W 9 Form 2024 Printable Irs Anni Malena

W 9 Form 2024 Printable Irs Anni Malena Chapter 3 or 4 purposes), do not use form w 9. instead, use the appropriate form w 8 or form 8233 (see pub. 515). if you are a qualified foreign pension fund under regulations section 1.897(l) 1(d), or a partnership that is wholly owned by qualified foreign pension funds, that is treated as a non foreign person for purposes of section 1445. All form w 9 revisions. about publication 515, withholding of tax on nonresident aliens and foreign entities. about publication 519, u.s. tax guide for aliens. publication 1281, backup withholding for missing and incorrect name tin(s) pdf. publication 5027, identity theft information for taxpayers pdf. video: how to complete form w 9. other.

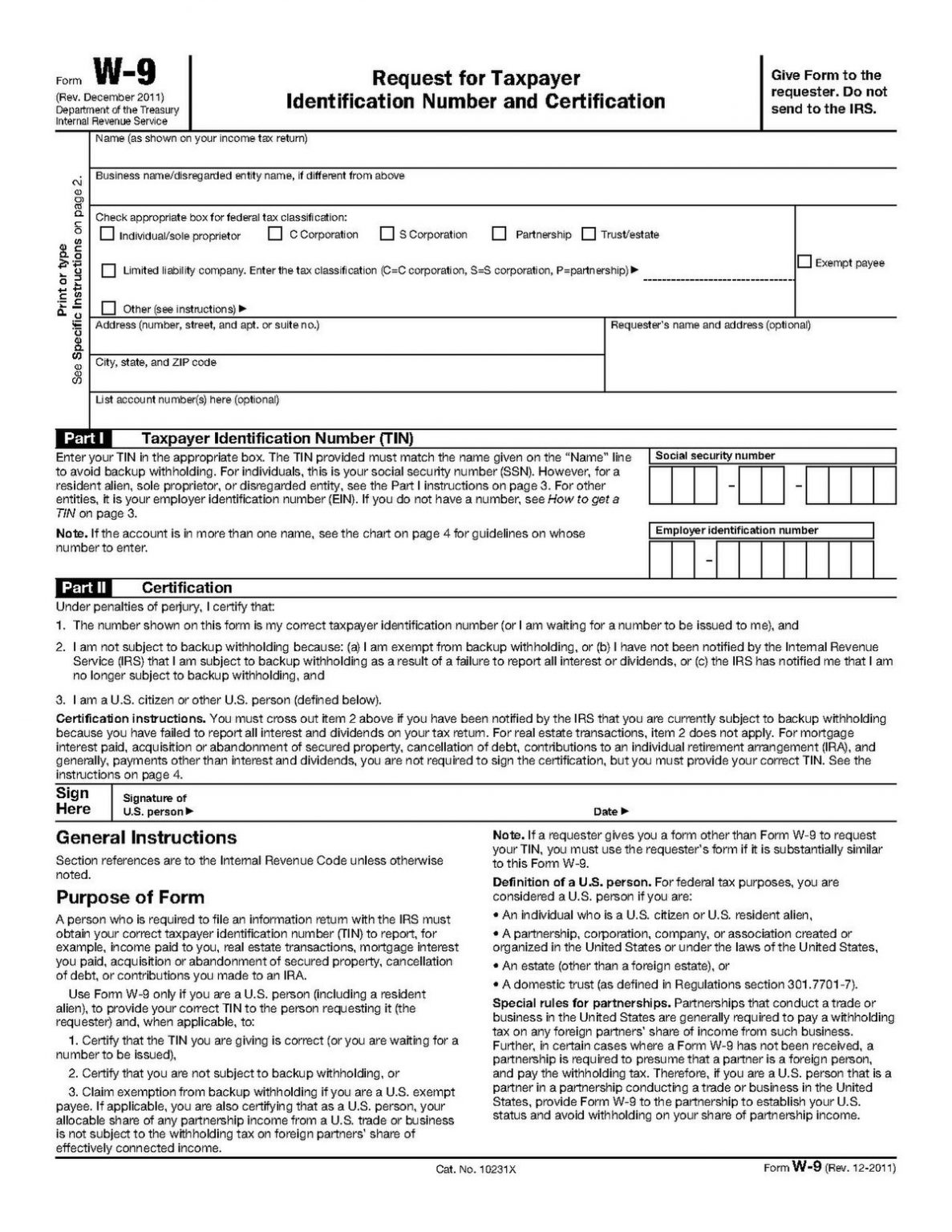

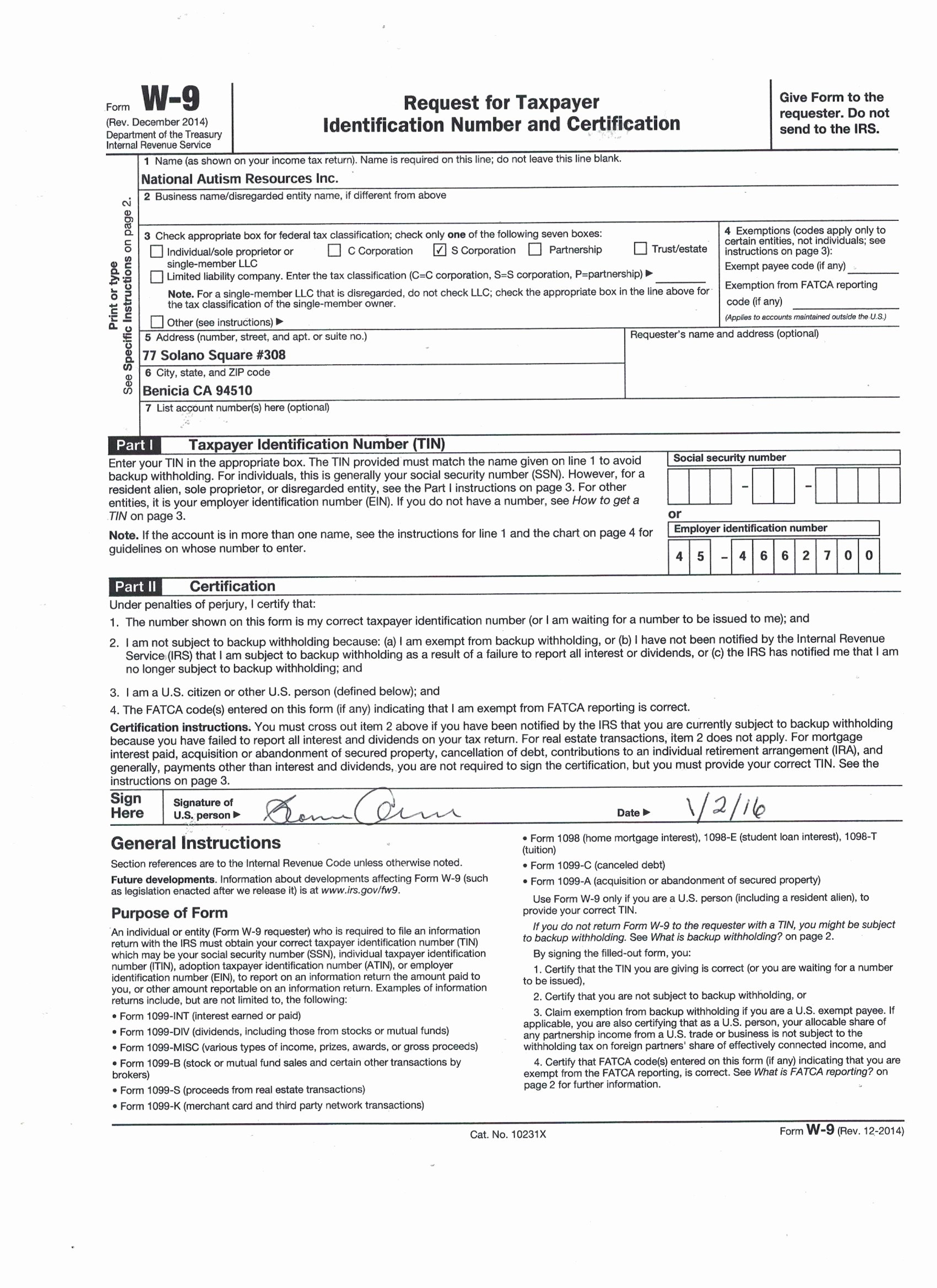

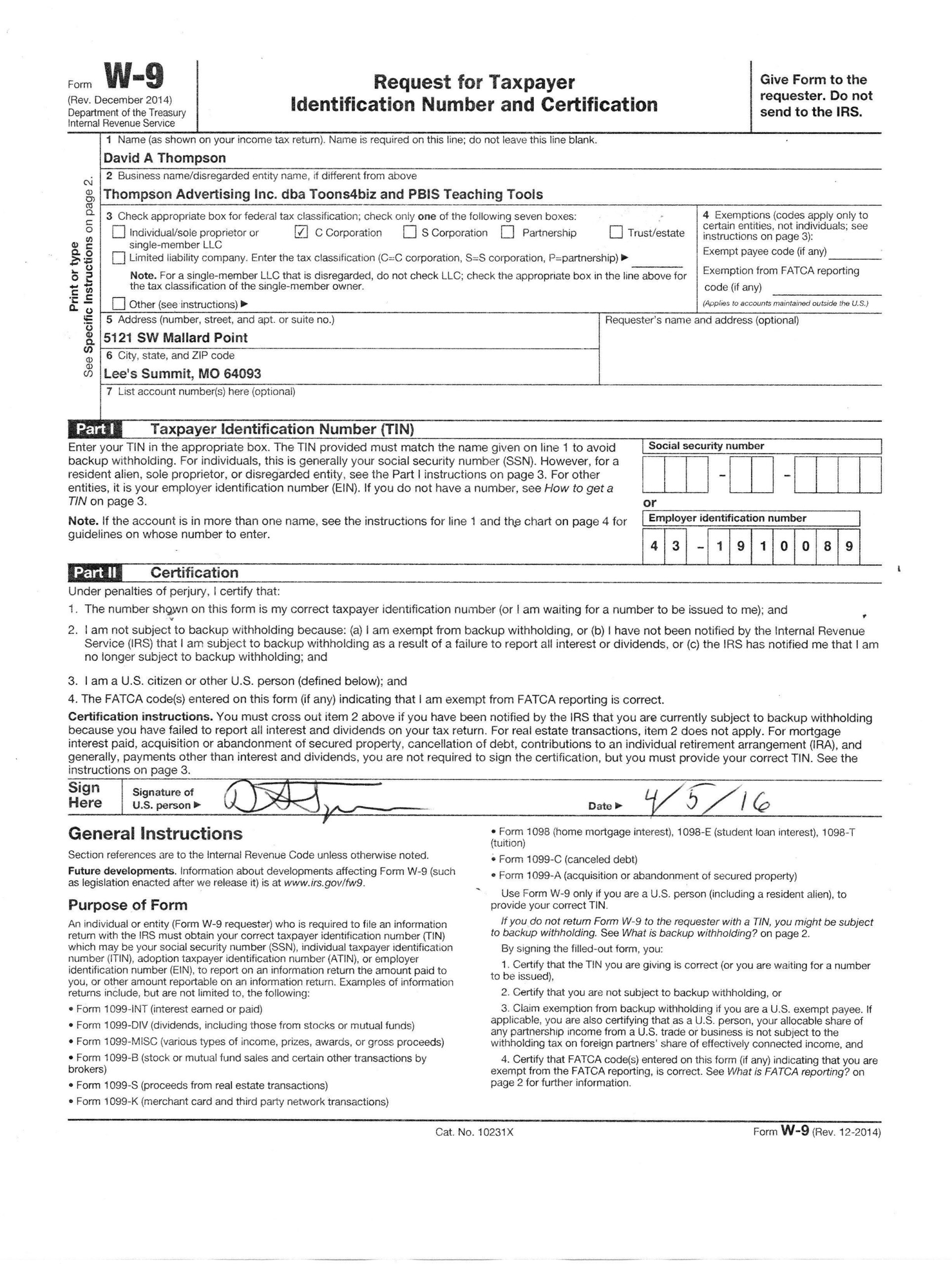

Blank W 9 Form Printable 2024 Chapter 4. for chapter 4 purposes, form w 9 is used to withhold on payments to foreign financial institutions (ffi) and non financial foreign entities (nffe) if they don't report all specified u.s. account holders. if an account holder fails to provide its tin, then the withholding rate is 30%. tin matching e services. Irs form w9 (2024) an irs form w 9, or "request for taxpayer identification number and certification," is a document used to obtain the legal name and tax identification number (tin) of an individual or business entity. it is commonly required when making a payment and withholding taxes are not being deducted. create document. A w 9 is an irs form that independent contractors and certain individuals fill out to give businesses and other entities their tax id number and personal information. updated may 24, 2024 · 2 min. Apply your e signature to the page. simply click done to save the changes. save the papers or print your pdf version. send immediately to the receiver. take advantage of the quick search and powerful cloud editor to create a precise irs w 9. remove the routine and make papers online!.

2024 W 9 Form Printable Lyndy Kimberli A w 9 is an irs form that independent contractors and certain individuals fill out to give businesses and other entities their tax id number and personal information. updated may 24, 2024 · 2 min. Apply your e signature to the page. simply click done to save the changes. save the papers or print your pdf version. send immediately to the receiver. take advantage of the quick search and powerful cloud editor to create a precise irs w 9. remove the routine and make papers online!. Filling out w 9s. filling out the form isn't difficult since it only requires a few pieces of basic information. when the w 9 is for a business, enter the business name at the top of the form and check the appropriate box to identity the type of entity. the tin is entered on part one of the form. part two is to certify that the information is. Irs w 9 tax form in 2024: terms for use. the requirement to deal with the w 9 tax form is specifically for united states persons, which include citizens and residents, as well as various entities established under u.s. law. freelancers, consultants, and other independent contractors are prime examples of individuals who must provide a copy of the w9 tax form to their payers.

Downloadable W 9 Form 2024 Megan Trudey Filling out w 9s. filling out the form isn't difficult since it only requires a few pieces of basic information. when the w 9 is for a business, enter the business name at the top of the form and check the appropriate box to identity the type of entity. the tin is entered on part one of the form. part two is to certify that the information is. Irs w 9 tax form in 2024: terms for use. the requirement to deal with the w 9 tax form is specifically for united states persons, which include citizens and residents, as well as various entities established under u.s. law. freelancers, consultants, and other independent contractors are prime examples of individuals who must provide a copy of the w9 tax form to their payers.

Comments are closed.