Three Tips To Maximize Your Employer Benefits Wealthnest Planners

Three Tips To Maximize Your Employer Benefits Wealthnest Planners Your employer benefits can add as much as 30 percent to the value of your salary. and it does add up: consider the value of insurance, retirement plans, other tax deferred savings plans, employer matches, and other benefits, and you could easily find you have access to many thousands of additional dollars per year. Here are 8 tips that can help you maximize your employee benefits: #1: understand your employee benefits package. your employer may offer a variety of benefits, from retirement plans and stock options to health insurance and wellness perks. to maximize your employee benefits, the first step is to gain a clear understanding of your options.

Does Your Employer Offer Benefits They Should Budget Boss Make sure you’re contributing at least the same amount as the employer match offer to maximize your benefits. let’s say your employer offers a match up to 3%, so you contribute 3% of your pay to your 401 (k). your employer will then contribute approximately 3% of your income to your 401 (k), doubling your money to a cumulative 6%. Legally mandated benefits are employee benefits that are required by federal, state or local laws. these benefits can include minimum wage, overtime pay, unemployment insurance, fmla, cobra and. Managing overall wellness. encourage your employees to stay active and put those wellness checkups and dental visits to good use. reassure your employees their health is a priority. in the. Health and wellness benefits are an important part of any comprehensive employee benefits plan. these benefits support employees’ physical, mental and emotional health, ensuring that workers can bring their best, healthiest selves to work. some health benefits are mandated by state or federal law, while others are voluntary.

Why Employee Benefits Are Important Importance Of Employee Benefits Managing overall wellness. encourage your employees to stay active and put those wellness checkups and dental visits to good use. reassure your employees their health is a priority. in the. Health and wellness benefits are an important part of any comprehensive employee benefits plan. these benefits support employees’ physical, mental and emotional health, ensuring that workers can bring their best, healthiest selves to work. some health benefits are mandated by state or federal law, while others are voluntary. 2. set goals for your benefits program. having goals or objectives for your benefits program will help you decide what benefits are best for your company. if you are unsure where to begin, start with the smart method. smart is an acronym for specific, measurable, achievable, relevant, and time bound. Employee benefits are the non salaried portion of employee compensation. standard employee benefits are medical insurance, vision and dental coverage, life insurance policies, and retirement planning support. benefits packages can be available to part time and full time employees, at the discretion of the company.

Maximizing Your Employee Benefits Wealthnest Planners 2. set goals for your benefits program. having goals or objectives for your benefits program will help you decide what benefits are best for your company. if you are unsure where to begin, start with the smart method. smart is an acronym for specific, measurable, achievable, relevant, and time bound. Employee benefits are the non salaried portion of employee compensation. standard employee benefits are medical insurance, vision and dental coverage, life insurance policies, and retirement planning support. benefits packages can be available to part time and full time employees, at the discretion of the company.

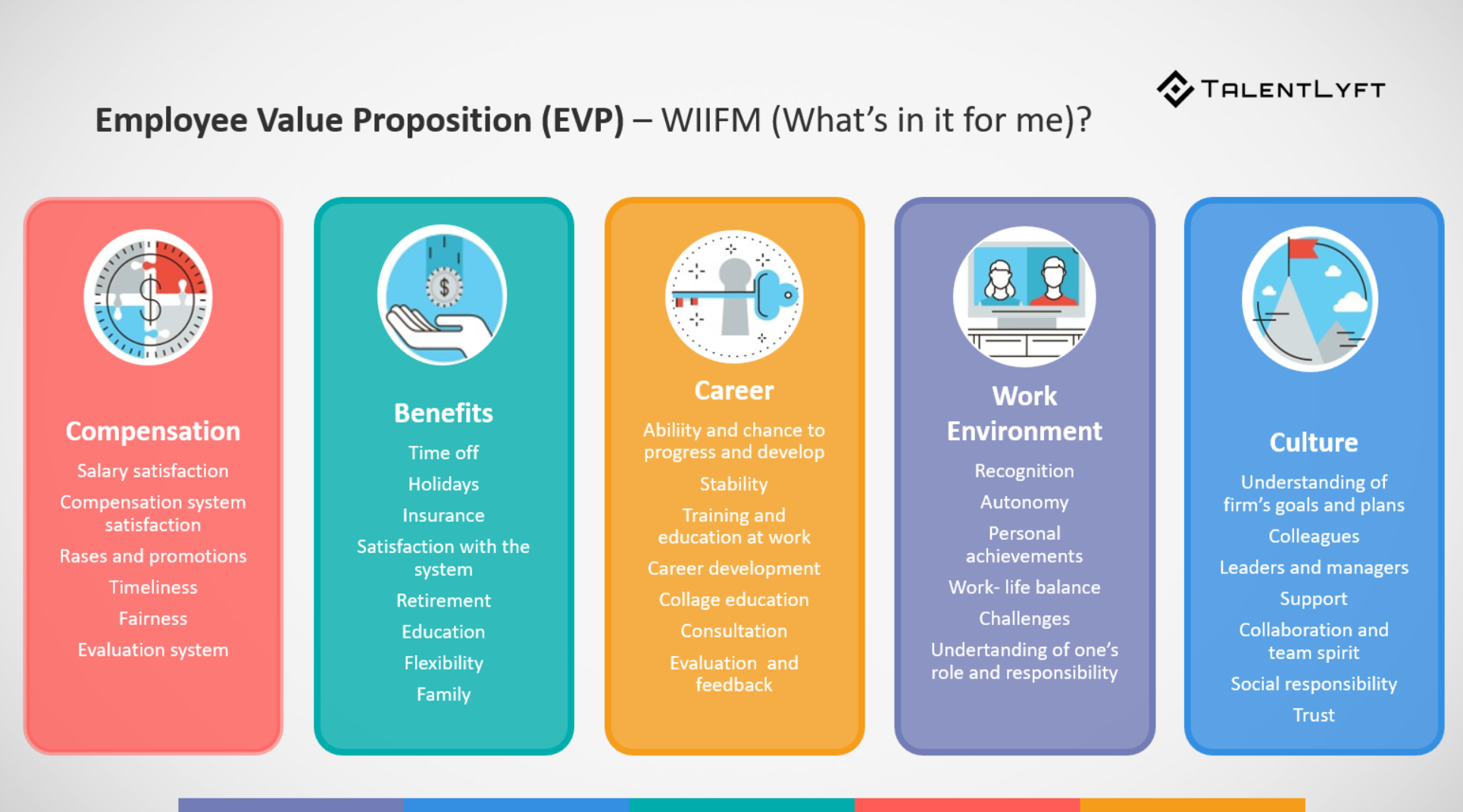

Employer Branding Strategy In 5 Steps Infographic

Comments are closed.