W9 2024 Form Fillable Format Rora Wallie

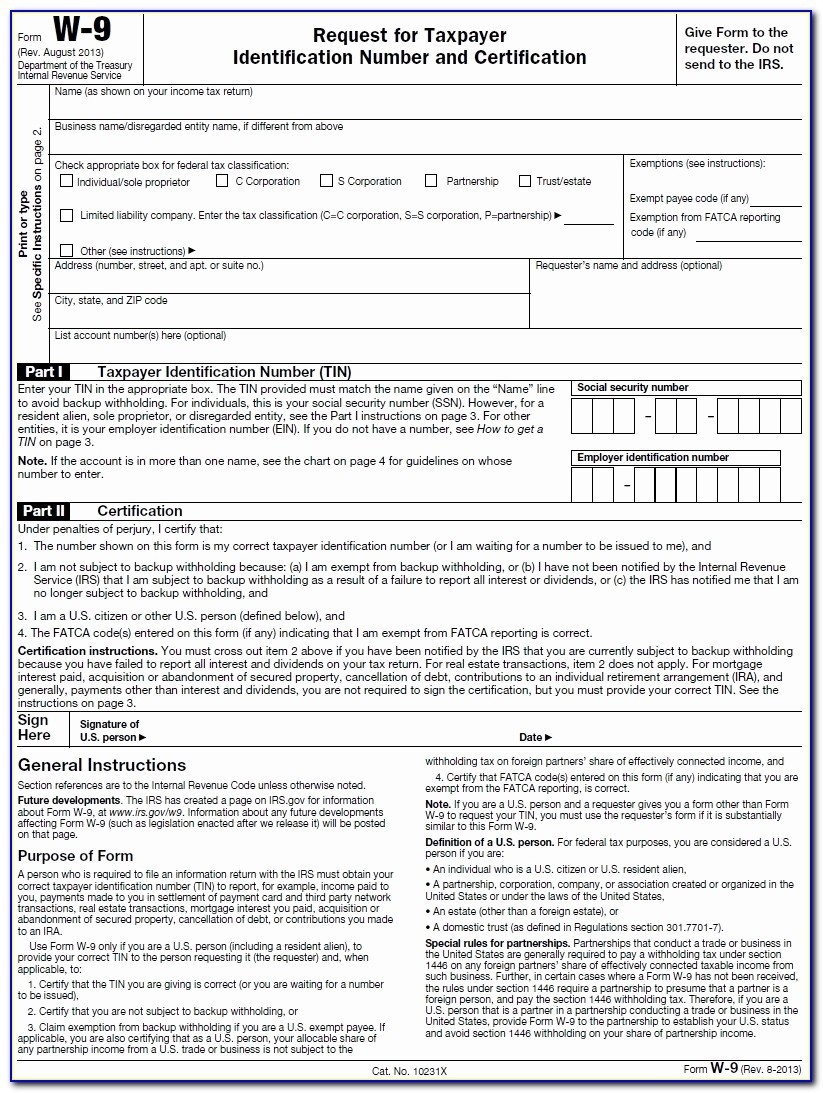

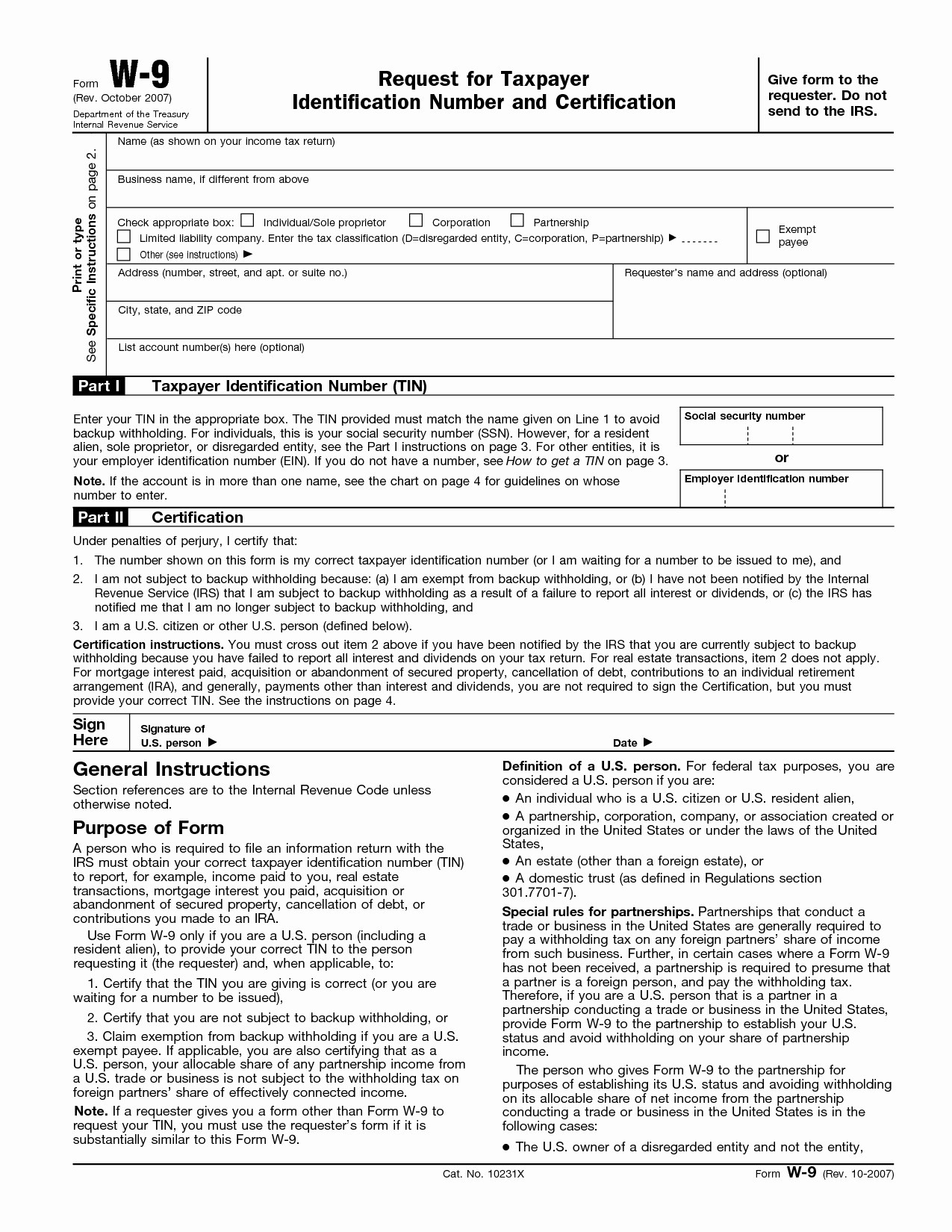

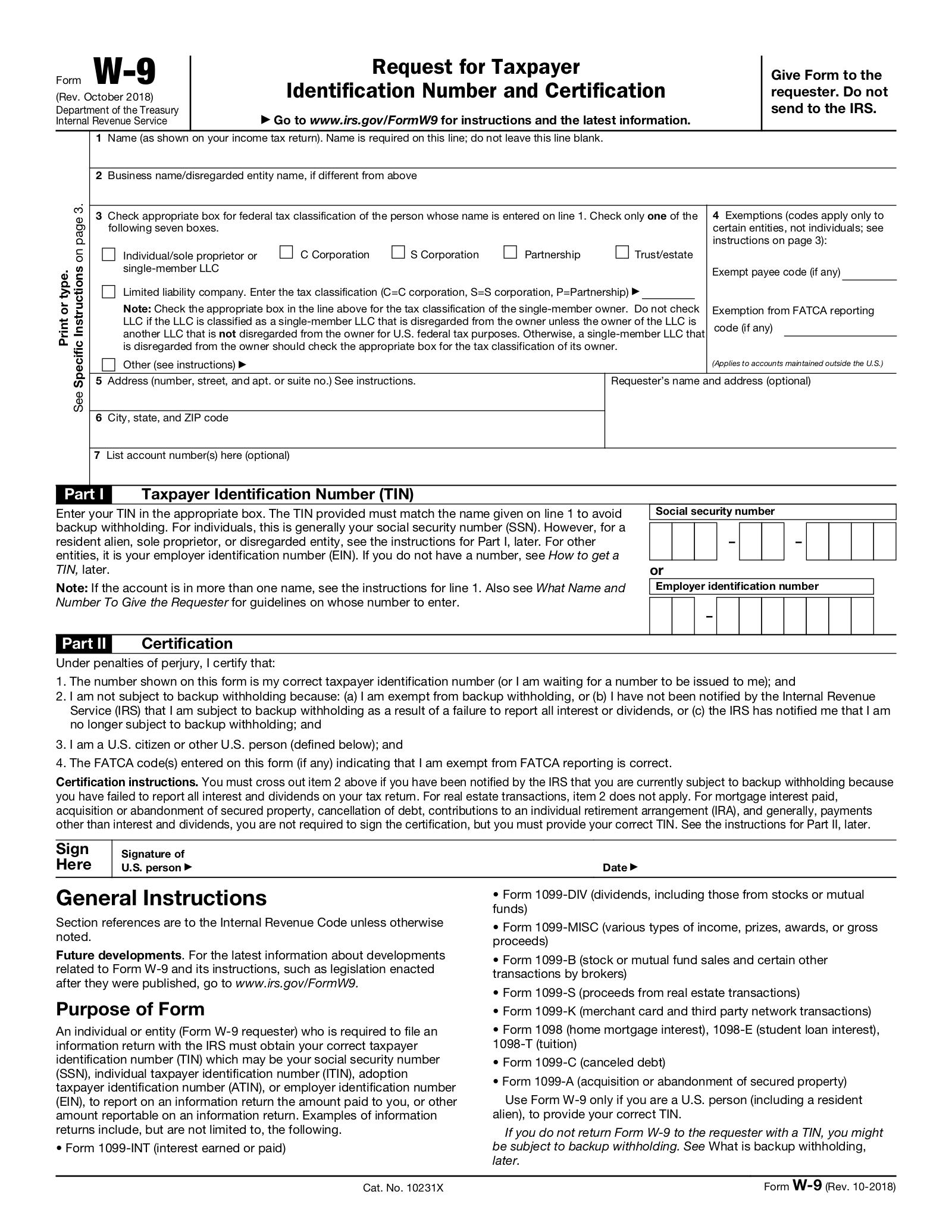

W9 2024 Form Fillable Format Rora Wallie Partnership instructions for schedules k 2 and k 3 (form 1065). purpose of form. an individual or entity (form w 9 requester) who is required to file an information return with the irs is giving you this form because they. cat. no. 10231x form . w 9 (rev. 3 2024). Chapter 4. for chapter 4 purposes, form w 9 is used to withhold on payments to foreign financial institutions (ffi) and non financial foreign entities (nffe) if they don't report all specified u.s. account holders. if an account holder fails to provide its tin, then the withholding rate is 30%. tin matching e services.

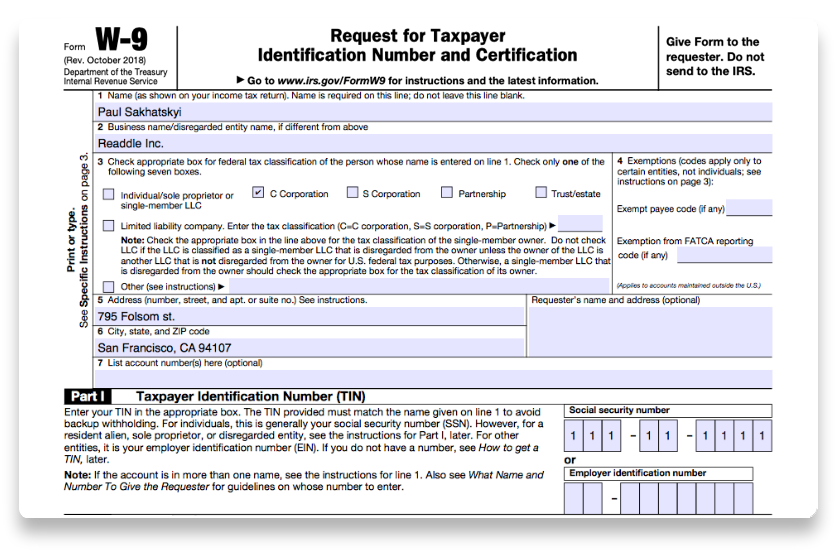

Blank W9 Form 2024 Fillable Gwen Pietra All form w 9 revisions. about publication 515, withholding of tax on nonresident aliens and foreign entities. about publication 519, u.s. tax guide for aliens. publication 1281, backup withholding for missing and incorrect name tin(s) pdf. publication 5027, identity theft information for taxpayers pdf. video: how to complete form w 9. other. Irs form w9 (2024) an irs form w 9, or "request for taxpayer identification number and certification," is a document used to obtain the legal name and tax identification number (tin) of an individual or business entity. it is commonly required when making a payment and withholding taxes are not being deducted. create document. The data is used to generate a 1099 nec. the w 9 form is an essential tool for employers to gather information about contractors for income tax purposes. verifying the information on this form and keeping it up to date ensures you collected accurate personal information. form w 9 should be reviewed and updated yearly. Printable free pdf irs form w9 2024 (new) understand this fillable blank irs form w 9 is one of the most important tax documents. it’s an official request from the internal revenue service (irs) for your taxpayer identification number (tin). this nine digit number is used to report income paid to you properly. w9 form 2023 2024.

W 9 Form 2024 Printable Pdf File Ange Maggie The data is used to generate a 1099 nec. the w 9 form is an essential tool for employers to gather information about contractors for income tax purposes. verifying the information on this form and keeping it up to date ensures you collected accurate personal information. form w 9 should be reviewed and updated yearly. Printable free pdf irs form w9 2024 (new) understand this fillable blank irs form w 9 is one of the most important tax documents. it’s an official request from the internal revenue service (irs) for your taxpayer identification number (tin). this nine digit number is used to report income paid to you properly. w9 form 2023 2024. The first section of form w 9 is where you must provide information about yourself and your federal tax classification, including details of exemption if it applies to you. line 1: enter your name as it appears on your income tax return. line 2: enter your business name or disregarded entity name if it is different from the name that you. Form w 9 is an irs document that businesses use to collect a person's tax identification number (tin). independent contractors who were paid at least $600 during the year need to fill out a w 9.

W9 Fillable Form 2024 Irs Rhoda Charmine The first section of form w 9 is where you must provide information about yourself and your federal tax classification, including details of exemption if it applies to you. line 1: enter your name as it appears on your income tax return. line 2: enter your business name or disregarded entity name if it is different from the name that you. Form w 9 is an irs document that businesses use to collect a person's tax identification number (tin). independent contractors who were paid at least $600 during the year need to fill out a w 9.

Comments are closed.