What Is A Consumer Finance Loan

Consumer Loan What Is It Examples Types Interest Eligibility As mentioned earlier, a consumer loan is any financial lending product that provides you with funding or credit for personal, family, or household purposes. a consumer is a person or individual, not an organization. consumer loans, therefore, are given to private individuals rather than businesses. a consumer loan is simply a consumer lending. 4. payday loans. a payday loan is a type of unsecured loan, but it is typically repaid on the borrower’s next payday rather than in installments over a period of time. loan amounts tend to be a.

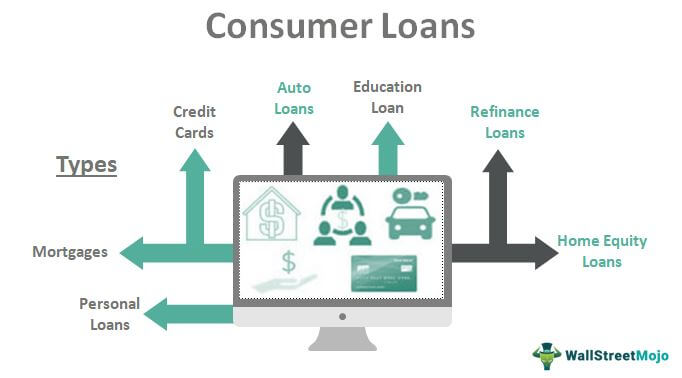

Consumer Loan Types And Categories Of Consumer Loan Examples A personal loan is money you can borrow in a lump sum with a fixed payment to finance large purchases, consolidate debt, invest in yourself or cover emergency expenses. interest rates, monthly. A consumer loan is a credit type offered to customers to aid them in financing only specific expenditures. consumer loans are mortgages, credit cards, auto loans, education loans, refinance loans, home equity loans, and personal loans. the documents required for consumer loans are identity proof, address proof, income proof, and other documents. Categories of loans. 1. open end loan. an open end consumer loan, also known as revolving credit, is a loan in that the borrower can use for any type of purchases but must pay back a minimum amount of the loan, plus interest, before a specified date. open end loans are generally unsecured. if a consumer is unable to pay off the loan in full. A personal loan is an amount of money you borrow to use for a variety of purposes. for instance, you may use a personal loan to consolidate debt, pay for home renovations, or plan a dream wedding.

Comments are closed.