Timeline For Revocation Of Gst Registration Cancellation Extended

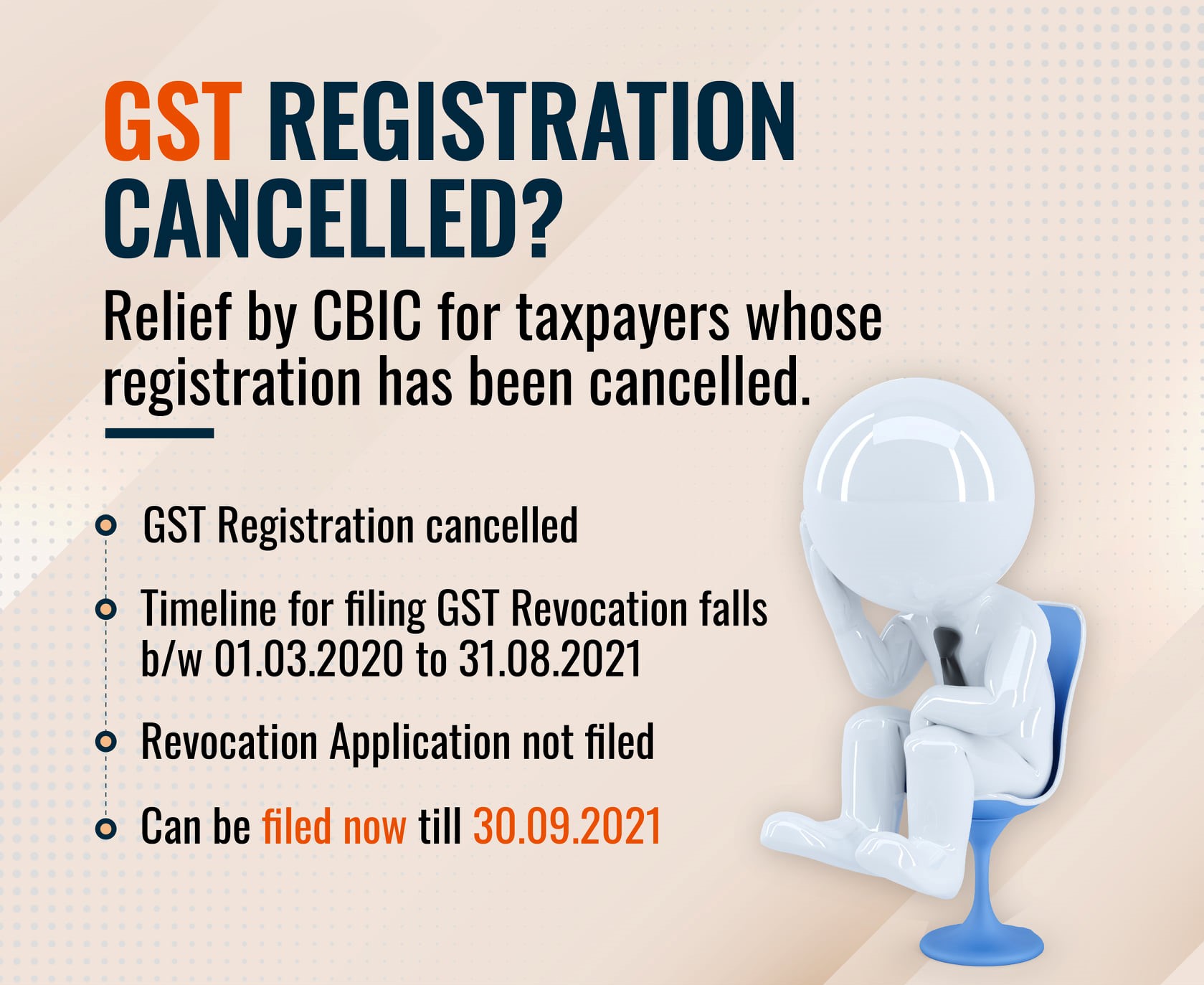

Timeline For Revocation Of Gst Registration Cancellation Extended The due date to apply for revocation of cancellation of registration extended to 30.09.2021. however, this extension is applicable when the original due date falls between 01.03.2020 to 31.08.2021. also, the taxpayer can apply irrespective of the status of such applications, which is explained in the table below: s.no. Also the timeline to file application for revocation of cancellation of registration can be further extended by another 30 days beyond 30.09.2021 by the commissioner as per clause (b) of proviso to section 30(1) of cgst act, 2017 on being satisfied that there was sufficient cause for not filing the application within the extended period i.e. upto 30.09.2021.

Timeline For Revocation Of Gst Registration Cancellation Extended The cbic temporarily extended the time limit to apply for revocation of cancellation of gst registration up to 30th september 2021 if the due date to apply for such revocation expired anytime from 1st march 2020 to 31st august 2021. several taxpayers raised queries about the applicability of this relief to them. Cbic has vide circular no. 158 14 2021 gst dated 6.09.2021 clarified the position that exists as of today with respect to the extension in the timeline for making revocation application of cancellation of gst registration in the cases where the due date for such application was falling between 1 st march, 2021 to 31 st august, 2021 prior to the relevant notification. The time period of 30 days (and not 60 days or 90 days) since the cancellation of registration has elapsed by 31.08.2021, the time limit to apply for revocation of cancellation of registration stands extended upto 30th september 2021, with the extension of timelines by another 30 days beyond 30.09.2021 by the joint additional commissioner and another 30 days by the commissioner, on being. The timeline to apply for revocation of cancelled gst registration is up to 30th september 2021 the central tax notification number 34 2021, dated 29th august 2021, deals with this matter. the government got several requests from trade and professionals to clarify this aspect.

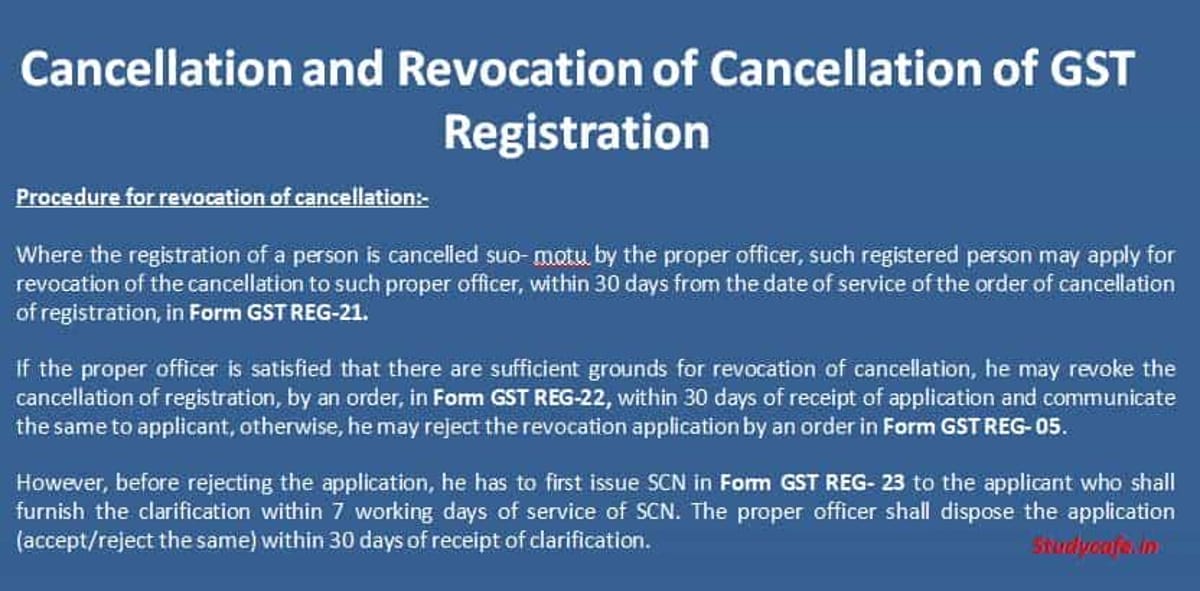

Gst Registration Cancellation Revocation Ca Rajput Jain The time period of 30 days (and not 60 days or 90 days) since the cancellation of registration has elapsed by 31.08.2021, the time limit to apply for revocation of cancellation of registration stands extended upto 30th september 2021, with the extension of timelines by another 30 days beyond 30.09.2021 by the joint additional commissioner and another 30 days by the commissioner, on being. The timeline to apply for revocation of cancelled gst registration is up to 30th september 2021 the central tax notification number 34 2021, dated 29th august 2021, deals with this matter. the government got several requests from trade and professionals to clarify this aspect. Recent notification for extension of time limit for revocation of cancellation of gst registration. cbic recently vide notification 03 2023 central tax dated 31 st march 2023 has provided final opportunity to the certain class of taxpayers to make an application for revocation of cancellation of gst registration on or before 30 th june 2023 in case it was suo moto cancelled by the proper officer. The relevant notification no. 04 2023 – central tax lays down the procedure for revocation of the cancelled registrations as given below: —. the registered person, whose registration has been cancelled under clause (b) or clause (c) of sub section (2) of section 29 of the central goods and services tax act on or before the 31st day of.

Cancellation And Revocation Of Cancellation Of Gst Registration Recent notification for extension of time limit for revocation of cancellation of gst registration. cbic recently vide notification 03 2023 central tax dated 31 st march 2023 has provided final opportunity to the certain class of taxpayers to make an application for revocation of cancellation of gst registration on or before 30 th june 2023 in case it was suo moto cancelled by the proper officer. The relevant notification no. 04 2023 – central tax lays down the procedure for revocation of the cancelled registrations as given below: —. the registered person, whose registration has been cancelled under clause (b) or clause (c) of sub section (2) of section 29 of the central goods and services tax act on or before the 31st day of.

Comments are closed.