W9 Form When And Why To Use It Harvard Business Services

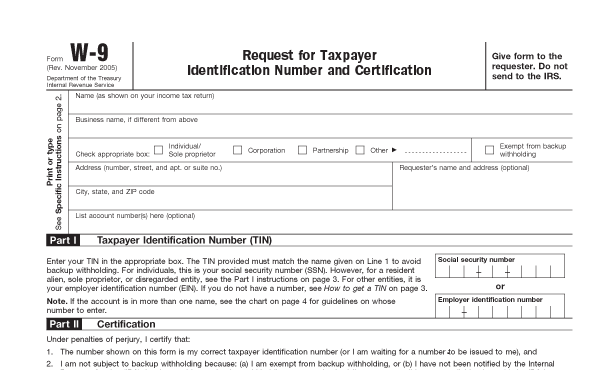

W9 Form When And Why To Use It Harvard Business Services Use form w 9 to provide your correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: income paid to you. real estate transactions. mortgage interest you paid. acquisition or abandonment of secured property. Travel services system applications: fad reporting units capital planning & project services office of the controller office of finance and administration office of financial strategy and planning office for sponsored programs office of treasury management risk management & audit services strategic procurement.

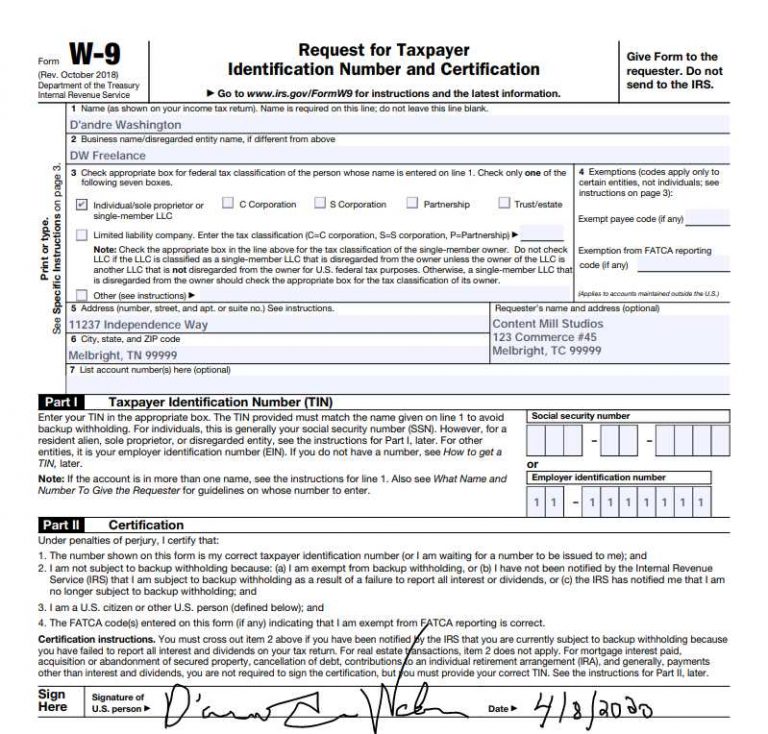

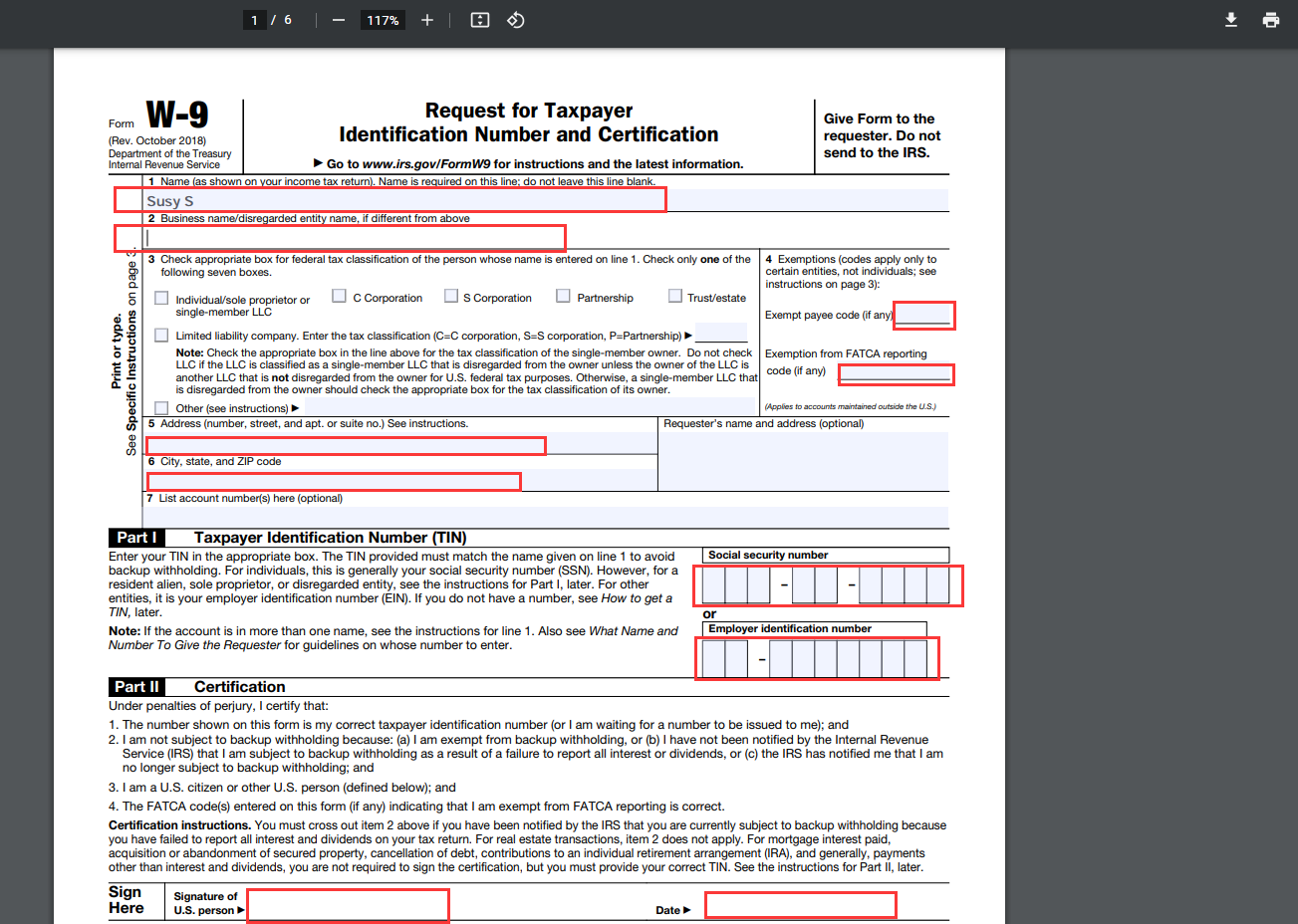

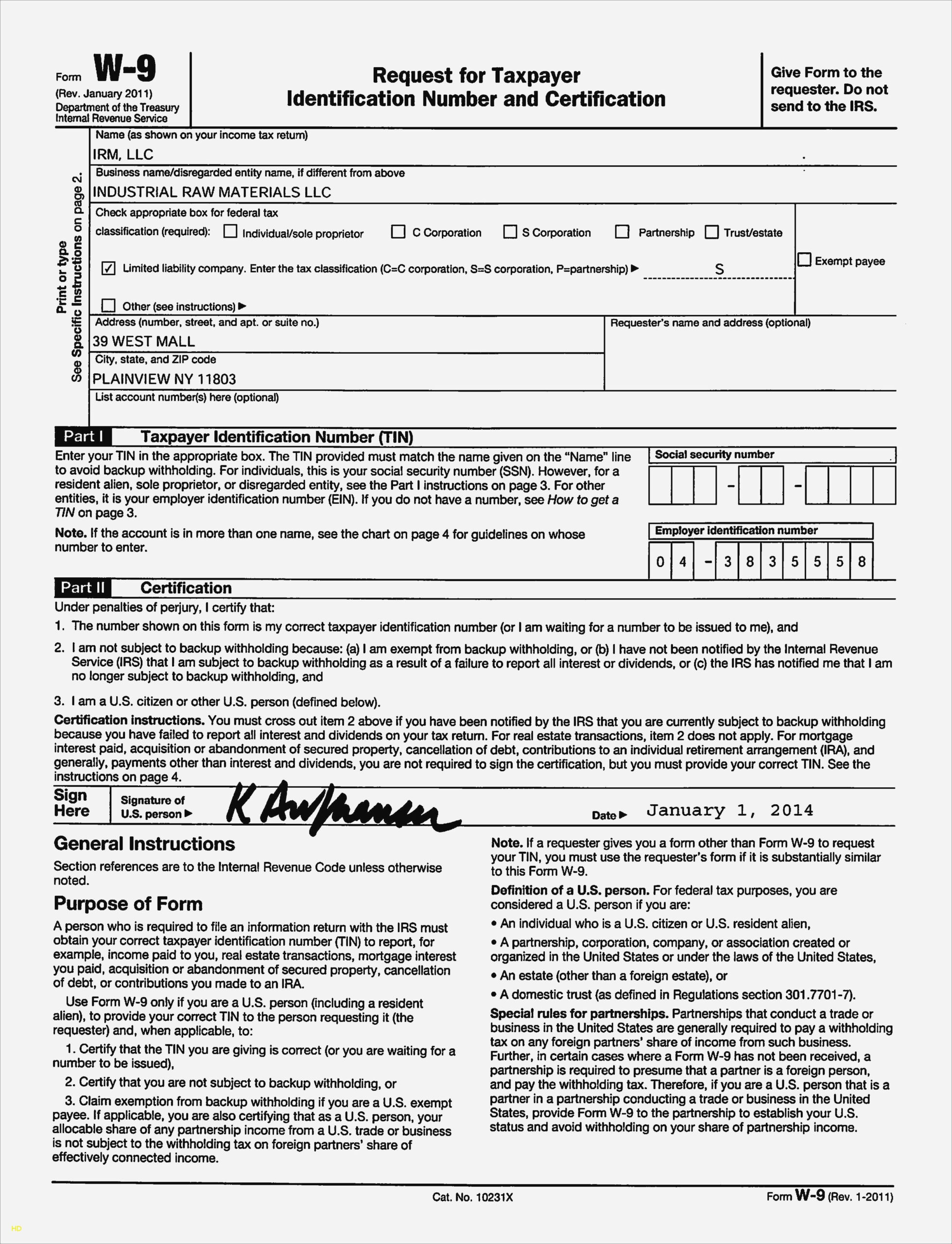

What Is A W9 Form How To Fill It Out Form w 9 is an “information return,” meaning it’s just for giving someone else a piece of information they need (rather than the irs). but because you’re not sending it to the irs, you need to be careful about who exactly you send it to. the irs made two updates to form w 9 in december 2023, affecting form w 9 for the 2024 tax year. Information about form w 9, request for taxpayer identification number (tin) and certification, including recent updates, related forms, and instructions on how to file. form w 9 is used to provide a correct tin to payers (or brokers) required to file information returns with irs. The purpose of a form w 9 extends beyond just this single situation. a bank or financial institution relies on the receipt of taxpayer information in order to properly report form 1099 int, 1099. As a small business owner, it is important to collect a w 9 for any person or entity you expect to pay more than $600 in a tax year. you will use the information provided to you on the w 9 to complete form 1099 nec, nonemployee compensation, or form 1099 misc, miscellaneous income. going forward, form 1099 nec will be used to report nonemployee.

All About W 9 Form What It Is What It Is Used For And How To Fill It Out The purpose of a form w 9 extends beyond just this single situation. a bank or financial institution relies on the receipt of taxpayer information in order to properly report form 1099 int, 1099. As a small business owner, it is important to collect a w 9 for any person or entity you expect to pay more than $600 in a tax year. you will use the information provided to you on the w 9 to complete form 1099 nec, nonemployee compensation, or form 1099 misc, miscellaneous income. going forward, form 1099 nec will be used to report nonemployee. Form w 9 is an irs document that businesses use to collect a person's tax identification number (tin). independent contractors who were paid at least $600 during the year need to fill out a w 9. Provide harvard's taxpayer id number to a requestor.

W 9 Free Printable Forms Form w 9 is an irs document that businesses use to collect a person's tax identification number (tin). independent contractors who were paid at least $600 during the year need to fill out a w 9. Provide harvard's taxpayer id number to a requestor.

Comments are closed.