Us Tax Rates For 2021 Form 1040 Tax Rate Tables

Tax Rate Table Irs Elcho Table You pay tax as a percentage of your income in layers called tax brackets. as your income goes up, the tax rate on the next layer of income is higher. when your income jumps to a higher tax bracket, you don't pay the higher rate on your entire income. you pay the higher rate only on the part that's in the new tax bracket. 2023 tax rates for a. Page 1 of 26 11:14 16 dec 2021 the type and rule above prints on all proofs including departmental reproduction proofs. must be removed before printing. dec 16, 2021 cat. no. 24327a tax and earned income credit tables this booklet only contains tax and earned income credit tables from the instructions for form 1040 (and 1040 sr).

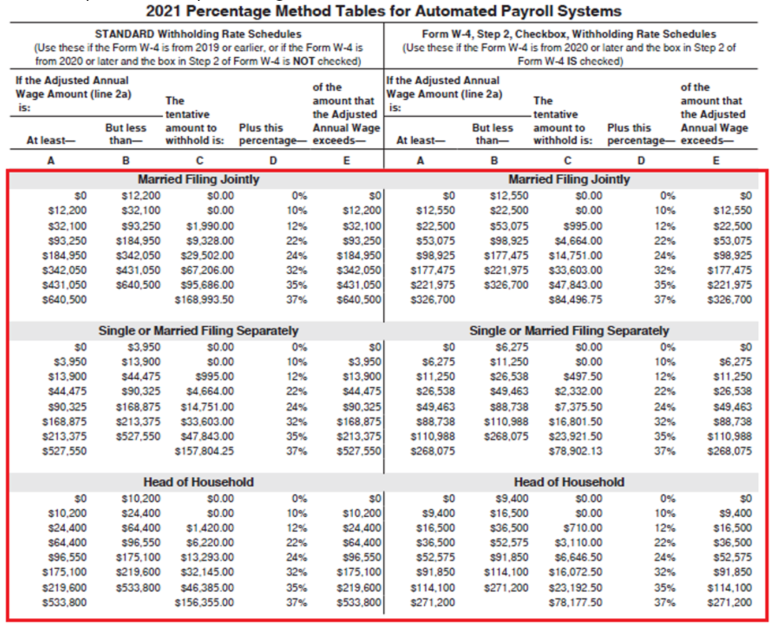

2021 Form 1040 Tax Table 1040tt 2021 federal income tax brackets and rates. in 2021, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). the top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $523,600 and higher for single filers and $628,300 and higher for married couples. The federal tax brackets are broken down into seven (7) taxable income groups, based on your filing status. the tax rates for 2021 are: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. it’s important to remember that moving up into a higher tax bracket does not mean that all of your income will be taxed at the higher rate. 3. include form 8962 with your form 1040, form 1040 sr, or form 1040 nr. (don t include form 1095 a.) health coverage reporting. if you or someone in your family was an employee in 2021, the employer may be required to send you form 1095 c. part ii of form 1095 c shows whether your employer offered you health insurance coverage and, if. 26% tax rate applies to income at or below: $99,950 $199,900 28% tax rate applies to income over: 3.8% tax on the lesser of: (1) net investment income, or (2) magi in excess of $200,000 for single filers or head of households, $250,000 for married couples filing jointly, and $125,000 for married couples filing separately. tax rates on long term.

Irs 2021 Tax Tables Pdf Federal Withholding Tables 2021 3. include form 8962 with your form 1040, form 1040 sr, or form 1040 nr. (don t include form 1095 a.) health coverage reporting. if you or someone in your family was an employee in 2021, the employer may be required to send you form 1095 c. part ii of form 1095 c shows whether your employer offered you health insurance coverage and, if. 26% tax rate applies to income at or below: $99,950 $199,900 28% tax rate applies to income over: 3.8% tax on the lesser of: (1) net investment income, or (2) magi in excess of $200,000 for single filers or head of households, $250,000 for married couples filing jointly, and $125,000 for married couples filing separately. tax rates on long term. When are taxes due? tax deadlines. tax refund schedule. written by bankrate staff. read more from bankrate. there are seven tax brackets for most ordinary income for the 2021 tax year: 10%, 12%. Year 2021 the u.s. federal income tax system is progressive. this means that income is taxed in layers, with a higher tax rate applied to each layer. below are the tax brackets for 2021 taxable income. taxable income is generally adjusted gross income (agi) less the standard or itemized deductions. tax brackets for 2021: individuals.

What Are Federal Income Tax Brackets For 2021 Printable Form When are taxes due? tax deadlines. tax refund schedule. written by bankrate staff. read more from bankrate. there are seven tax brackets for most ordinary income for the 2021 tax year: 10%, 12%. Year 2021 the u.s. federal income tax system is progressive. this means that income is taxed in layers, with a higher tax rate applied to each layer. below are the tax brackets for 2021 taxable income. taxable income is generally adjusted gross income (agi) less the standard or itemized deductions. tax brackets for 2021: individuals.

Us Tax Rates For 2021 Form 1040 Tax Rate Tables Youtube

Comments are closed.