Traditional Iras Vs Roth Iras Comparison 1st National Bank

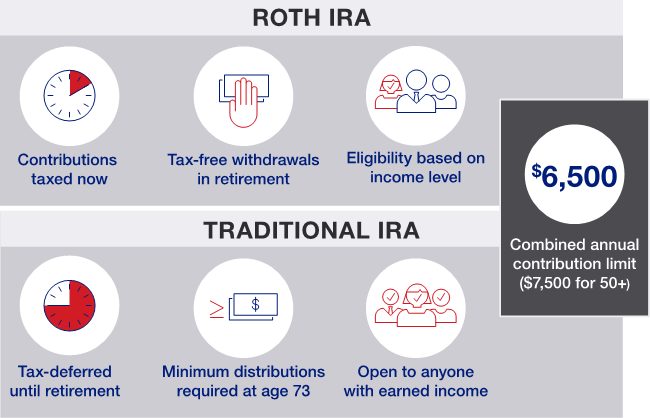

Traditional Iras Vs Roth Iras Comparison 1st National Bank The two main iras are often traditional iras and roth iras. the irs will only let you contribute a certain amount to these accounts. if you are under the age of 50, you are only able to contribute $6,000 a year to save on your taxes. if you are over 50, you are able to contribute $7,000. in 2023 the irs will raise those limits by $500 for all. The difference between roth and traditional iras. the main difference between a roth ira and a traditional ira is how and when you get a tax break. contributions to traditional iras are tax.

Traditional Vs Roth Ira Yolo Federal Credit Union While a traditional ira defers your taxes, a roth ira is not designed to give you immediate tax benefits. so, if you decide to contribute $4,000 to a roth ira this year, it’s all after tax money. Key takeaways. the key difference between roth and traditional individual retirement accounts (iras) lies in the timing of their tax advantages. with traditional iras, you deduct contributions now. Any earnings in the traditional ira are tax deferred as long as they remain in the account. withdrawals of pre tax monies are subject to ordinary income tax when withdrawn. rmds are required from traditional iras no later than april 1st of the year following the year in which you turn age 73 1. if you wait until april 1st, you will then be. First contributed directly to the roth ira. rolled over a roth 401(k) or roth 403(b) to the roth ira. converted a traditional ira to the roth ira. if you're under age 59½ and you have one roth ira that holds proceeds from multiple conversions, you're required to keep track of the 5 year holding period for each conversion separately.

How Does An Ira Work U S Bank Any earnings in the traditional ira are tax deferred as long as they remain in the account. withdrawals of pre tax monies are subject to ordinary income tax when withdrawn. rmds are required from traditional iras no later than april 1st of the year following the year in which you turn age 73 1. if you wait until april 1st, you will then be. First contributed directly to the roth ira. rolled over a roth 401(k) or roth 403(b) to the roth ira. converted a traditional ira to the roth ira. if you're under age 59½ and you have one roth ira that holds proceeds from multiple conversions, you're required to keep track of the 5 year holding period for each conversion separately. Both traditional and roth iras: for 2021, your total contribution limit to both traditional and roth iras is up to $6,000 if you are under 50, and up to $7,000 if you are 50 or older. A traditional ira is funded by pre tax income, while roth iras are funded by after tax dollars. choosing between a traditional or roth ira depends on your financial situation and preferences. roth.

Traditional Ira Vs Roth Ira Both traditional and roth iras: for 2021, your total contribution limit to both traditional and roth iras is up to $6,000 if you are under 50, and up to $7,000 if you are 50 or older. A traditional ira is funded by pre tax income, while roth iras are funded by after tax dollars. choosing between a traditional or roth ira depends on your financial situation and preferences. roth.

Ira Plans Traditional Ira Vs Roth Ira Dupage Tax Solutions

Comments are closed.