What Is Debt Relief Everything You Need To Know

What Is Debt Relief Everything You Need To Know The first step is realizing that you need help with managing debts. the next step is choosing a debt relief option. some of the ways debt relief can work include: interest rate reductions. changes. Debt forgiveness programs. with a debt forgiveness program, a creditor eliminates part or all of your debt based on factors like financial distress. debt forgiveness is typically used for non.

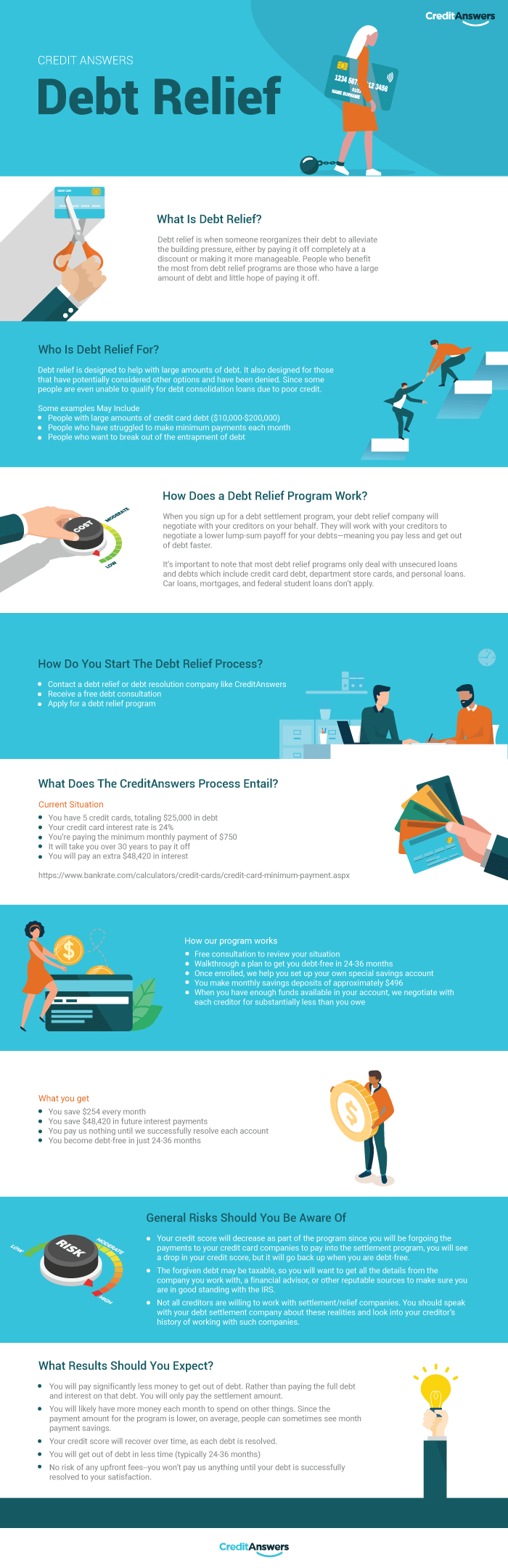

Debt Relief Everything You Need To Know Youtube The term "debt relief" can mean many different things, but the main goal of any debt relief program is usually to change the terms or amount of your debt so you can get back on your feet faster. Debt relief can take many forms, from consolidating debt to filing for bankruptcy. a so called debt relief program, also known as a debt settlement program, is a detailed road map designed to help. Debt relief involves the reorganization of a borrower's debts to make them easier to repay. it can also give creditors a chance to recoup at least a portion of what they are owed. debt relief can. Key takeaways. debt relief or debt settlement is a way to reduce or completely eliminate certain debts. debt consolidation, by contrast, can make debts easier to pay off but doesn't reduce or.

What Is Debt Relief Infographic Credit Answers Debt relief involves the reorganization of a borrower's debts to make them easier to repay. it can also give creditors a chance to recoup at least a portion of what they are owed. debt relief can. Key takeaways. debt relief or debt settlement is a way to reduce or completely eliminate certain debts. debt consolidation, by contrast, can make debts easier to pay off but doesn't reduce or. The most common debt relief options are: 1. debt management plans (dmps), which are facilitated by nonprofit credit counselors for a small fee 2. debt consolidation, which includes dmps but can also be done by taking out a personal loan or doing a credit card balance transfer to a credit card offering 0% apr for a period of time 3. debt. Debt relief programs offer consumers a pathway to financial freedom. these programs can help consumers deal with overwhelming debt in a number of ways, with each one offering a slightly different solution. sometimes the solution includes asking lenders for lower interest rates. sometimes it involves negotiating with lenders to reduce the total.

The Ultimate Guide To Debt Relief Everything You Need To Know Bi The most common debt relief options are: 1. debt management plans (dmps), which are facilitated by nonprofit credit counselors for a small fee 2. debt consolidation, which includes dmps but can also be done by taking out a personal loan or doing a credit card balance transfer to a credit card offering 0% apr for a period of time 3. debt. Debt relief programs offer consumers a pathway to financial freedom. these programs can help consumers deal with overwhelming debt in a number of ways, with each one offering a slightly different solution. sometimes the solution includes asking lenders for lower interest rates. sometimes it involves negotiating with lenders to reduce the total.

What Is Debt Relief The Complete Guide Debtstoppers

Comments are closed.