What Is A Home Equity Conversion Mortgage Hecm Loan

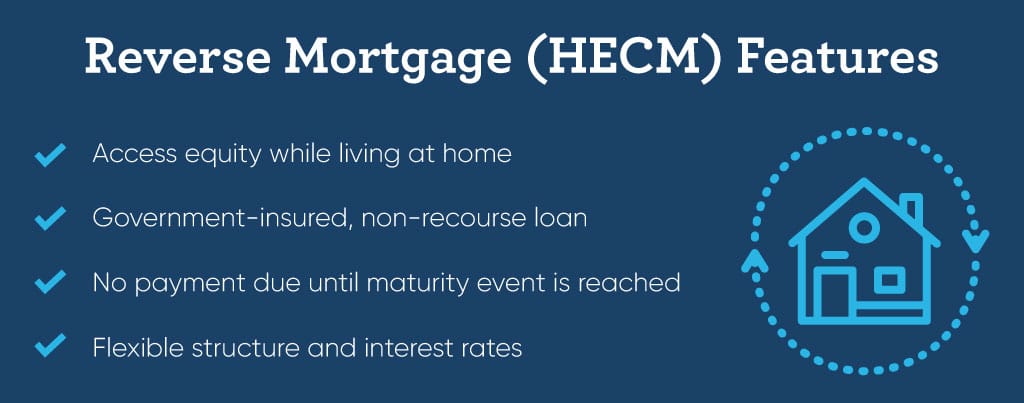

Hecm A Simple Guide To Home Equity Conversion Mortgages A home equity conversion mortgage (hecm) is a type of federal housing administration (fha) insured reverse mortgage. however, with a home equity loan, the funds have to be paid back, usually. The hecm is the fha's reverse mortgage program that enables you to withdraw a portion of your home's equity to use for home maintenance, repairs, or general living expenses. hecm borrowers may reside in their homes indefinitely as long as property taxes and homeowner's insurance are kept current.

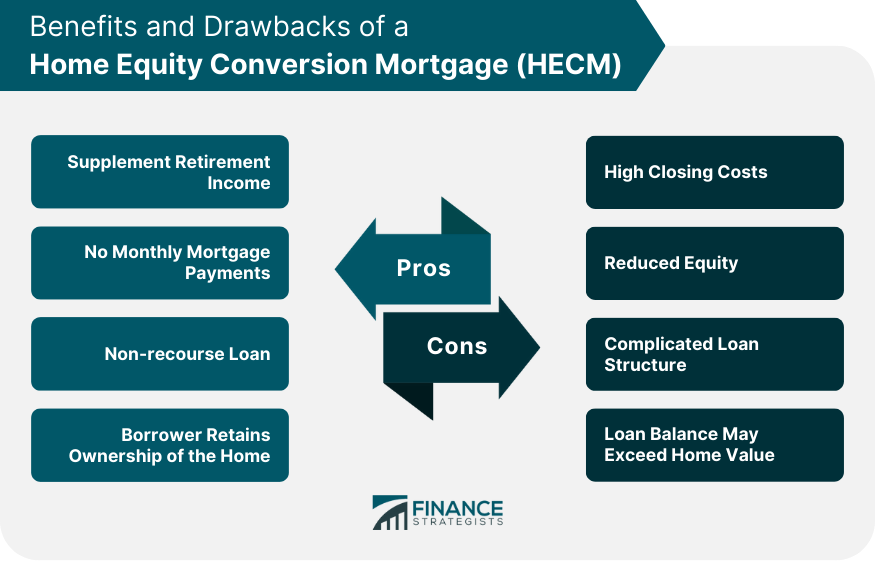

Home Equity Conversion Mortgage Hecm Finance Strategists A lender can charge 2% of the first $200,000 of your home's value plus 1% of the amount over $200,000. hecm origination fees are capped at $6,000. servicing fee. lenders can charge an ongoing. A home equity conversion mortgage (hecm) is a federally insured reverse mortgage that allows you to receive a cash payment from your home equity every month, using your home as collateral. hecms are backed by the u.s. department of housing and urban development (hud). the cash you receive is typically tax free and you can use it for any purpose. A home equity conversion mortgage (hecm) is a reverse mortgage that enables seniors to access their home equity without selling their homes or making monthly mortgage payments. personal loan. A lender can charge the greater of $2,500 or 2% of the first $200,000 of your home's value plus 1% of the amount over $200,000. hecm origination fees are capped at $6,000. lenders or their agents provide servicing throughout the life of the hecm.

Home Equity Conversion Mortgage Hecm Loan Guide Goodlife A home equity conversion mortgage (hecm) is a reverse mortgage that enables seniors to access their home equity without selling their homes or making monthly mortgage payments. personal loan. A lender can charge the greater of $2,500 or 2% of the first $200,000 of your home's value plus 1% of the amount over $200,000. hecm origination fees are capped at $6,000. lenders or their agents provide servicing throughout the life of the hecm. They age. fha’s home equity conversion mortgage (hecm) program can be that resource for aging homeowners. the hecm program helps qualified seniors to borrow upon their home equity they’ve built over the years and to age in place. since the program’s inception, fha has insured more than one million reverse mortgages for senior borrowers. The home equity conversion mortgage (hecm) is a reverse mortgage regulated by the department of housing and urban development and insured by the federal housing administration (fha). hecm loans allow homeowners aged 62 or older to tap into their home equity and remain in their homes while they access their equity.

Comments are closed.