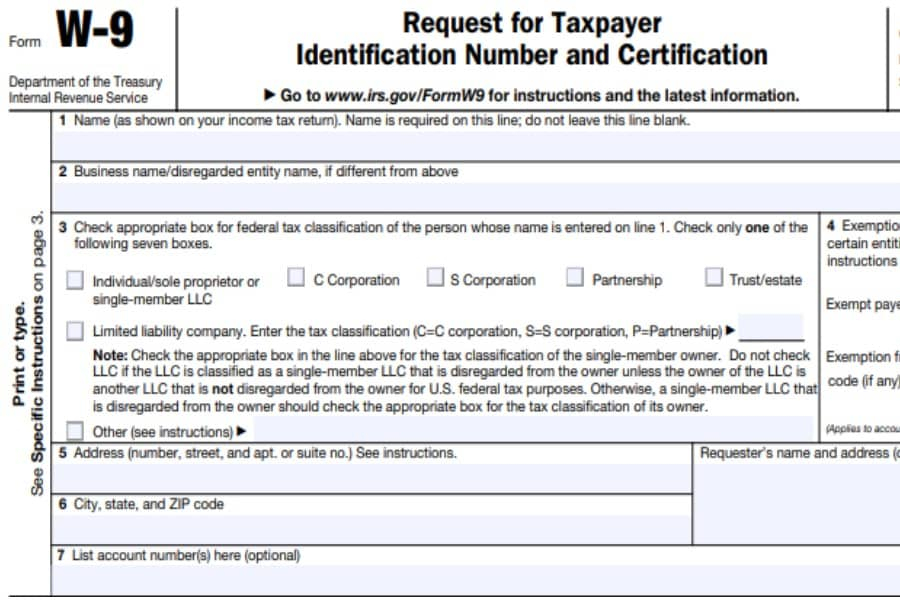

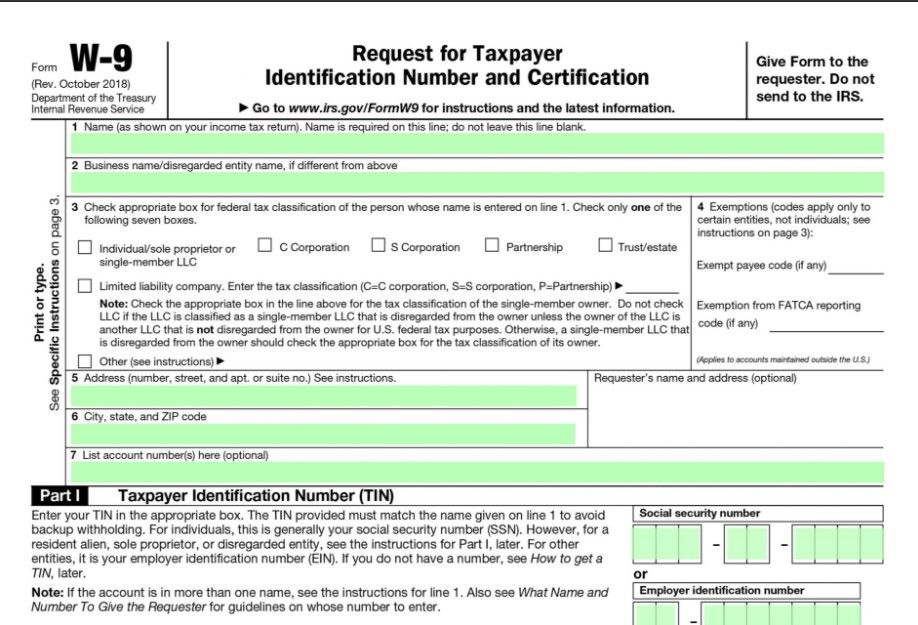

W9 Form 2021 Fillable Paperspanda

W9 Form 2021 Fillable Paperspanda See pub. 515, withholding of tax on nonresident aliens and foreign entities. the following persons must provide form w 9 to the payor for purposes of establishing its non foreign status. in the case of a disregarded entity with a u.s. owner, the u.s. owner of the disregarded entity and not the disregarded entity. Information about form w 9, request for taxpayer identification number (tin) and certification, including recent updates, related forms, and instructions on how to file. form w 9 is used to provide a correct tin to payers (or brokers) required to file information returns with irs.

2021 W9 Form Fill Out Online Paperspanda Form w 9 is an internal revenue service (irs) tax form that self employed individuals fill out with their identifying information. businesses issue this form and collect it once the self employed individuals have completed it. then, they use the details the self employed individuals provided to report nonemployee compensation to the irs properly. Irs form w9 (2024) an irs form w 9, or "request for taxpayer identification number and certification," is a document used to obtain the legal name and tax identification number (tin) of an individual or business entity. it is commonly required when making a payment and withholding taxes are not being deducted. create document. The data is used to generate a 1099 nec. the w 9 form is an essential tool for employers to gather information about contractors for income tax purposes. verifying the information on this form and keeping it up to date ensures you collected accurate personal information. form w 9 should be reviewed and updated yearly. Chapter 4. for chapter 4 purposes, form w 9 is used to withhold on payments to foreign financial institutions (ffi) and non financial foreign entities (nffe) if they don't report all specified u.s. account holders. if an account holder fails to provide its tin, then the withholding rate is 30%. tin matching e services.

Comments are closed.