What To Expect From Digital Banking In 2023 Jpmorgan Chase Co

What To Expect From Digital Banking In 2023 Jpmorgan Chase Co Three trends you can expect to see in digital banking this year with chase's head of digital products and channels, sonali divilek.subscribe: jpm. These were largely offset by internal efficiencies and incremental investments were in line at $1.1 billion. for 2023, we expect to end the year at $15.3 billion in spend driven by increased volumes, wage inflation and targeted investments primarily in ccb.

Jpmorgan Chase Digital Transformation Ai And Data Strategy Sets Up In the united states, bank deposit accounts and related services, such as checking, savings and bank lending, are offered by jpmorgan chase bank, n.a. member fdic. jpmorgan chase bank, n.a. and its affiliates (collectively “jpmcb”) offer investment products, which may include bank managed investment accounts and custody, as part of its. New york, feb. 13, 2024 —a new survey from chase found 62% of consumers said they can’t live without their mobile banking app, and 78% are using it weekly. banking app users are doing more than just transacting and the majority would prefer one app to manage all their money needs. the survey also found increased interest in financial health. 1:40 banking. strong foundations: how we foster successful banking relationships. sep 10, 2024. our bankers share how they create meaningful connections with diverse business owners, and why relationship banking matters. Digital banking was more popular than ever in 2021, and we expect that small business owners and consumers’ digital engagement with banks will continue to accelerate in 2022 because of four key trends. 1. technology that puts consumers & small business owners in control. more than ever, our customers are empowered to track their money habits.

Jpmorgan Chasevoice Banking On The Go The Future Of Digital Banking 1:40 banking. strong foundations: how we foster successful banking relationships. sep 10, 2024. our bankers share how they create meaningful connections with diverse business owners, and why relationship banking matters. Digital banking was more popular than ever in 2021, and we expect that small business owners and consumers’ digital engagement with banks will continue to accelerate in 2022 because of four key trends. 1. technology that puts consumers & small business owners in control. more than ever, our customers are empowered to track their money habits. Jpmorgan chase (jpm) is a financial holding company that provides consumer and commercial banking, investment banking, financial transaction processing, and asset management solutions. In 2022, ccb delivered a 29% return on equity (roe) on net income of $14.9 billion. revenue of $55 billion was up 10% year over year, and our overhead ratio was 57%, down one percentage point. we take a long term approach to investments and focus on delivering sustainable growth and outperformance.

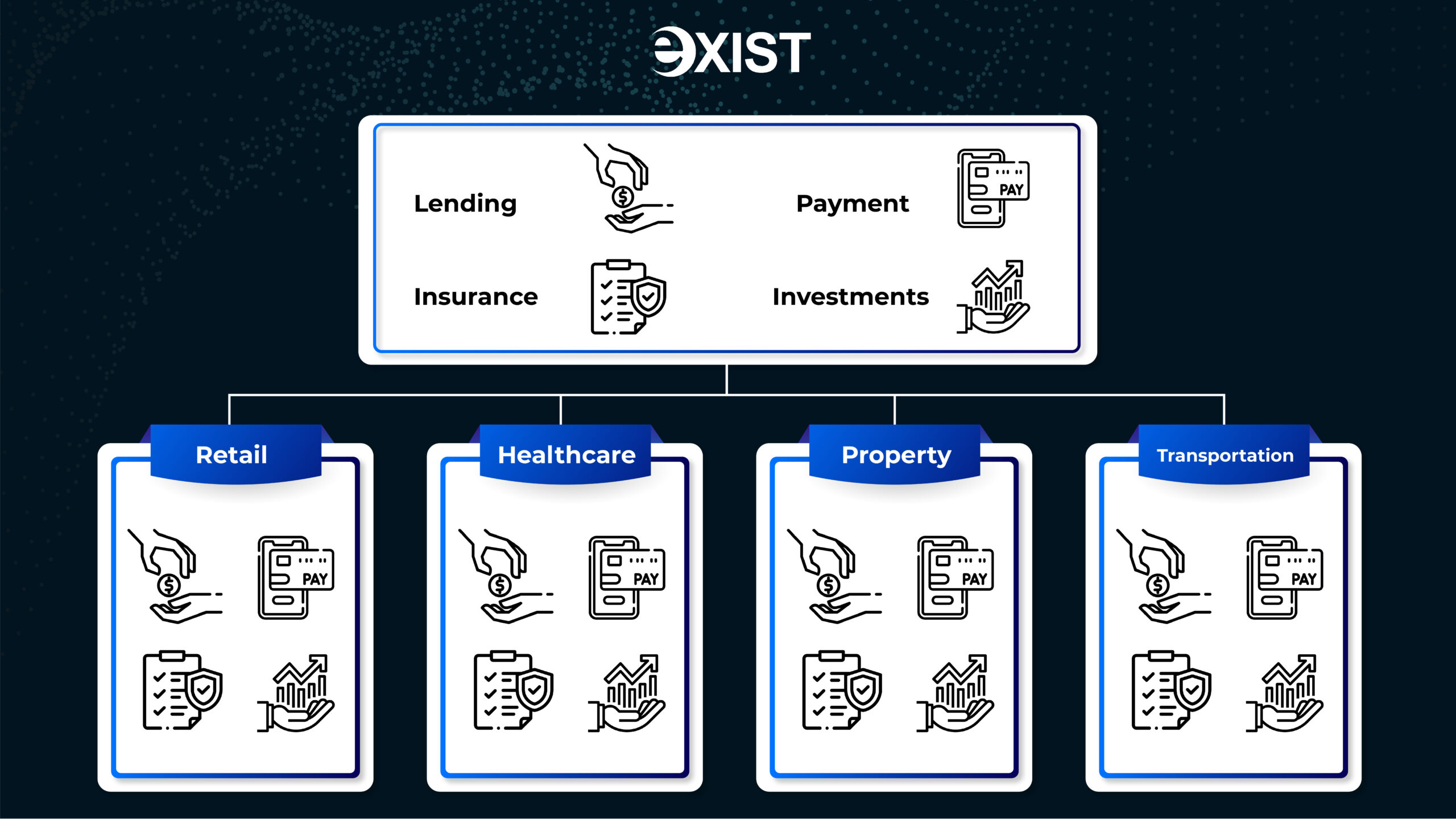

Digital Banking In 2023 What To Expect Exist Software Labs Jpmorgan chase (jpm) is a financial holding company that provides consumer and commercial banking, investment banking, financial transaction processing, and asset management solutions. In 2022, ccb delivered a 29% return on equity (roe) on net income of $14.9 billion. revenue of $55 billion was up 10% year over year, and our overhead ratio was 57%, down one percentage point. we take a long term approach to investments and focus on delivering sustainable growth and outperformance.

Comments are closed.