Treasury Bills Vs Treasury Bonds Overview And Differences

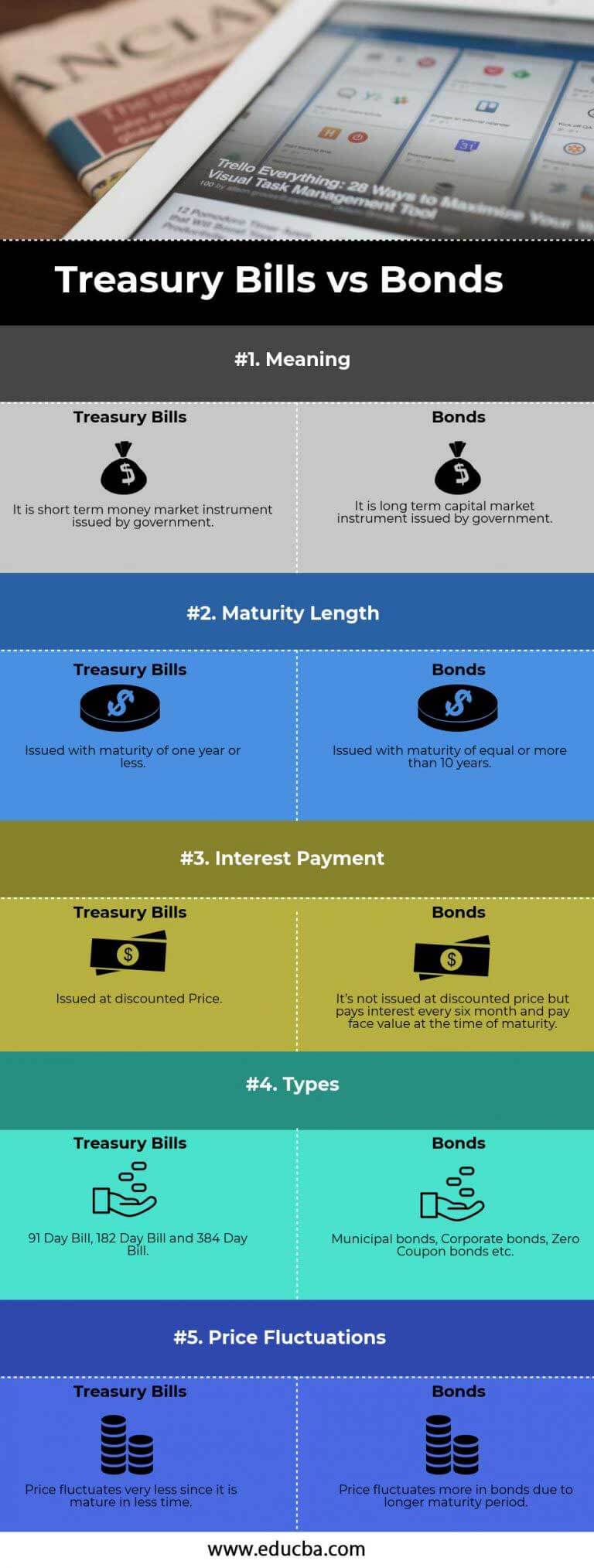

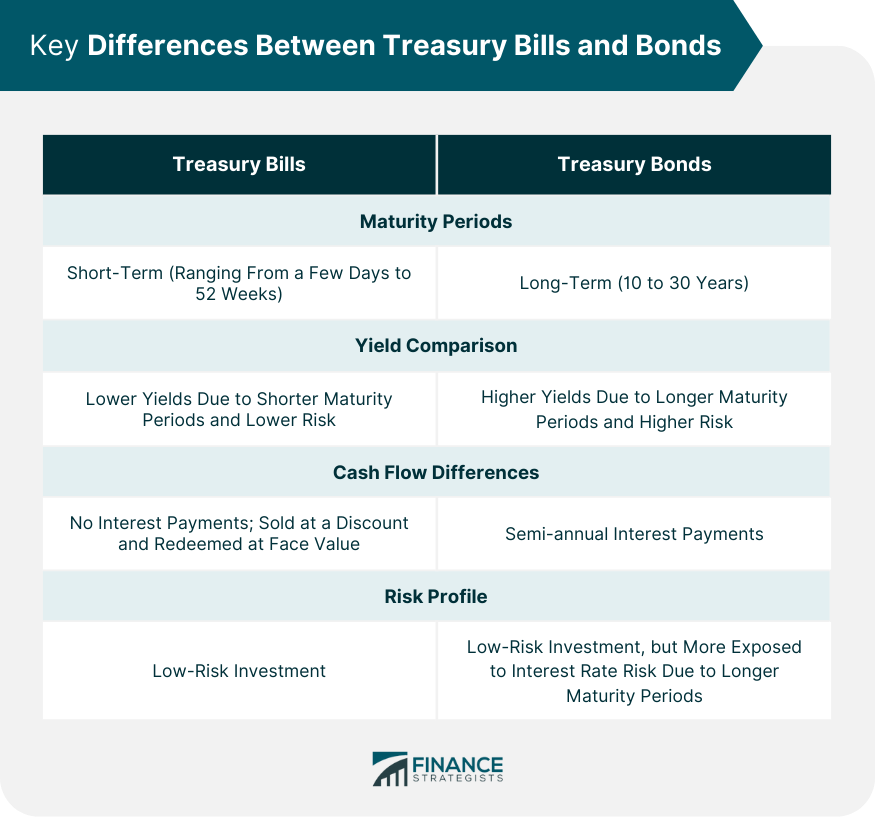

Treasury Bills Vs Bonds Top 5 Best Differences With Infographics Treasury bills (t bills) are short term securities maturing in one year or less, offering lower risk and yields, ideal for conservative investors seeking liquidity. treasury bonds (t bonds) are long term, with maturities over 10 years, offering higher yields but increased interest rate risk, suitable for those aiming for long term savings like. Treasury bills have the shortest terms, maturing in one year or less. treasury notes occupy the middle ground, with maturities ranging from two to 10 years. treasury bonds have the longest.

Treasury Bills Vs Bonds Top 5 Best Differences With Infographics 2023 Here’s what treasury bonds, notes and bills are – and their key similarities and differences. what is a treasury bill? treasury bills (or t bills) are one type of treasury security issued by. Understanding the differences between treasury bills vs. notes vs. bonds can help you build an effective strategy for your portfolio. Key takeaways. treasury securities are one of the safest investments as they are backed by the full faith and credit of the u.s. government. treasury securities are divided into three primary. Treasury bills have short term maturities and pay interest at maturity. treasury notes have mid range maturities and pay interest every 6 months. treasury bonds have long maturities and pay interest every 6 months. government issued fixed income securities might not sound as exciting as tech stocks and cryptocurrency.

Treasury Bills Vs Bonds What Are They Infographics Key takeaways. treasury securities are one of the safest investments as they are backed by the full faith and credit of the u.s. government. treasury securities are divided into three primary. Treasury bills have short term maturities and pay interest at maturity. treasury notes have mid range maturities and pay interest every 6 months. treasury bonds have long maturities and pay interest every 6 months. government issued fixed income securities might not sound as exciting as tech stocks and cryptocurrency. The key difference between the two is the amount of time it takes for each to mature. while treasury bonds are considered long term debt securities, maturing 30 years after they are sold, treasury. Key takeaways. u.s. savings bonds, t bills, and t notes are all forms of debt issued by the federal government to help finance its operations. bonds typically mature in 20 30 years and offer.

Treasury Bills Vs Treasury Bonds Overview And Differences The key difference between the two is the amount of time it takes for each to mature. while treasury bonds are considered long term debt securities, maturing 30 years after they are sold, treasury. Key takeaways. u.s. savings bonds, t bills, and t notes are all forms of debt issued by the federal government to help finance its operations. bonds typically mature in 20 30 years and offer.

Treasury Bills Vs Treasury Bonds Overview And Differences

Comments are closed.