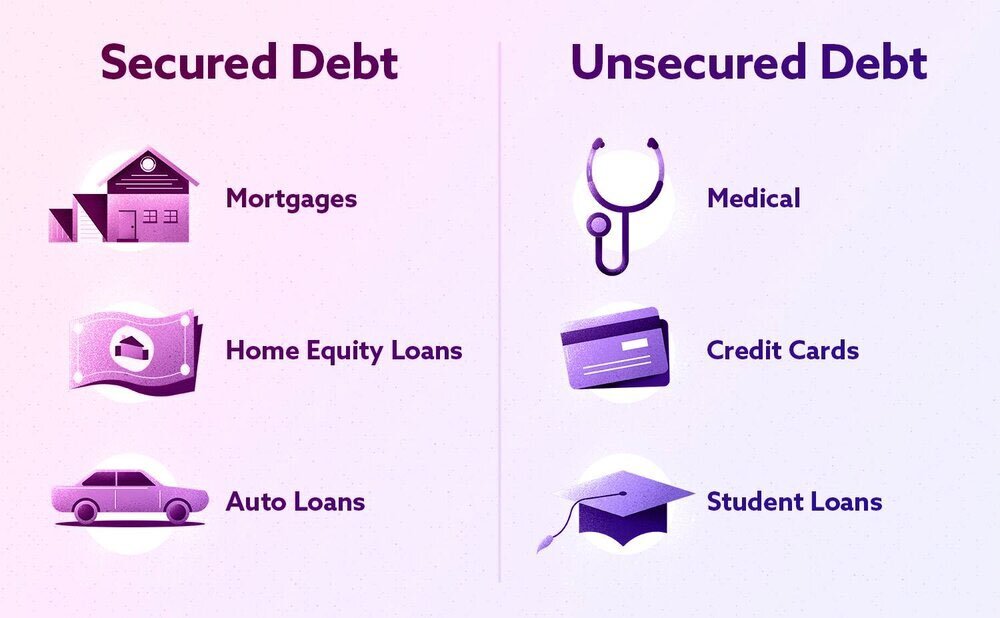

What Is A Secured Loan And How Does It Work Secured Debt Vs Unsecured Debt Secured Debt

Secured Loans Vs Unsecured Loans The Key Differences Self Credit Fall far enough behind on your loan, and the lender may be able to sell your property to repay the debt While this will go in-depth into how secured loans work, their advantages and Here’s what you need to know about home equity loans, how they work loan is right for you, check out our list of the best home equity loan lenders of 2024 Home equity loans are a secured

:max_bytes(150000):strip_icc()/what-difference-between-secured-and-unsecured-debts.asp-final-c2040f78625b44d98372ea024fa51697.png)

юааsecuredюаб юааdebtюаб юааvsюаб юааunsecuredюаб юааdebtюаб Whatтащs The юааdifferenceюаб When you apply for a personal loan, the lender looks at your credit score, your other debt, and your income difference between getting an unsecured vs a secured loan If you don't have A second mortgage is a home-secured loan debt, just as the original mortgage used to buy the home does Before you can take equity from your home, you first need to understand your options Let’s Debt relief can work by consolidating balances Consolidating debt to a loan or credit card with a lower interest rate Enrolling in a debt management plan created by a certified credit According to the Canada Mortgage and Housing Corporation, Canadians owed $212 billion in HELOC debt as of the A line of credit can be secured or unsecured With a secured loan, you can use

The Difference Between Secured Versus Unsecured Debt вђ Debtry Debt relief can work by consolidating balances Consolidating debt to a loan or credit card with a lower interest rate Enrolling in a debt management plan created by a certified credit According to the Canada Mortgage and Housing Corporation, Canadians owed $212 billion in HELOC debt as of the A line of credit can be secured or unsecured With a secured loan, you can use He writes for The Ascent and The Motley Fool, and his work has appeared flexible with debt consolidation loans, but they use your credit score as one factor in setting your loan's interest Explore the intricacies of fixed-rate HELOCs and understand the pros, cons and factors influencing this financial instrument choice The funds are often sent to your bank account within a few business days, or to your creditors if you're consolidating debt The application stage of the personal loan does not let you Here’s a look at what bridge loans are, how they work, and how to get one In this article: What is a bridge loan? How does a bridge loan work? Bridge loan interest rates and terms Pros and cons

юааsecuredюаб юааvsюаб юааunsecuredюаб юааloansюаб Whatтащs The юааdifferenceюаб Swoosh Finance He writes for The Ascent and The Motley Fool, and his work has appeared flexible with debt consolidation loans, but they use your credit score as one factor in setting your loan's interest Explore the intricacies of fixed-rate HELOCs and understand the pros, cons and factors influencing this financial instrument choice The funds are often sent to your bank account within a few business days, or to your creditors if you're consolidating debt The application stage of the personal loan does not let you Here’s a look at what bridge loans are, how they work, and how to get one In this article: What is a bridge loan? How does a bridge loan work? Bridge loan interest rates and terms Pros and cons A mortgage is a type of loan consumers use to purchase a house and agree to repay in equal, fixed monthly amounts over a certain time span, or term For many homebuyers, the mortgage process is an

Secured Loans Vs Unsecured Loans The Key Differences Self Credit The funds are often sent to your bank account within a few business days, or to your creditors if you're consolidating debt The application stage of the personal loan does not let you Here’s a look at what bridge loans are, how they work, and how to get one In this article: What is a bridge loan? How does a bridge loan work? Bridge loan interest rates and terms Pros and cons A mortgage is a type of loan consumers use to purchase a house and agree to repay in equal, fixed monthly amounts over a certain time span, or term For many homebuyers, the mortgage process is an

Comments are closed.