What Is E Invoice In Gst Tranzact

What Is E Invoice In Gst Tranzact E invoice also known as e invoicing is a system in which all business to business (b2b) invoices and other documents are electronically uploaded and authenticated on the government's gst invoice registration portal (irp). and after the successful verification of the invoice, a unique invoice reference number (irn) is generated by the irp portal. Applicability, limit & implementation date. e invoicing under gst denotes electronic invoicing defined by the gst law. just like how a gst registered business uses an e way bill while transporting goods from one place to another. similarly, certain notified gst registered businesses must generate e invoice for business to business (b2b.

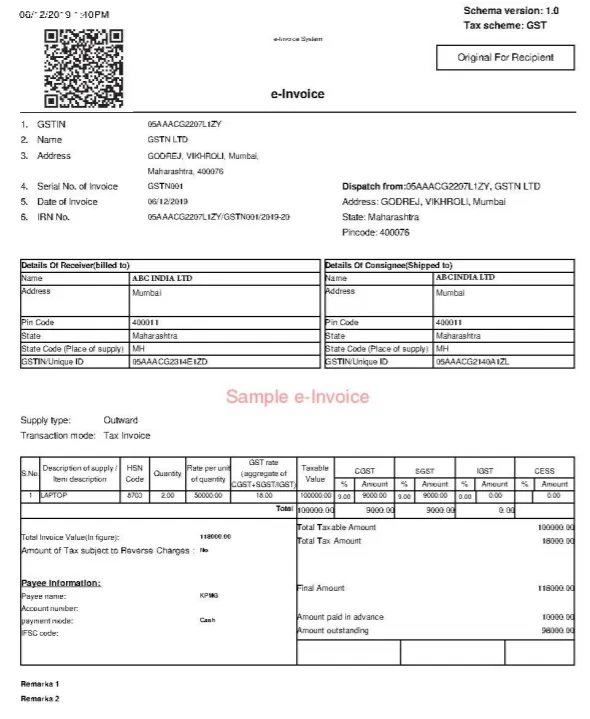

What Is E Invoice In Gst Tranzact 1. what is gst e invoice? gst e invoice is a type of invoicing or platform in india wherein b2b invoices are validated electronically by the goods and services tax network. the gst e invoicing system has introduced digital invoices for eligible goods and services a business offers to another. it is a move aimed at curbing fake gst e invoicing. Use taxpayer gst login credenals for logging into the e invoice portal. ii. on the dashboard of the portal, click on enable me for the e invoice tile. iii. alternavely, on the portal, click on the dashboard tile under quick actions, click on “enable me for e invoice” option. iv. E invoicing or electronic invoicing is a system introduced under gst. applicable taxpayers must report b2b invoices to the invoice registration portal (irp) and get it verified by the gstn. in return, they receive a unique invoice reference number (irn) and signed qr code. the e invoicing system was implemented from 1st october 2020 for. Go to "settings" on the left side of your tranzact dashboard. access the "advanced" option on the right side and click on "tax options." the list of gst slabs will appear on th screen, ranging from 0% to 28%. enable the tax option according to the type and price of your products.

What Is E Invoice In Gst Tranzact E invoicing or electronic invoicing is a system introduced under gst. applicable taxpayers must report b2b invoices to the invoice registration portal (irp) and get it verified by the gstn. in return, they receive a unique invoice reference number (irn) and signed qr code. the e invoicing system was implemented from 1st october 2020 for. Go to "settings" on the left side of your tranzact dashboard. access the "advanced" option on the right side and click on "tax options." the list of gst slabs will appear on th screen, ranging from 0% to 28%. enable the tax option according to the type and price of your products. Here's how you can upload e invoice in the gst portal: you need to login to your gst account. now, select the month for which you want to upload gst invoices. post this, select gstr 1 return and click on prepare online. now you can select b2b invoices and enter details of the invoices one by one. Benefits of e invoicing system. businesses have the following benefits by using e invoice system initiated by gstn: e invoice resolves and plugs a major gap in data reconciliation under gst to reduce mismatch errors. e invoices created on one software can be read by another, allowing interoperability and help reduce data entry errors.

Comments are closed.