuss the growth and evolution of the sustainable finance markets for ems focusing on the overall 5 financial markets and climate transition opportunities, challenges and policy implications, 2021, oecd 6 costs or benefits? assessing the economy wide effects of the electricity sector's low carbon transition—the role of capital costs. Foreign direct investment across the many sectors impacting (or impacted by) climate change —“green fdi” for short—is the most important segment of these much needed private capital flows. with sectors ranging from agriculture and forestry to energy and infrastructure, it is difficult to track green fdi investment flows comprehensively.

Capital Flows To Emerging Markets Download Scientific Diagram

Comments are closed.