Valuation Methods Four Main Approaches To Value A Business

Valuation Methods Four Main Approaches To Value A Business Here’s a glimpse at six business valuation methods that provide insight into a company’s financial standing, including book value, discounted cash flow analysis, market capitalization, enterprise value, earnings, and the present value of a growing perpetuity formula. 1. book value. one of the most straightforward methods of valuing a. It adjusts the current p e ratio to account for current interest rates. 4. discounted cash flow (dcf) method. the dcf method of business valuation is similar to the earnings multiplier. this.

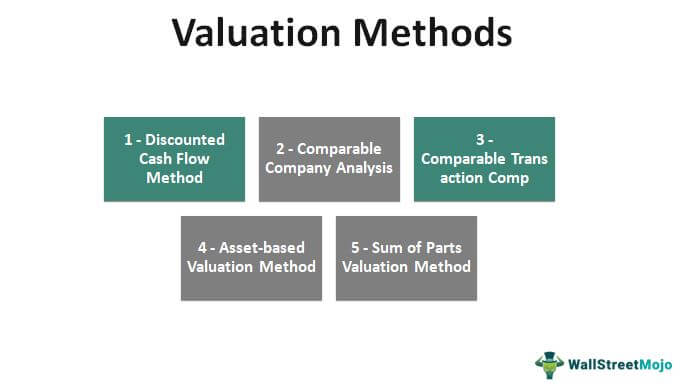

Business Valuation All You Need To Know Detailed Guide Businessyield 3. discounted cash flow (dcf) analysis. this intrinsic valuation method estimates the subject asset's or company's intrinsic value based on its future cash flows. the formula for the dcf analysis is as follows: dcf value = future cash flows (1 discount rate)number of years. 2. asset based valuation method. next, you might use an asset based business valuation method to determine what your company is worth. as the name suggests, this type of approach considers your business’s total net asset value, minus the value of its total liabilities, according to your balance sheet. Below, you will find four typical valuation methods. #1) earnings based valuation methods. earnings based business valuation methods value your company by its ability to be profitable in the future. it is best to use earnings based valuation methods for a company that is stable and profitable. there are two main approaches: capitalization of. A p b ratio greater than 1 suggests that the market values the company’s assets above their book value. methods to value a business #3 – asset based approaches . i) book value method. the book value method calculates a company’s value by subtracting its total liabilities from its total assets, as recorded in its balance sheet.

Valuation Methods What Are They Example Below, you will find four typical valuation methods. #1) earnings based valuation methods. earnings based business valuation methods value your company by its ability to be profitable in the future. it is best to use earnings based valuation methods for a company that is stable and profitable. there are two main approaches: capitalization of. A p b ratio greater than 1 suggests that the market values the company’s assets above their book value. methods to value a business #3 – asset based approaches . i) book value method. the book value method calculates a company’s value by subtracting its total liabilities from its total assets, as recorded in its balance sheet. Ev = market capitalization total debt cash and cash equivalents. for example, if a company has a market capitalization of $50 million, total debt of $20 million, and cash reserves of $5 million, its enterprise value would be $65 million ($50m $20m $5m). 9. present value of a growing perpetuity. There are three main approaches to business valuation: market based, income based, and asset based. each approach implies a few different methods. the most common business valuation techniques are comparable company analysis, precedent transaction analysis, discounted cash flow method, capitalization of earnings, book value, and liquidation value.

Comments are closed.