What Is The Aim Of The Consumer Credit Act

What Is The Aim Of The Consumer Credit Act Commons Credit Portal Org The truth in lending act (tila) the truth in lending act, or title i, was part of the original consumer credit protection act that congress enacted in may of 1968. it has gone through several. 1. right to safety. consumers have the right to be safe while using the product they purchased. this was put into law in 1972 and is enforced by the consumer protection safety commission, which regulates testing of products and created standards and warning labels. 2. right to information.

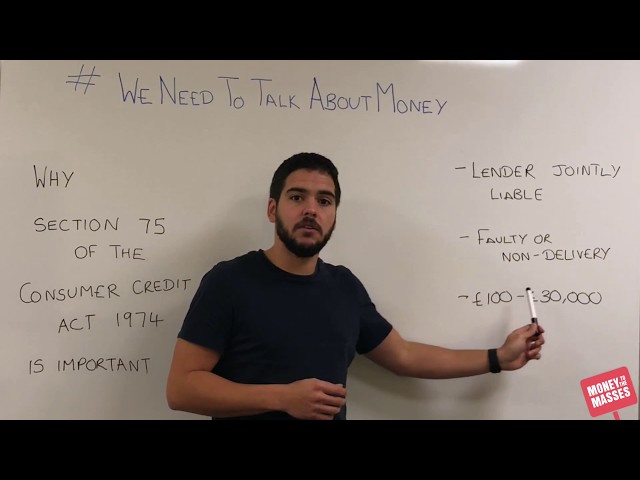

What Is Section 75 Of The Consumer Credit Act The consumer credit protection act of 1968 (ccpa) is federal legislation that created protections for consumers from banks, credit card companies, and other lenders. the act mandates disclosure. Your consumer credit rights are protected in large part by the consumer credit protection act (ccpa), which became effective in the late 1960s. this act is made up of several laws which each protect an aspect of your personal credit, such as banning discrimination or requiring honest credit reports. since its inception, the ccpa has grown to. Consumer credit refers to the ability of a consumer to access a loan. the most common form of credit used by consumers is a credit card account issued by a financial institution. merchants may also provide direct financing for products which they sell. banks may directly finance purchases through loans and mortgages. The consumer credit protection act (ccpa) helps ensure consumer protections around things like privacy, credit access, credit reporting and debt collection. read on to learn more about ccpa and some of the protections it provides. key takeaways. ccpa rules apply to banks, lenders and other financial institutions.

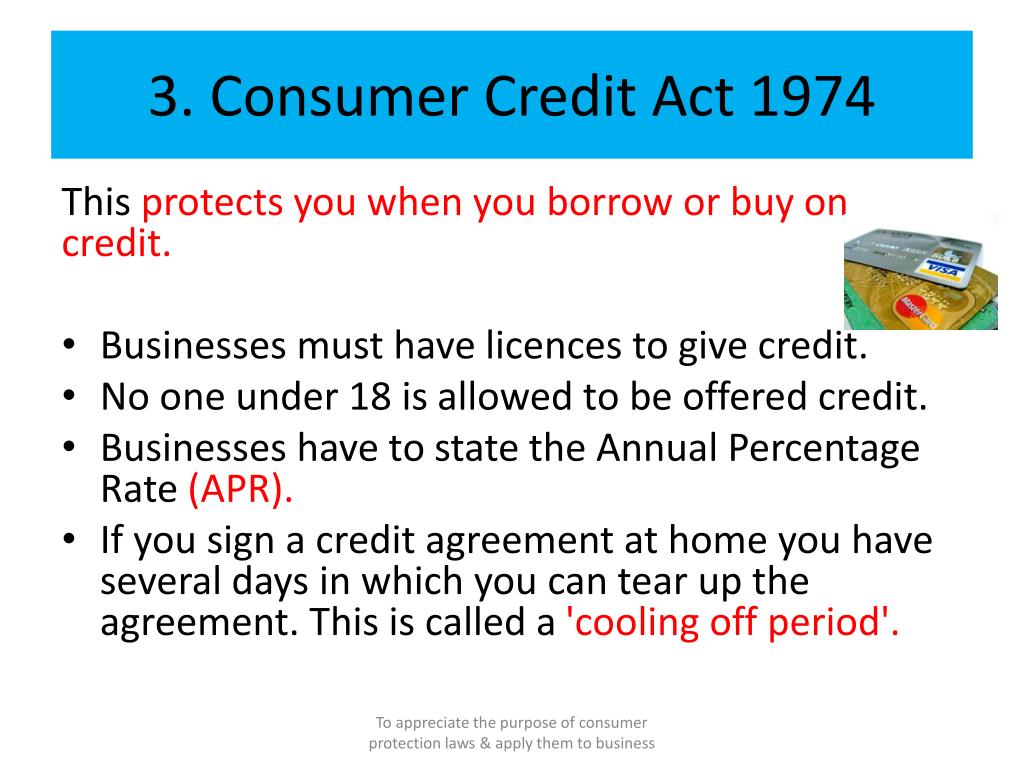

Ppt Consumer Protection Laws Powerpoint Presentation Free Download Consumer credit refers to the ability of a consumer to access a loan. the most common form of credit used by consumers is a credit card account issued by a financial institution. merchants may also provide direct financing for products which they sell. banks may directly finance purchases through loans and mortgages. The consumer credit protection act (ccpa) helps ensure consumer protections around things like privacy, credit access, credit reporting and debt collection. read on to learn more about ccpa and some of the protections it provides. key takeaways. ccpa rules apply to banks, lenders and other financial institutions. Consumer financial protection bureau, " what protections do i have against credit discrimination? " accessed sept. 12, 2023. federal trade commission, " fair credit reporting act ." accessed sept. The fair credit reporting act is the primary federal law that governs the collection and reporting of credit information about consumers. its rules cover how a consumer's credit information is.

Comments are closed.