Treasury Bills Meaning Types How To Buy Vs Treasury Notes Bonds

:max_bytes(150000):strip_icc()/treasurynotes-bills-and-bonds-3305609-finalv42-fc941b4ff55d4247951067ef742a406b.png)

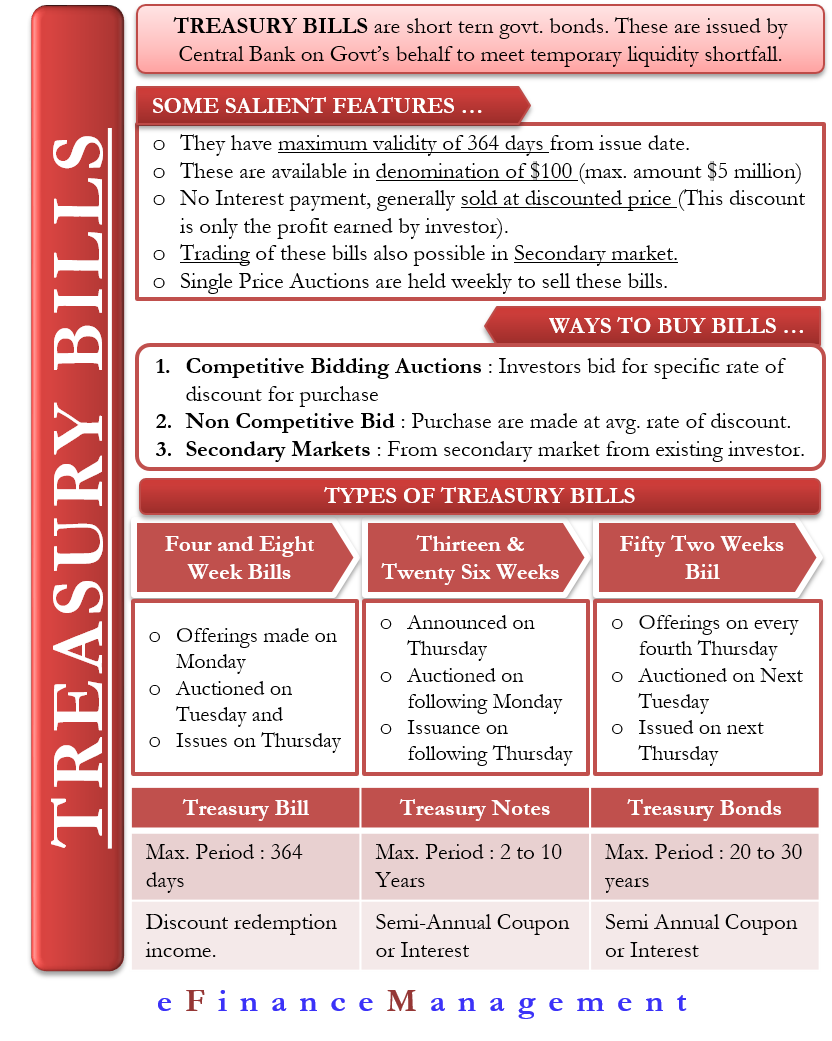

Treasury Bills Notes And Bonds Definition How To Buy Treasury bonds, treasury notes, and treasury bills have different maturity dates and pay different amounts of interest (usually, the longer the term, the more interest). however, all treasurys are. U.s. treasury bills. in contrast to notes and bonds, treasury bills are the shortest term government investment and mature in four weeks to one year. treasury bills are also known as zero coupon.

Treasury Bills Meaning Types How To Buy Vs Treasury Notes Bonds Treasury bills have short term maturities and pay interest at maturity. treasury notes have mid range maturities and pay interest every 6 months. treasury bonds have long maturities and pay interest every 6 months. government issued fixed income securities might not sound as exciting as tech stocks and cryptocurrency. In contrast, t bills are sold at a discount to their face (or par) value. when they mature, the owner collects the full face value of the security. the difference is the interest you receive. How treasury bills work. treasury bills are assigned a par value (or face value), which the bill is worth if held throughout the term. you buy bills at a discount — a price below par — and. A treasury note (t note for short) is a marketable u.s. government debt security with a fixed interest rate and a maturity between two and 10 years. treasury notes are available from the.

Comments are closed.