What Is Credit Counseling

Credit Counseling Meaning Types Process Agency Selection Credit counseling can help you manage your money and debts, develop a budget, and organize a debt management plan. learn how to choose a reputable and certified credit counselor and avoid scams. Credit counseling is designed to help you create a game plan for managing your finances. this involves having a credit counselor look over your finances and use their expertise to help you create.

Your Guide To Credit Counseling Services вђ Forbes Advisor Credit counseling is a service that helps consumers manage their debt, budget, and avoid bankruptcy. learn how credit counseling works, what fees to expect, and how to find a reputable agency. Debt management plan:a counselor creates a plan to consolidate your consumer debts and lower the interest rate on your credit card debt, setting up one monthly payment to pay off the debt over. Credit counseling can help you improve your financial situation by offering tools and resources to manage your debt and credit. learn what credit counseling is, how to find a reputable agency, and what to expect from a session or a debt management plan. Credit counseling is a way to help those overwhelmed by debt or unable to manage their expenses. in credit counseling, you’ll work with a credit counselor to review your finances and find out.

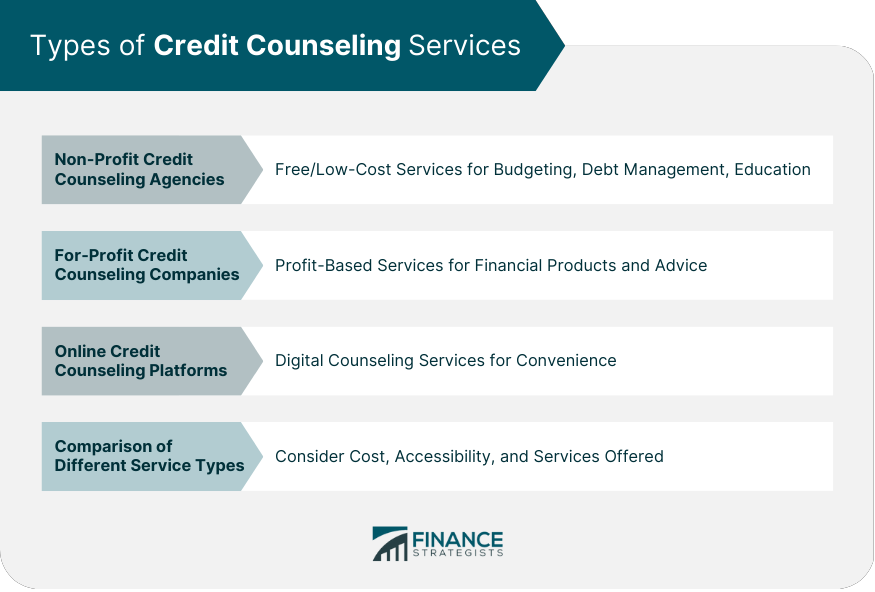

How Does Credit Counseling Affect Your Credit Critical Financial Credit counseling can help you improve your financial situation by offering tools and resources to manage your debt and credit. learn what credit counseling is, how to find a reputable agency, and what to expect from a session or a debt management plan. Credit counseling is a way to help those overwhelmed by debt or unable to manage their expenses. in credit counseling, you’ll work with a credit counselor to review your finances and find out. Credit counseling organizations offer a range of services, classes and programs around topics like bankruptcy, credit card debt, mortgages and reverse mortgages, foreclosure prevention, student. Credit counseling, also known as debt or financial counseling, is a process where licensed professionals help consumers resolve their financial challenges, like debt management and budgeting.

Comments are closed.