What Is A Reverse Mortgage Loan

Reverse Mortgages Demystified A Simple Guide For Homeowners Reverse mortgage flip the traditional lending model on its head Learn who this home equity tool can benefit — and who should steer clear with a reverse mortgage, even though you don’t have to pay back the loan until you sell the home because you move or someone passes away, interest accrues over that entire time with no

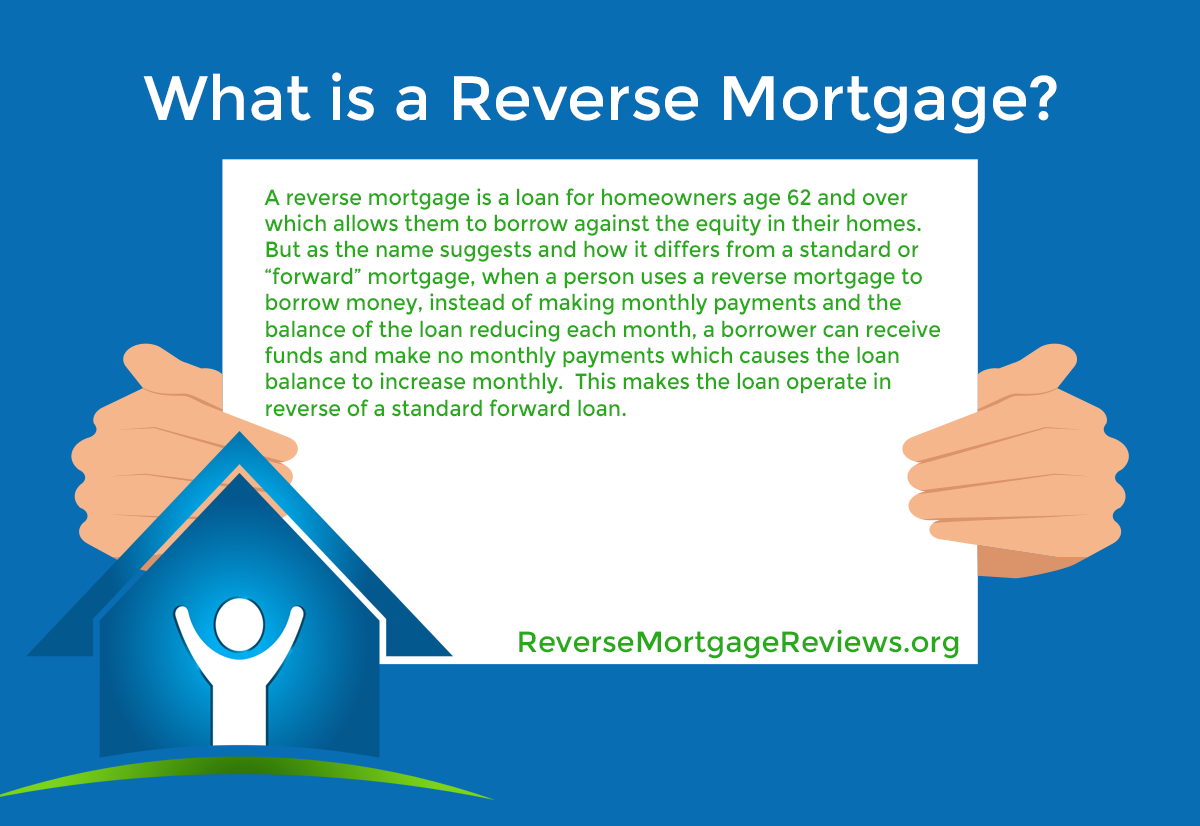

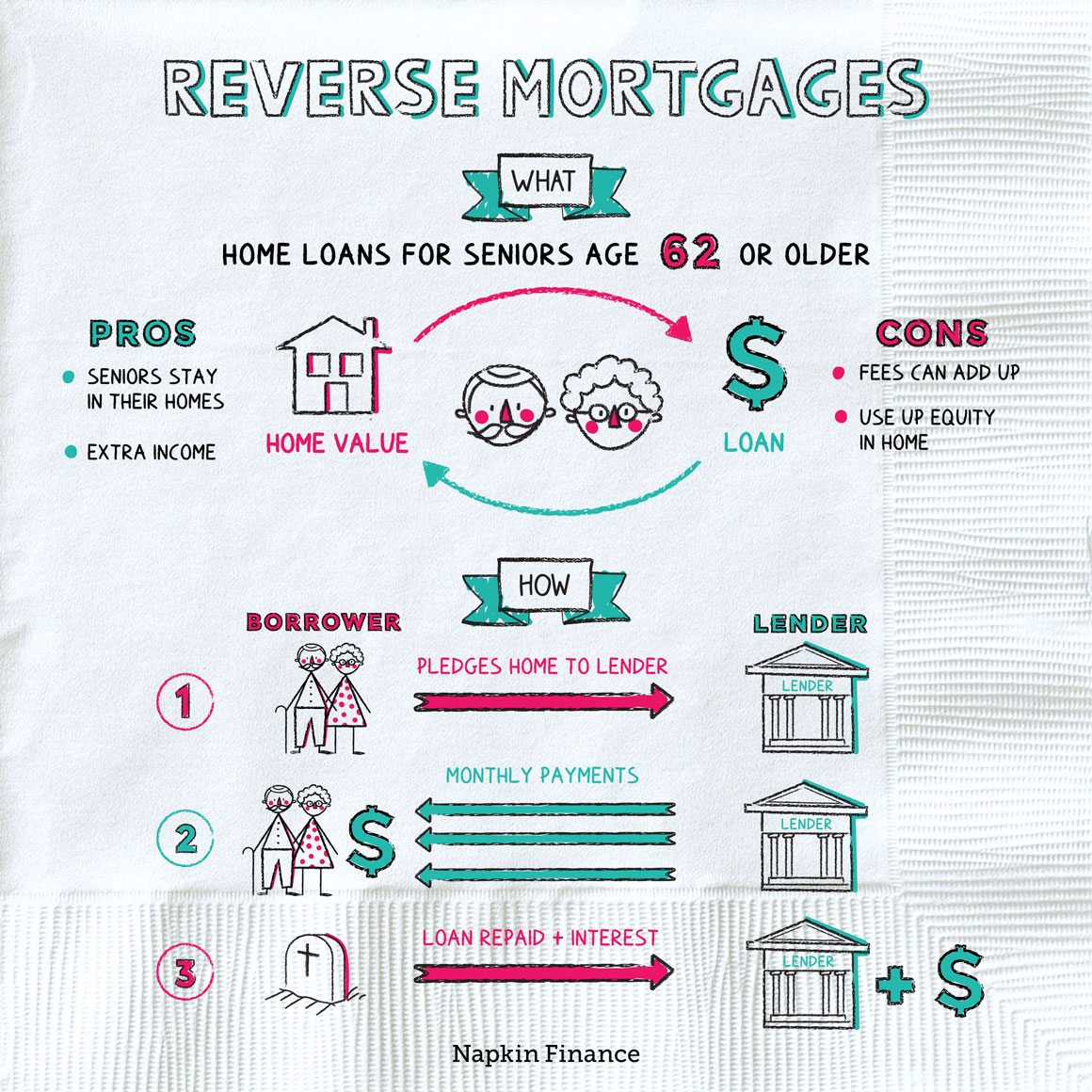

What Is Reverse Mortgage Loan Learn Reverse Mortgage Definition Here Reverse mortgages are one way for older homeowners to borrow money against their home equity without having to sell, but they can also be financially risky If you’re 62 or older, you might qualify A reverse mortgage allows you to tap into your home equity in retirement, but there are caveats Here are the best reverse mortgage companies and what they offer If you inherit a home with a reverse mortgage, it’s still possible for you to keep the home However, you’ll have to repay the loan balance within 30 days You may be able to get a loan to do this If A reverse mortgage is a unique type of mortgage loan geared toward senior borrowers (typically those ages 62 or older) that allows you to convert a portion of your home equity into cash

The Complete Guide To Understanding Reverse Mortgages If you inherit a home with a reverse mortgage, it’s still possible for you to keep the home However, you’ll have to repay the loan balance within 30 days You may be able to get a loan to do this If A reverse mortgage is a unique type of mortgage loan geared toward senior borrowers (typically those ages 62 or older) that allows you to convert a portion of your home equity into cash How does a reverse mortgage work? A reverse mortgage is a type of home loan only available to people age 62 or older Unlike traditional mortgages, with a reverse mortgage, the lender pays you As NRMLA prepares to host its 2024 Annual Meeting and Expo in San Diego, President Steve Irwin offers a preview Learn about this writer’s experience with family opportunity mortgages and whether this unique but conventional home loan could help your folks The lender maintains a 42% market share in Australia, easily the largest player in the country's reverse mortgage space

Hereтащs How To Get Out Of A юааreverseюаб юааmortgageюаб How does a reverse mortgage work? A reverse mortgage is a type of home loan only available to people age 62 or older Unlike traditional mortgages, with a reverse mortgage, the lender pays you As NRMLA prepares to host its 2024 Annual Meeting and Expo in San Diego, President Steve Irwin offers a preview Learn about this writer’s experience with family opportunity mortgages and whether this unique but conventional home loan could help your folks The lender maintains a 42% market share in Australia, easily the largest player in the country's reverse mortgage space Choosing the right lender to work with when applying for a reverse mortgage is a decision that can significantly impact one’s financial flexibility and, more importantly, provide a sense of

7 Steps To Apply For A Reverse Mortgage Homeequity Bank Learn about this writer’s experience with family opportunity mortgages and whether this unique but conventional home loan could help your folks The lender maintains a 42% market share in Australia, easily the largest player in the country's reverse mortgage space Choosing the right lender to work with when applying for a reverse mortgage is a decision that can significantly impact one’s financial flexibility and, more importantly, provide a sense of

Comments are closed.