Treasury Bill Definitions

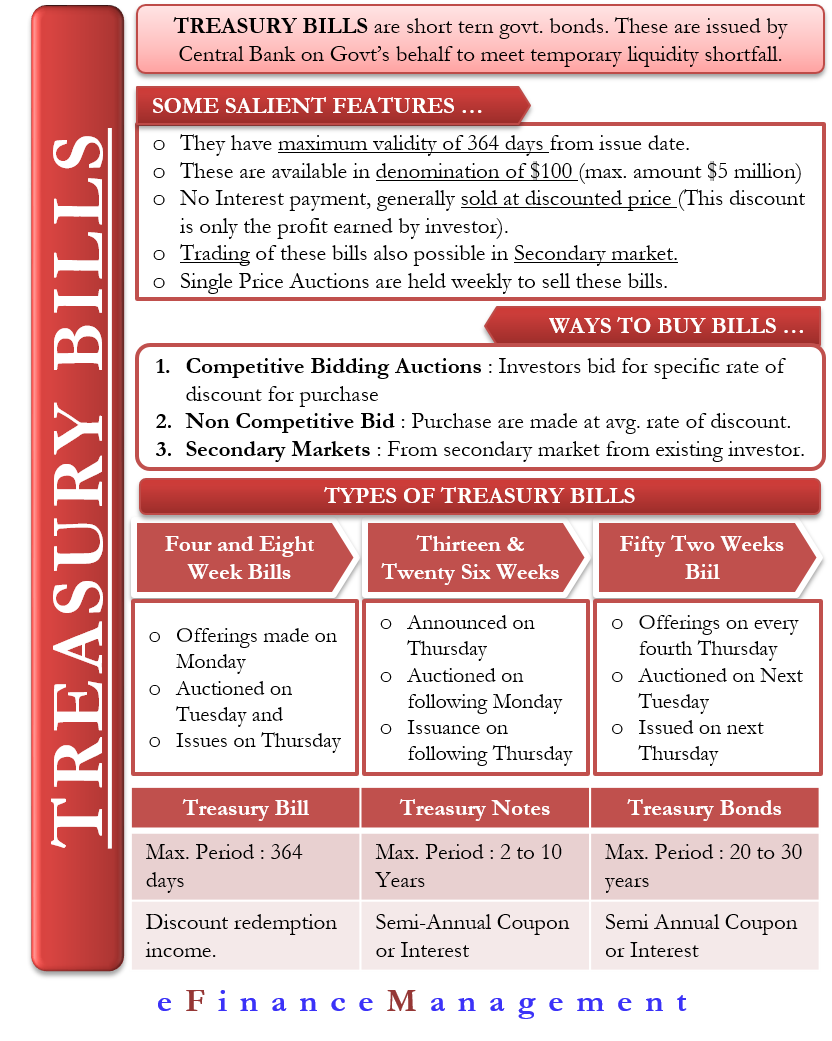

What Are Treasury Bills Definition And Meaning Market Business News A treasury bill (t bill) is a short term debt obligation backed by the u.s. department of the treasury with a one year maturity or less. treasury bills are usually sold in denominations of $100. Treasury bills are debt obligations issued by the u.s. department of the treasury. t bills have the shortest maturity date of all the debt issued by the federal government. you can purchase t.

Treasury Bill Meaning Features Benefits And More How treasury bills work. treasury bills are assigned a par value (or face value), which the bill is worth if held throughout the term. you buy bills at a discount — a price below par — and. The difference between the discounted sale price and the face value the bill acts as the interest paid to investors for owning a treasury bill for example, if a 26 week, $1000 treasury bill is discounted to $980, then the owner of the bill will stand to make a $20 profit. $20 is 2.04% of $980, but 4.08% when prorated annually. Treasury bills (t bills) are investment vehicles that allow investors to lend money to the government. in return the investors get a steady interest income. the maturity period for a treasury bill is less than one year. these short term debt instruments are issued at a discounted price, but while redeeming, investors get at par value. A treasury bill, or t bill, is short term debt issued and backed by the full faith and credit of the united states government. these debt obligations are issued in maturities of four, 13 and 26 weeks in various denominations as low as $1,000. learn how to buy us treasury bonds and t bills online through treasurydirect.

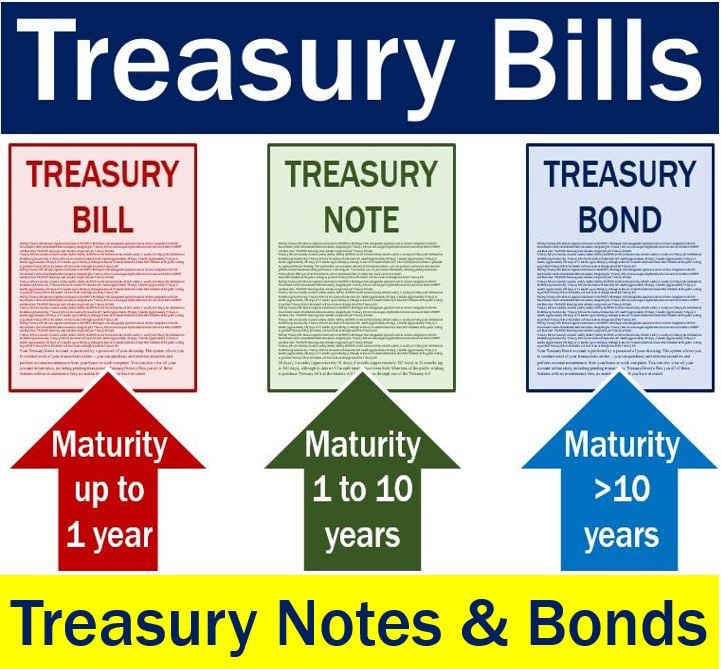

Treasury Bills Meaning Types How To Buy Vs Treasury Notes Bonds Treasury bills (t bills) are investment vehicles that allow investors to lend money to the government. in return the investors get a steady interest income. the maturity period for a treasury bill is less than one year. these short term debt instruments are issued at a discounted price, but while redeeming, investors get at par value. A treasury bill, or t bill, is short term debt issued and backed by the full faith and credit of the united states government. these debt obligations are issued in maturities of four, 13 and 26 weeks in various denominations as low as $1,000. learn how to buy us treasury bonds and t bills online through treasurydirect. The government issues t bills at regular auctions, in four , eight , 13 , 17 , 26 , and 52 week terms, in increments ranging from $100 to $10 million. the minimum t bill purchase from treasurydirect.gov is $100. some investors may create ladders (similar to bond ladders), which allow them to roll their t bills at maturity into more t bills. Treasury bills (t bills) are short term debt instruments backed by the u.s. department of the treasury. the government issues t bills to finance its operations. they typically have maturities of.

What Is A Treasury Bill And How Does It Work The government issues t bills at regular auctions, in four , eight , 13 , 17 , 26 , and 52 week terms, in increments ranging from $100 to $10 million. the minimum t bill purchase from treasurydirect.gov is $100. some investors may create ladders (similar to bond ladders), which allow them to roll their t bills at maturity into more t bills. Treasury bills (t bills) are short term debt instruments backed by the u.s. department of the treasury. the government issues t bills to finance its operations. they typically have maturities of.

Comments are closed.