What Is Consumer Use Tax

What Is Consumer Use Tax Taxjar Use tax is a type of sales tax charged on goods purchased outside a consumer's home jurisdiction and brought back home. it is up to consumers to calculate and pay use tax, which is the same rate as the local state sales tax, to protect in state retailers and fund state programs. Consumer use tax is the tax paid by the purchaser when the retailer does not charge sales tax. learn how it works, when it is due, and why online sellers need to understand it.

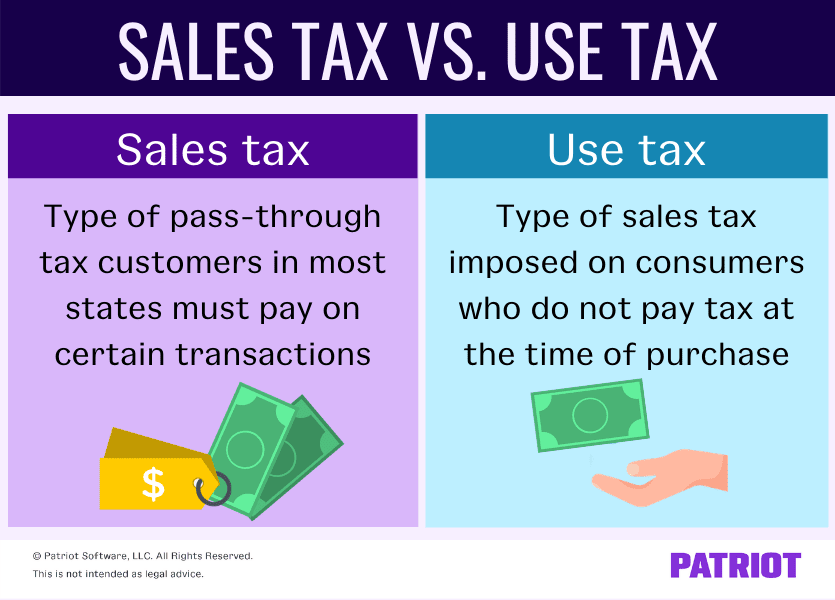

Use Tax Definition Example How Does Use Tax Works The differences. sales tax and use tax are both types of taxes that are imposed on the sale of goods and services. the main difference between the two is that sales tax is a tax on the sale of tangible personal property, while use tax is a tax on the use of that property within a state. Consumer use tax is a tax on the use, storage, or consumption of untaxed tangible personal property. learn how it differs from sales tax, what goods and services are subject to it, and how to comply with it. Use tax is a tax on taxable goods and services that are consumed, stored, or used in the jurisdiction. learn the difference between sales tax and use tax, who pays and reports them, and how to simplify compliance. Consumer use tax is a transaction tax imposed by state and local governments on purchases from out of state sellers that are not required to collect sales tax. learn the difference between consumer use tax and sales tax, when it applies, and how to comply with it.

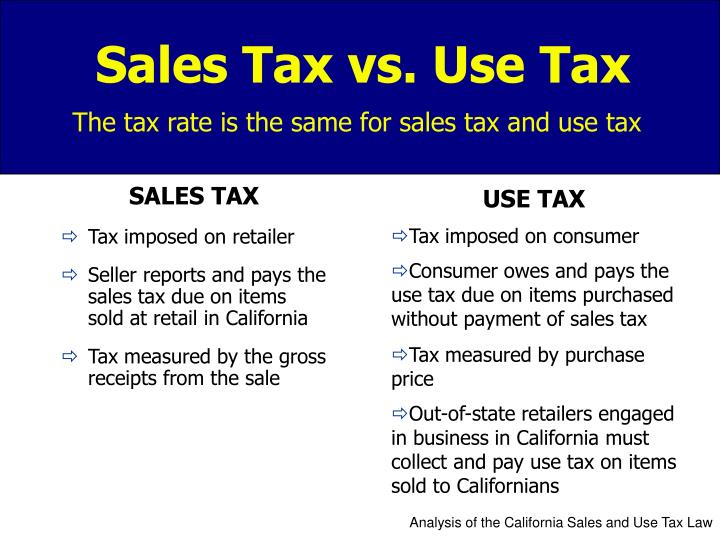

Sales Tax Vs Use Tax How They Work Who Pays More Use tax is a tax on taxable goods and services that are consumed, stored, or used in the jurisdiction. learn the difference between sales tax and use tax, who pays and reports them, and how to simplify compliance. Consumer use tax is a transaction tax imposed by state and local governments on purchases from out of state sellers that are not required to collect sales tax. learn the difference between consumer use tax and sales tax, when it applies, and how to comply with it. Most of the states are considered consumer tax states. use tax is defined as a tax on the storage, use, or consumption of a taxable item or service on which no sales tax has been paid. use tax is a complementary or compensating tax to the sales tax and does not apply if the sales tax was charged. use tax applies to purchases made outside the. Learn the differences and similarities between sales tax, consumer use tax and seller use tax, and how they apply to different types of sellers and buyers. find out when and how to collect, remit and report these taxes in various states and jurisdictions.

What Is Consumer Use Tax Youtube Most of the states are considered consumer tax states. use tax is defined as a tax on the storage, use, or consumption of a taxable item or service on which no sales tax has been paid. use tax is a complementary or compensating tax to the sales tax and does not apply if the sales tax was charged. use tax applies to purchases made outside the. Learn the differences and similarities between sales tax, consumer use tax and seller use tax, and how they apply to different types of sellers and buyers. find out when and how to collect, remit and report these taxes in various states and jurisdictions.

Ppt Sales Tax Vs Use Tax Powerpoint Presentation Id 1295294

Comments are closed.