Uk Landlords Beware Mortgage Tax Relief Changes In 2024 Explained Gyb

Uk Landlords Guide Navigating Buy To Let Mortgage Tax Relief Change The uk property market is facing significant changes, especially with the potential loss of mortgage tax relief for landlords. as of 2024, the ability to off. Landlord mortgage interest tax relief in 2024 25. since april 2020, you've no longer been able to deduct any of your mortgage expenses from your rental income to reduce your tax bill. instead, you now receive a tax credit, based on 20% of your mortgage interest payments. this is less generous than the old system for higher rate taxpayers, who.

How Will Changes To Mortgage Tax Relief Impact Landlords Property Mortgage interest restrictions under section 24. before section 24, landlords enjoyed the ability to deduct all finance costs, including mortgage interest, from their rental income, reducing their tax bills. but this has now changed. landlords are no longer able to deduct mortgage interest and other finance costs from their rental income. The capital gains tax rates on the sale of residential properties for higher rate taxpayers will change from 28% in 2023 24 to 24% in 2024 25. the 18% basic rate remains unchanged. non uk domiciled individuals. the current remittance basis of taxation for non uk domiciled individuals will be abolished and replaced with a residence based regime. 7 changes for landlords to track in 2024. 1. the labour government’s new renters’ rights bill. 2. the leasehold and freehold reform act 2024 becomes law. 3. the new leasehold and commonhold reform bill. 4. last full year of lower stamp duty. 9. capital gains tax allowances will be slashed in april. landlords selling buy to let properties in 2024 may face higher capital gains tax (cgt) bills. in april 2023, the tax free allowance for capital gains was cut from £12,300 to £6,000. from 6 april 2024, it will be halved to just £3,000.

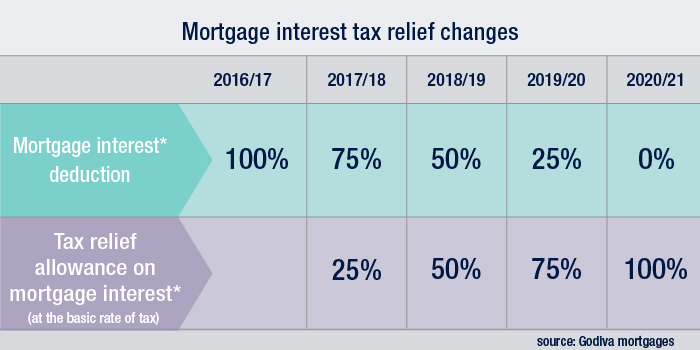

Uk Landlords Guide Navigating Buy To Let Mortgage Tax Relief Change 7 changes for landlords to track in 2024. 1. the labour government’s new renters’ rights bill. 2. the leasehold and freehold reform act 2024 becomes law. 3. the new leasehold and commonhold reform bill. 4. last full year of lower stamp duty. 9. capital gains tax allowances will be slashed in april. landlords selling buy to let properties in 2024 may face higher capital gains tax (cgt) bills. in april 2023, the tax free allowance for capital gains was cut from £12,300 to £6,000. from 6 april 2024, it will be halved to just £3,000. The tax relief that landlords of residential properties get for finance costs is being restricted to the basic rate of income tax. this is being phased in from 6 april 2017 and will be fully in. In the 2018 19 tax year, you can claim 50% of your mortgage tax relief. in the 2019 20 tax year, you can claim 25% of your mortgage tax relief. the table below shows how this will impact on a higher rate taxpaying landlord receiving £1000 rent a month and paying £650 towards their mortgage. mortgage tax impact on a higher rate taxpaying.

Comments are closed.