Types Of Tax System Progressive Tax Regressive Tax Proportional

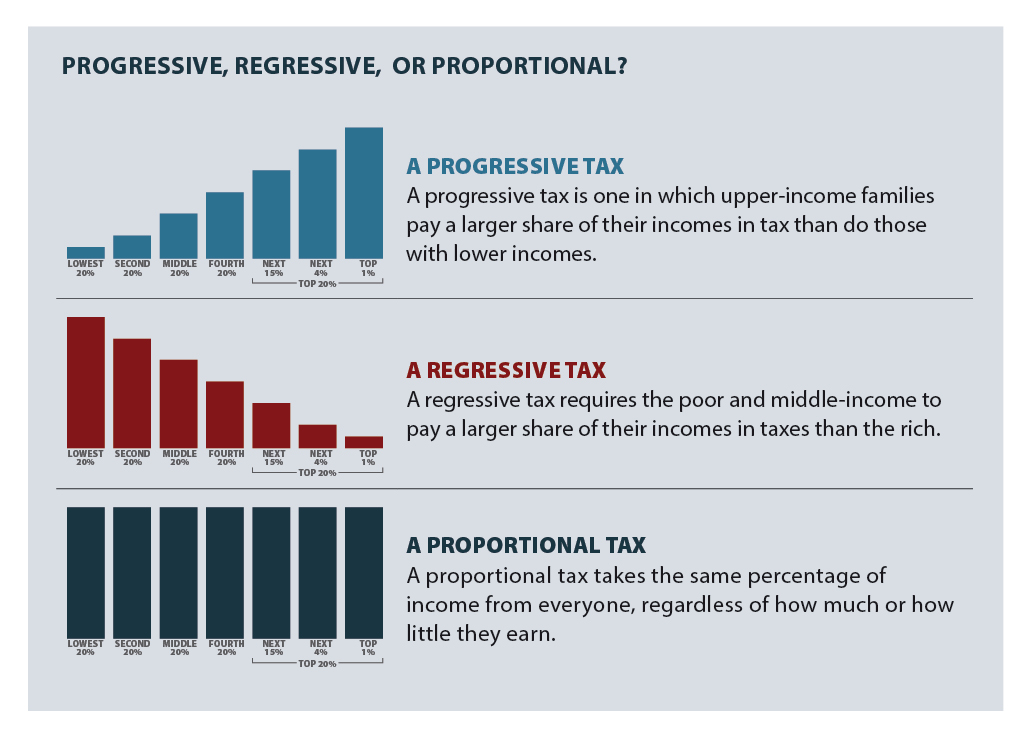

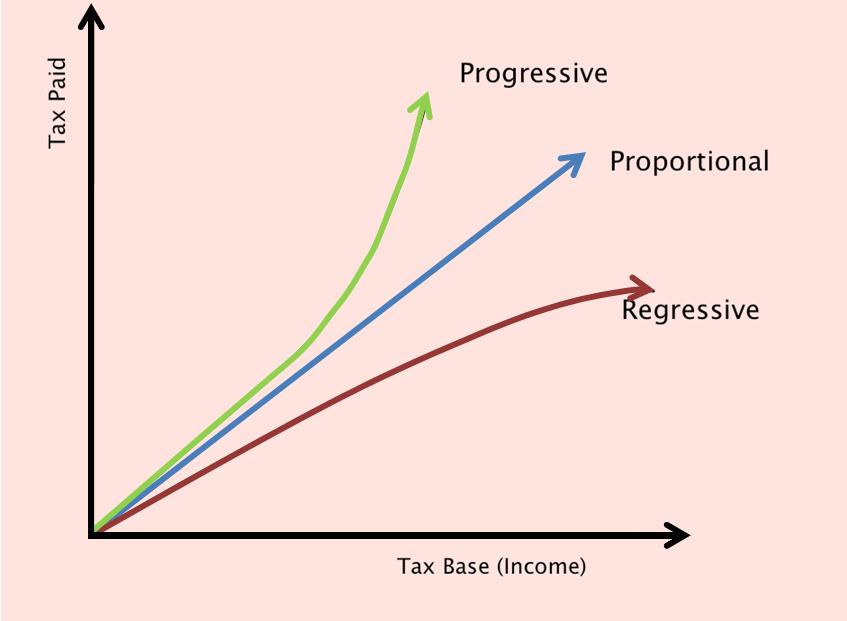

Types Of Tax In Uk Economics Help The u.s. uses three types of tax systems: regressive, proportional, and progressive. two impact high and low income earners differently and one is the same for all. Proportional taxes are levied constantly, while progressive taxes are levied at a higher rate on higher income earners. regressive taxes are levied at a higher rate on lower income earners. understanding the differences between these tax systems is crucial for individuals, businesses, and policymakers to make informed decisions regarding taxation.

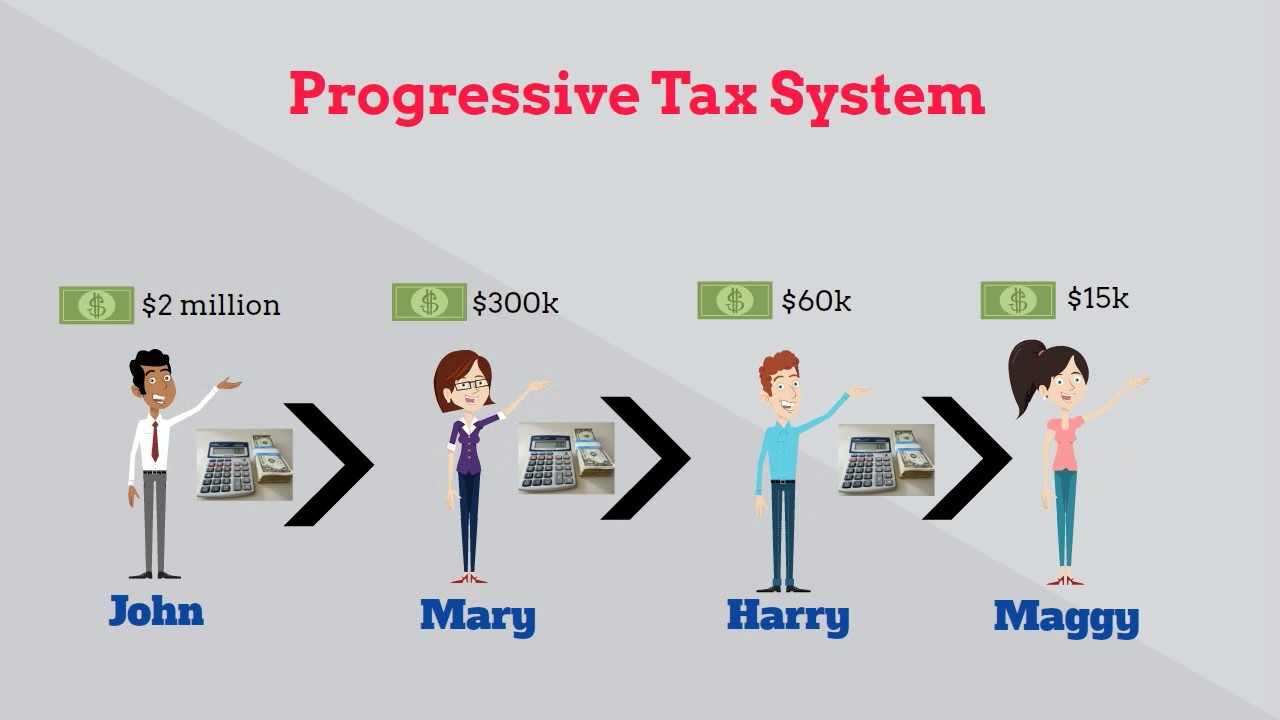

What Is Progressive Tax Youtube A regressive tax is a tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases. the average tax rate is higher than the marginal tax rate. a progressive tax is a tax in which the tax rate increases as the taxable base amount increases. the average tax rate is lower than the marginal tax rate. Progressive taxes are when the tax rate you pay increases as your taxable income rises. the us federal income tax is progressive, with tax brackets ranging from 10% to 37%. regressive taxes are when the average tax burden decreases as income increases. a flat tax system is a regressive tax system where everyone pays the same tax rate. A progressive tax is characterized by a more than proportional rise in the tax liability relative to the increase in income, and a regressive tax is characterized by a less than proportional rise in the relative burden. thus, progressive taxes are seen as reducing inequalities in income distribution, whereas regressive taxes can have the effect. A regressive tax system is the opposite of a progressive tax system where the wealthier are taxed more. common forms of a regressive tax system include sales taxes and excise taxes on certain.

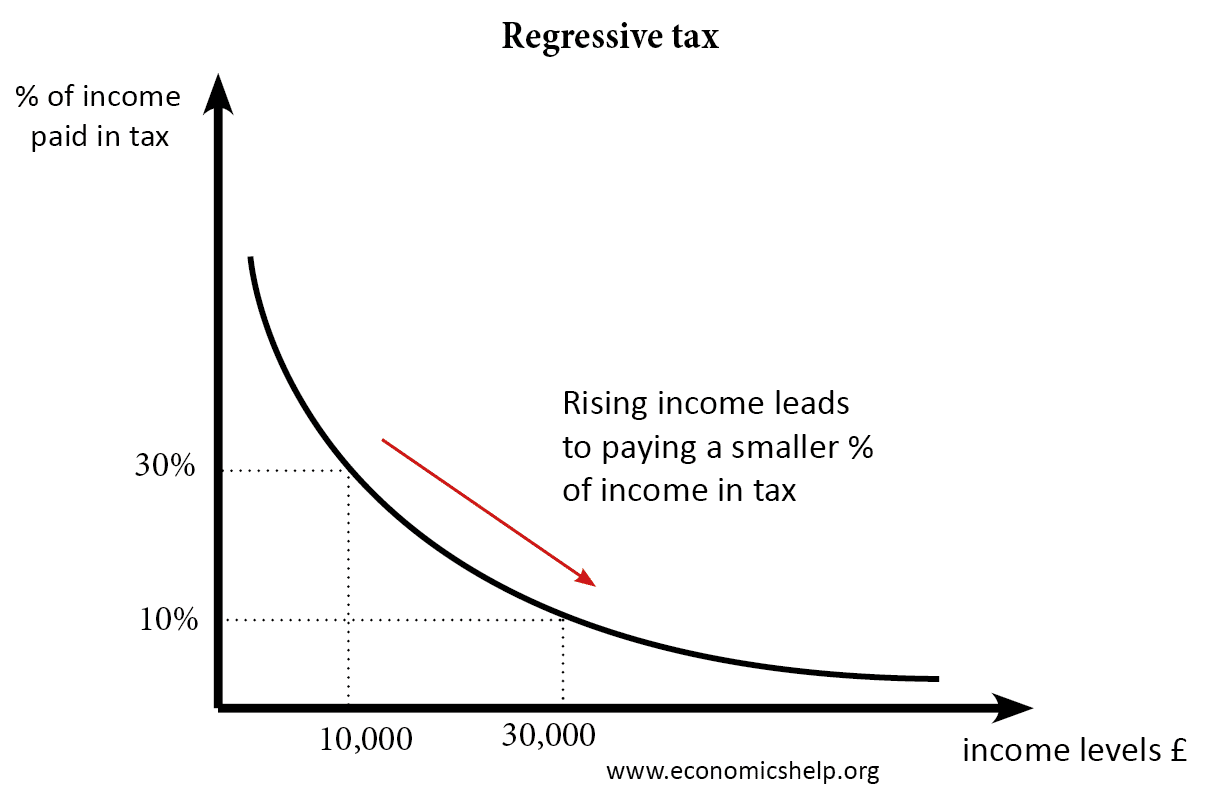

Regressive Tax Economics Help A progressive tax is characterized by a more than proportional rise in the tax liability relative to the increase in income, and a regressive tax is characterized by a less than proportional rise in the relative burden. thus, progressive taxes are seen as reducing inequalities in income distribution, whereas regressive taxes can have the effect. A regressive tax system is the opposite of a progressive tax system where the wealthier are taxed more. common forms of a regressive tax system include sales taxes and excise taxes on certain. Regressive taxes have a greater impact on low income individuals than they do on high income earners. a proportional tax, also referred to as a flat tax, impacts low , middle , and high income earners relatively equally. they all pay the same tax rate, regardless of income. a progressive tax has more of a financial impact on higher income. Difference between regressive tax v. progressive tax. the major difference between regressive and progressive taxes is who pays more. for a regressive tax, low income earners pay more than middle.

Who Pays 6th Edition Itep Regressive taxes have a greater impact on low income individuals than they do on high income earners. a proportional tax, also referred to as a flat tax, impacts low , middle , and high income earners relatively equally. they all pay the same tax rate, regardless of income. a progressive tax has more of a financial impact on higher income. Difference between regressive tax v. progressive tax. the major difference between regressive and progressive taxes is who pays more. for a regressive tax, low income earners pay more than middle.

Proportional Tax Tax

Comments are closed.