W 4 Form 2024 Printable Peggi Tomasine

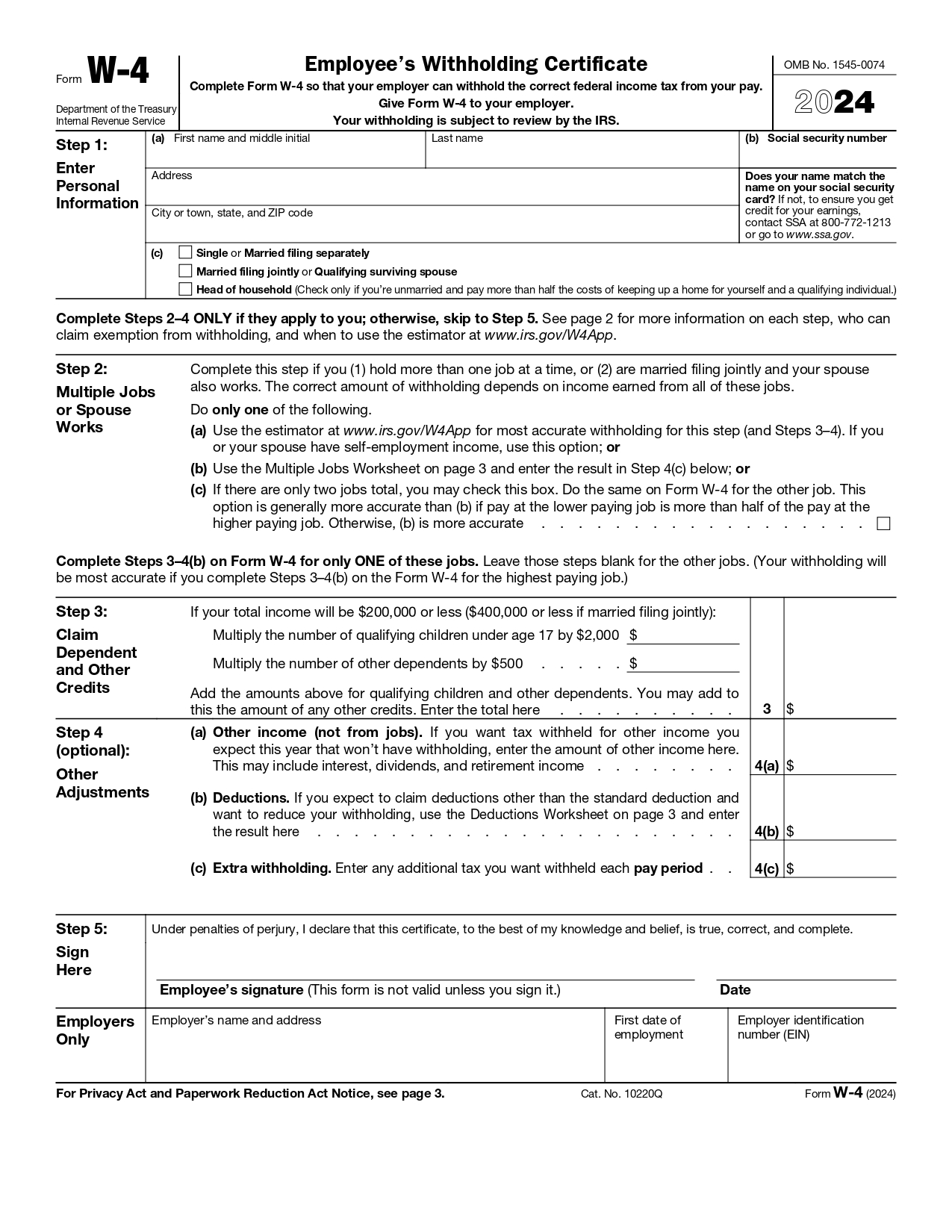

2024 W 4 Form Printable Internal Revenue Service Irs Employee’s withholding certificate. complete form w 4 so that your employer can withhold the correct federal income tax from your pay. give form w 4 to your employer. your withholding is subject to review by the irs. 2024. step 1: enter personal information. first name and middle initial. last name. Irs form w 4, or employee’s withholding certificate, is a form given to an employer by an employee that calculates the amount of federal income tax that should be withheld from the employee’s pay. a w 4 is not required to be submitted annually unless the employee is exempt from withholding. it is filled out at the start of a job or when an.

W 4 Form 2024 Printable Peggi Tomasine A w 4 form, or "employee's withholding certificate," is an irs tax document that employees fill out and submit to their employers. employers use the information on a w 4 to calculate how much tax. This modifying solution enables you to customize, fill, and sign your w 4v form type form right on the spot. once you discover an appropriate template, click on it to open the modifying mode. once you open the form in the editor, you have all the needed instruments at your fingertips. you can easily fill in the dedicated fields and remove them. Employee's withholding certificate 2024. form. w 4. department of the treasury internal revenue service. employee’s withholding certificate. complete form w 4 so that your employer can withhold the correct federal income tax from your pay. give form w 4 to your employer. your withholding is subject to review by the irs. omb no. 1545 0074. Page last reviewed or updated: 22 may 2024. information about form w 4, employee's withholding certificate, including recent updates, related forms and instructions on how to file. form w 4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employee's pay.

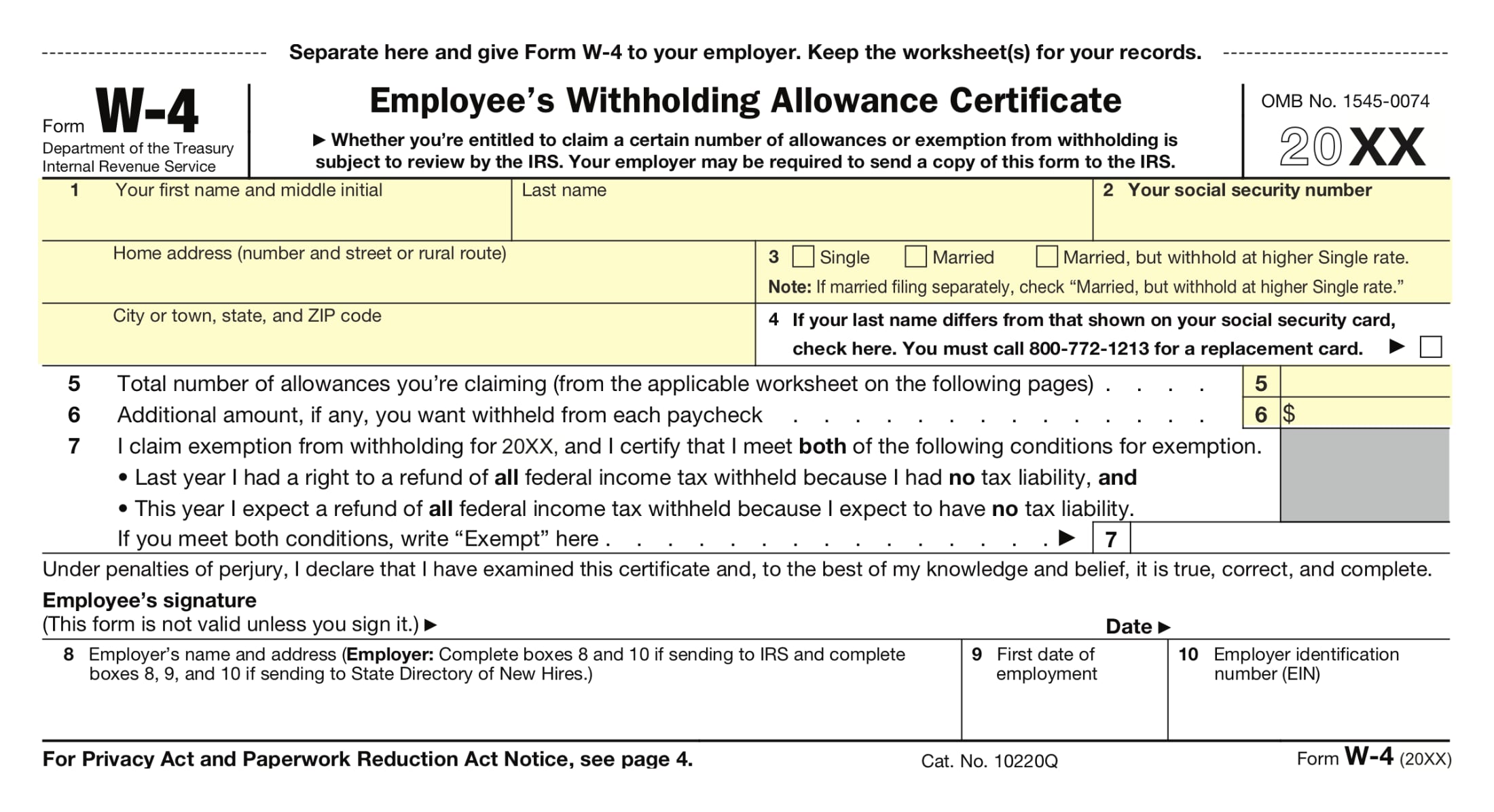

W4 Form 2024 Withholding Adjustment W 4 Forms Taxuni Employee's withholding certificate 2024. form. w 4. department of the treasury internal revenue service. employee’s withholding certificate. complete form w 4 so that your employer can withhold the correct federal income tax from your pay. give form w 4 to your employer. your withholding is subject to review by the irs. omb no. 1545 0074. Page last reviewed or updated: 22 may 2024. information about form w 4, employee's withholding certificate, including recent updates, related forms and instructions on how to file. form w 4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employee's pay. Step 2: account for all jobs you and your spouse have. unlike when you filled out w 4 forms in the past, you’ll have to fill out your w 4 with your combined income in mind, including self employment. otherwise, you may set up your withholding at too low a rate. to fill out this part correctly, you have three choices. 2023 form w 4. form. w 4. department of the treasury internal revenue service. employee’s withholding certificate. complete form w 4 so that your employer can withhold the correct federal income tax from your pay. give form w 4 to your employer. your withholding is subject to review by the irs. omb no. 1545 0074.

Comments are closed.