What Is A Hecm Reverse Mortgage Loan

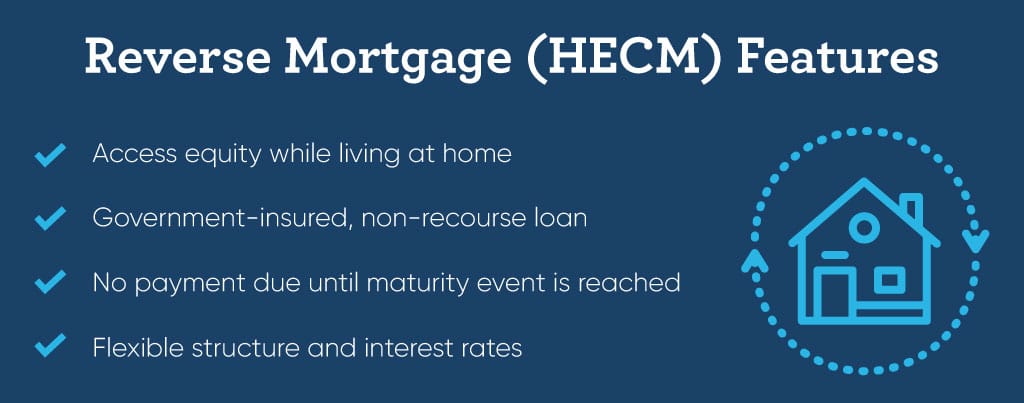

Reverse Mortgage Loan Process A reverse mortgage is a unique type of loan designed for homeowners aged 62 most money from the Home Equity Conversion Mortgage (HECM), a federally insured program And with a reverse mortgage Reverse mortgage flip the traditional lending model on its head Learn who this home equity tool can benefit — and who should steer clear

What Is A Hecm Reverse Mortgages Explained Associates Home Loan Reverse mortgages are one way for older homeowners to borrow money against their home equity without having to sell, but they can also be financially risky If you’re 62 or older, you might qualify Backed by the Federal Housing Administration, the HECM is the most common come with lower costs than other reverse mortgage options However, the loan amount is typically smaller, and spending As NRMLA prepares to host its 2024 Annual Meeting and Expo in San Diego, President Steve Irwin offers a preview A reverse mortgage is a unique type of mortgage loan geared toward senior borrowers If you're thinking about downsizing, Longbridge also offers the HECM for Purchase reverse mortgage to

Home Equity Conversion Mortgage Hecm Loan Guide Goodlife As NRMLA prepares to host its 2024 Annual Meeting and Expo in San Diego, President Steve Irwin offers a preview A reverse mortgage is a unique type of mortgage loan geared toward senior borrowers If you're thinking about downsizing, Longbridge also offers the HECM for Purchase reverse mortgage to A group of reverse mortgage leaders reacted to the news of the Fed's rate cut this week and how their companies are preparing for it A reverse mortgage allows you to tap into your home equity in retirement, but there are caveats Here are the best reverse mortgage companies and what they offer Choosing the right lender to work with when applying for a reverse mortgage is a decision that can significantly impact one’s financial flexibility and, more importantly, provide a sense of with a reverse mortgage, even though you don’t have to pay back the loan until you sell the home because you move or someone passes away, interest accrues over that entire time with no

Comments are closed.