What Is The Purpose Of A W 9

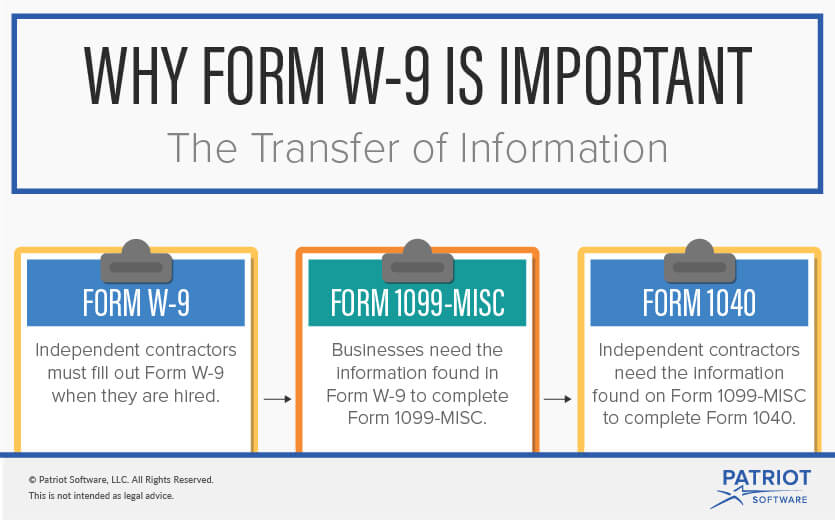

W9 Form When And Why To Use It Harvard Business Services Form w 9 is a commonly used irs form for providing necessary information to a person or company that will be making payments to another person or company. one of the most common situations is when someone works as an independent contractor for a business. when you are hired as a contractor for a business or beginning work as a freelancer, you may be asked to complete a w 9 and provide it to. All form w 9 revisions. about publication 515, withholding of tax on nonresident aliens and foreign entities. about publication 519, u.s. tax guide for aliens. publication 1281, backup withholding for missing and incorrect name tin(s) pdf. publication 5027, identity theft information for taxpayers pdf. video: how to complete form w 9. other.

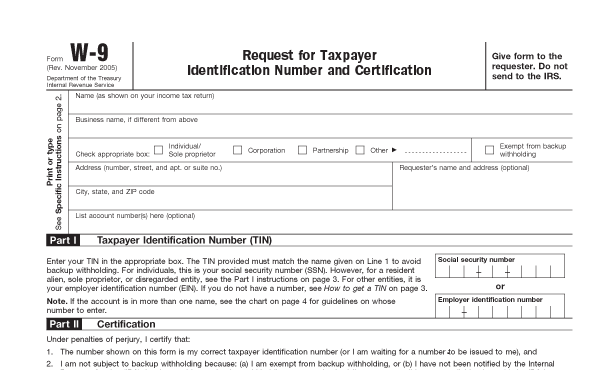

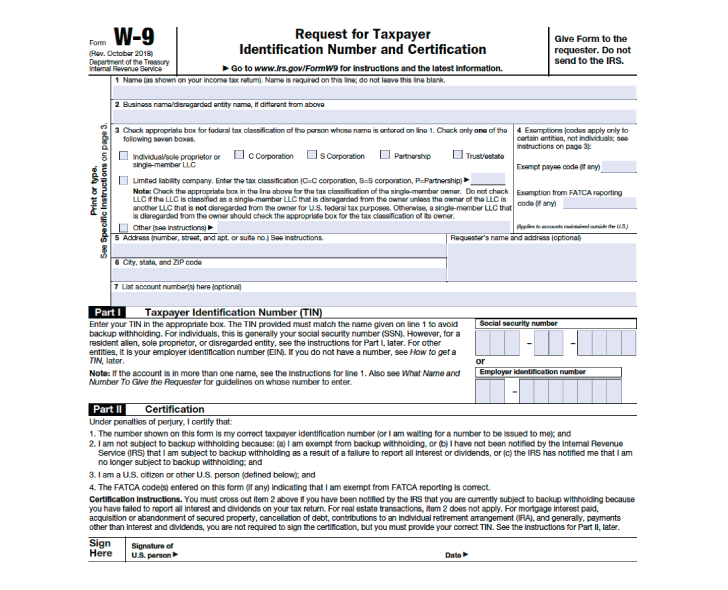

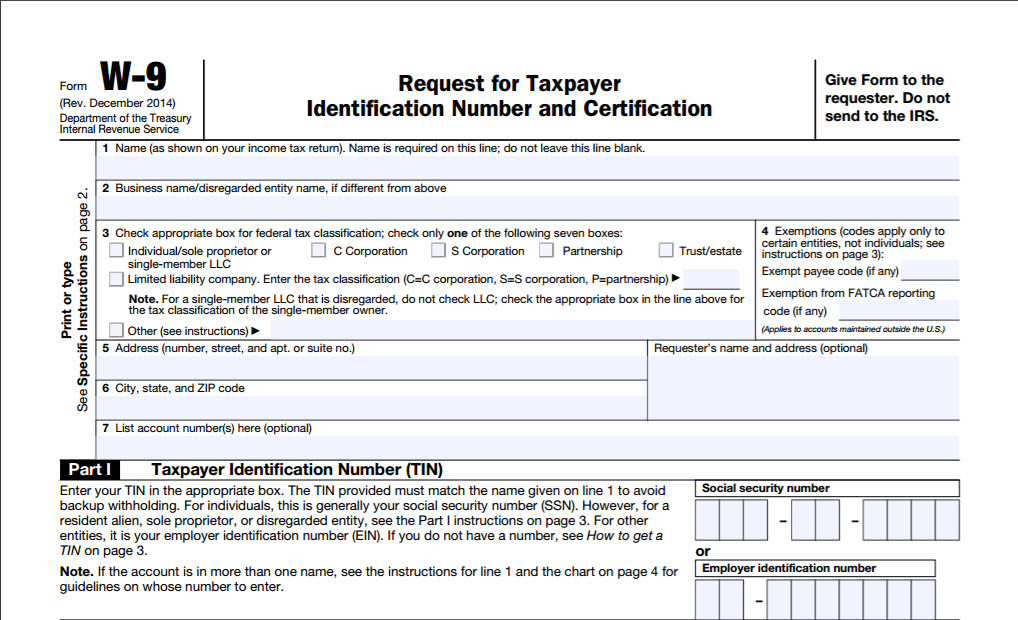

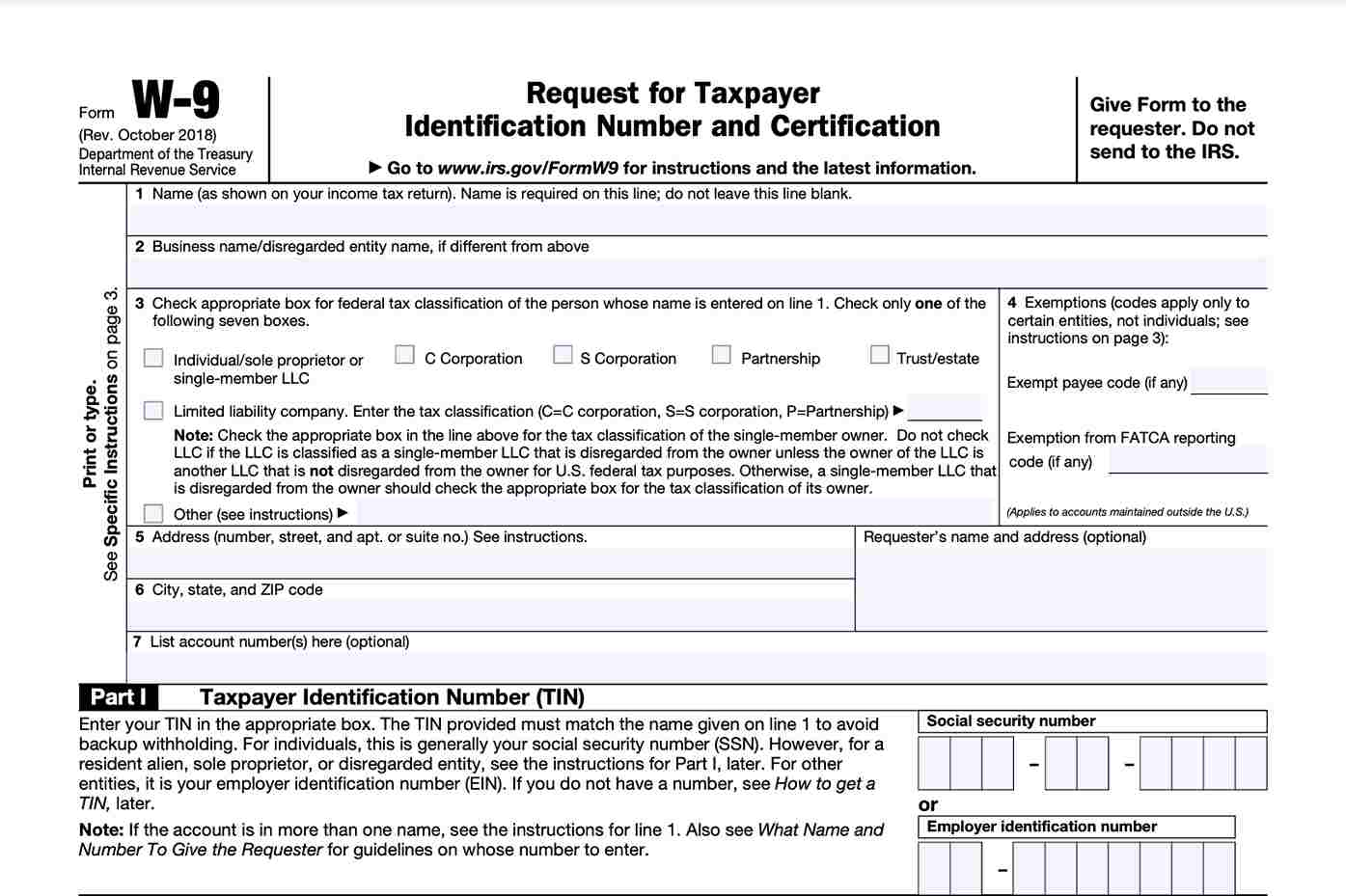

What Is W 9 Form The purpose of a w 9 is to gather tax information from a vendor. when a company pays a non employee or other entity more than $600 in a year for their service, the company must file an information. A w 9 form is an internal revenue service (irs) tax form that is used to confirm a person's name, address, and taxpayer identification number (tin) for employment or other income generating. Form w 9 is an irs document that businesses use to collect a person's tax identification number (tin). independent contractors who were paid at least $600 during the year need to fill out a w 9. The form, officially called form w 9, request for taxpayer identification number and certification, is typically used when a person or entity is required to report certain types of income. the form helps businesses obtain important information from payees to prepare information returns for the irs. taxpayers use the w 9 tax form to verify their.

W 9 What Is It And How Do You Fill It Out Smartasset Form w 9 is an irs document that businesses use to collect a person's tax identification number (tin). independent contractors who were paid at least $600 during the year need to fill out a w 9. The form, officially called form w 9, request for taxpayer identification number and certification, is typically used when a person or entity is required to report certain types of income. the form helps businesses obtain important information from payees to prepare information returns for the irs. taxpayers use the w 9 tax form to verify their. Use form w 9 to request the taxpayer identification number (tin) of a u.s. person (including a resident alien) and to request certain certifications and claims for exemption. (see purpose of form on form w 9.) withholding agents, defined later, may require signed forms w 9 from u.s. exempt recipients to overcome a presumption of foreign status. Form w 9 is an “information return,” meaning it’s just for giving someone else a piece of information they need (rather than the irs). but because you’re not sending it to the irs, you need to be careful about who exactly you send it to. the irs made two updates to form w 9 in december 2023, affecting form w 9 for the 2024 tax year.

Fill And Sign W9 Form Online For Free Digisigner Use form w 9 to request the taxpayer identification number (tin) of a u.s. person (including a resident alien) and to request certain certifications and claims for exemption. (see purpose of form on form w 9.) withholding agents, defined later, may require signed forms w 9 from u.s. exempt recipients to overcome a presumption of foreign status. Form w 9 is an “information return,” meaning it’s just for giving someone else a piece of information they need (rather than the irs). but because you’re not sending it to the irs, you need to be careful about who exactly you send it to. the irs made two updates to form w 9 in december 2023, affecting form w 9 for the 2024 tax year.

Form W 9 And Taxes Everything You Should Know Turbotax Tax Tips

Comments are closed.