Using Rsi 17 My Trading Skills

Using Rsi 17 My Trading Skills One of the most insightful analysis techniques using rsi is to look for divergences against price. like all momentum indicators, rsi can stay overbought and oversold for long periods of time as the trend plays out. there are other techniques, like rsi centerline crossovers and failure swings. always remember to trade the price action and not. Our part: relative strength index (12 mins) using rsi (17) summary & next steps (3) your turn: task: leading vs lagging (30) knowledge check (2) 4.8 out of 5. another fast track course, we are introducing you to the rsi indicator, how to set it up correctly and how to use it to supercharge your analysis.

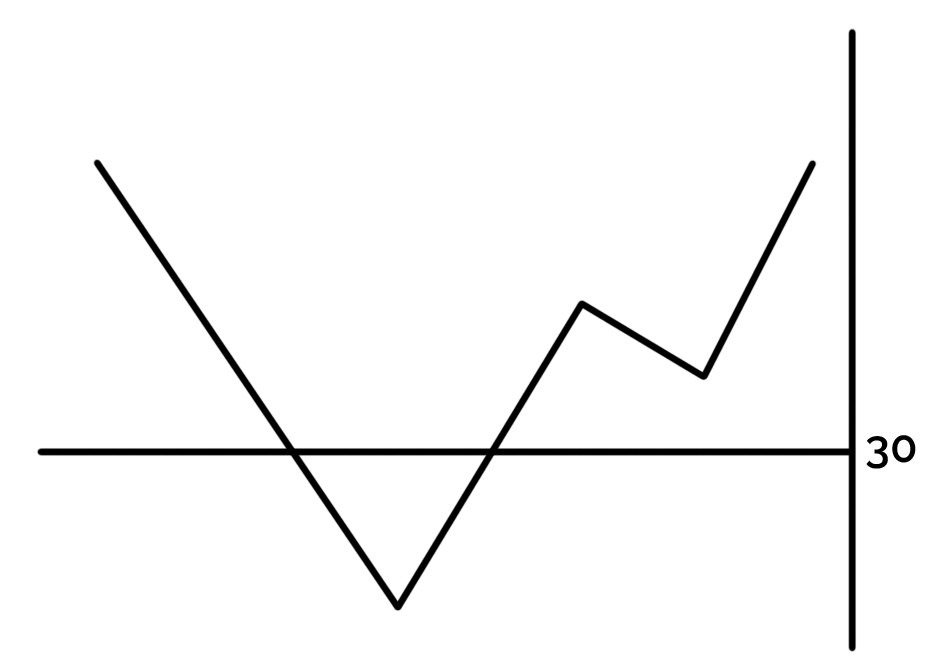

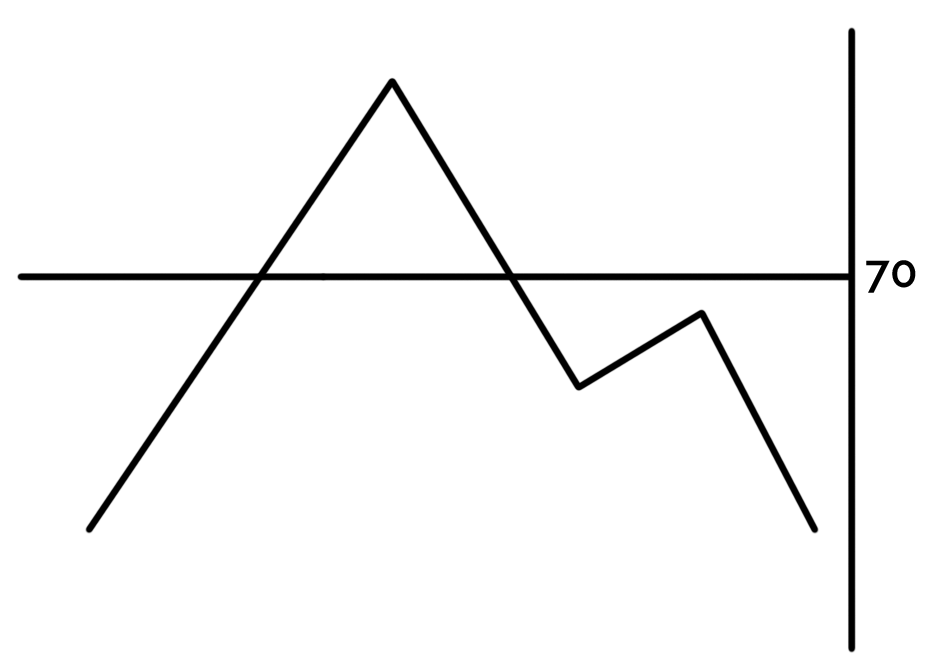

Using Rsi 17 My Trading Skills The rsi formula looks like this: rsi = 100 – 100 1 rs rs = average gain average loss. the trader sets the number periods the indicator looks back over, its creator welles wilder recommends 14, so we also use that. initially, the formula distinguishes between periods where the price goes up or down. next, it averages out all the up days, the. Rsi oversold and overbought. the first common approaches to use the rsi is to identify the oversold and overbought level. a financial asset is said to be oversold when it has moved so much lower. an rsi level below 30 is said to be oversold. most traders view this situation as the best place to buy an asset. The relative strength index is calculated using a formula that takes into account the average gain and average loss over a specified period. the rsi formula is as follows: rsi = 100 – (100 (1 rs)), where rs is the average gain divided by the average loss. this calculation results in a numerical value ranging from 0 to 100, with values. Rsi is short for relative strength index. it is a trading indicator used in technical analysis (a momentum oscillator) that measures the magnitude of recent price moves to determine whether overbought or oversold conditions are present in the price of a stock. the rsi is typically measured on a scale of 0 to 100, with the default overbought and.

Using Rsi 17 My Trading Skills The relative strength index is calculated using a formula that takes into account the average gain and average loss over a specified period. the rsi formula is as follows: rsi = 100 – (100 (1 rs)), where rs is the average gain divided by the average loss. this calculation results in a numerical value ranging from 0 to 100, with values. Rsi is short for relative strength index. it is a trading indicator used in technical analysis (a momentum oscillator) that measures the magnitude of recent price moves to determine whether overbought or oversold conditions are present in the price of a stock. the rsi is typically measured on a scale of 0 to 100, with the default overbought and. In the screenshot above, you can see inside the tradingsim rsi settings. the default parameters are usually set for a 14 period and 80 20 upper and lower threshold. within, you can change the period from the standard 14 to whatever you prefer. you can also change the “overbought” and “oversold” parameters as you wish. Rsi can be used just like the stochastic indicator. we can use it to pick potential tops and bottoms depending on whether the market is overbought or oversold. below is a 4 hour chart of eur usd. eur usd had been dropping the week, falling about 400 pips over the course of two weeks. on june 7, it was already trading below the 1.2000 handle.

Using Rsi 17 My Trading Skills In the screenshot above, you can see inside the tradingsim rsi settings. the default parameters are usually set for a 14 period and 80 20 upper and lower threshold. within, you can change the period from the standard 14 to whatever you prefer. you can also change the “overbought” and “oversold” parameters as you wish. Rsi can be used just like the stochastic indicator. we can use it to pick potential tops and bottoms depending on whether the market is overbought or oversold. below is a 4 hour chart of eur usd. eur usd had been dropping the week, falling about 400 pips over the course of two weeks. on june 7, it was already trading below the 1.2000 handle.

Using The Rsi For Better Trading

Comments are closed.