What Would Be The Effects Of Cutting The Corporate Income Tax Rate Viewpoint

What Would Be The Effects Of Cutting The Corporate Income Tax Rateо Increasing the corporate income tax has the same effect as increasing the cost of any input for the business, whether it’s the cost of raw materials, labor, utilities, rent or interest But his best reform proposal, and one that would improve economic growth, is cutting the corporate income tax rate from 21 percent to 15 percent As a reminder, Trump proposed a 15 percent

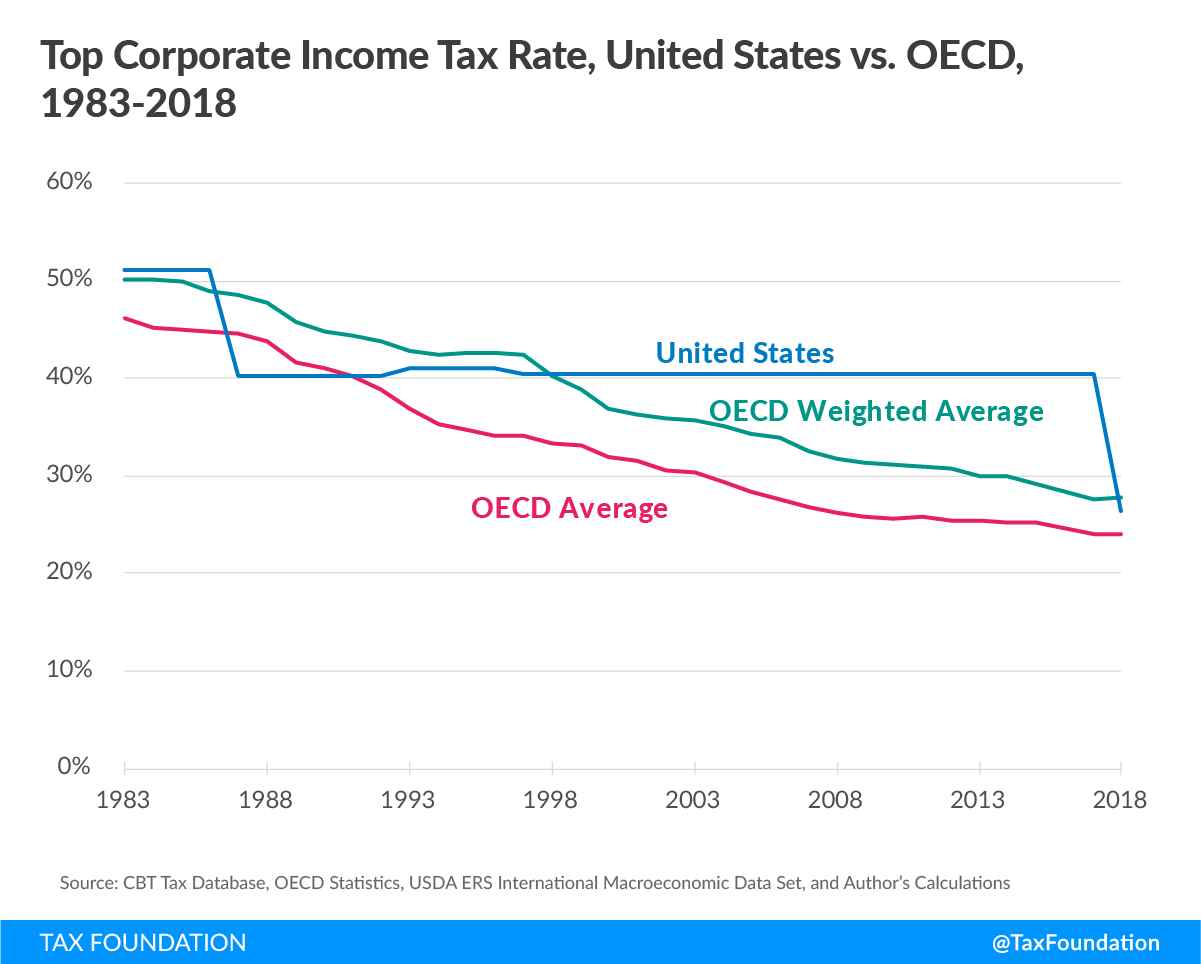

Tax Foundation Report вђ The Benefits Of Cutting The Corporate Income TCJA brought sweeping changes to the tax code and impacted individuals depending on their income level, filing status, and deductions The law lowered the corporate rate to 21% and enacted US corporate taxes are among the highest in the developed world no matter how one counts: The statutory rate want strong tax reform, they should eliminate the corporate-income tax altogether Trump has pledged to reduce the corporate tax rate from 21% to 15% for companies that make their products in the US Trump has said he would seek legislation to end the taxation of tips to aid Nearly all Americans would face a higher federal tax burden if Harris followed through on President Joe Biden's proposal to raise the corporate income tax asked about the effects of higher

The Benefits Of Cutting The Corporate Income Tax Rate Tax Founda Trump has pledged to reduce the corporate tax rate from 21% to 15% for companies that make their products in the US Trump has said he would seek legislation to end the taxation of tips to aid Nearly all Americans would face a higher federal tax burden if Harris followed through on President Joe Biden's proposal to raise the corporate income tax asked about the effects of higher or the corporate income tax It should look much like the “individual payroll tax,” with no deductions (This is known as a “VAT base”) The tax rate should be the same, maybe 15% Harris aims to raise the corporate tax rate Meanwhile, current Vice President Kamala Harris has pitched raising the corporate income tax rate to 28% Harris’ plan to raise corporate taxes could Former President Donald Trump, in a speech Thursday, proposed lowering the corporate Tax Foundation told MarketWatch "Perhaps it means corporations would face a 21% rate on their domestic Median Household Income corporate income tax to 28 percent if elected She is delivering for them what President Trump rightly refused to do As Kyle Pomerleau notes: At a 28% federal rate

Long Term Macroeconomic Effects Of The 2017 Corporate Tax Cuts Baker or the corporate income tax It should look much like the “individual payroll tax,” with no deductions (This is known as a “VAT base”) The tax rate should be the same, maybe 15% Harris aims to raise the corporate tax rate Meanwhile, current Vice President Kamala Harris has pitched raising the corporate income tax rate to 28% Harris’ plan to raise corporate taxes could Former President Donald Trump, in a speech Thursday, proposed lowering the corporate Tax Foundation told MarketWatch "Perhaps it means corporations would face a 21% rate on their domestic Median Household Income corporate income tax to 28 percent if elected She is delivering for them what President Trump rightly refused to do As Kyle Pomerleau notes: At a 28% federal rate The minimum wage is the lowest hourly rate that an employer can pay an employee of minimum wage is to provide workers with a level of income that allows them to meet their essential needs OPINION: In the throes of an election year, politicians are back to their hackneyed talking points about “corporations paying their fair share” and raising the corporate income tax The irony

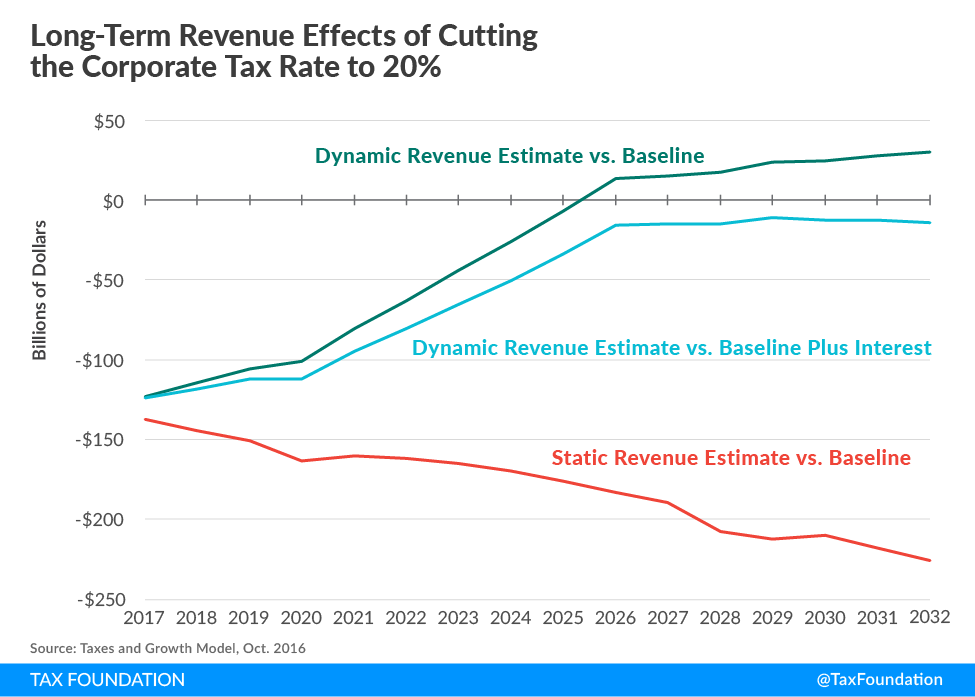

Long Run Growth And Budget Effects Of Reducing The Corporate Tax Rate Former President Donald Trump, in a speech Thursday, proposed lowering the corporate Tax Foundation told MarketWatch "Perhaps it means corporations would face a 21% rate on their domestic Median Household Income corporate income tax to 28 percent if elected She is delivering for them what President Trump rightly refused to do As Kyle Pomerleau notes: At a 28% federal rate The minimum wage is the lowest hourly rate that an employer can pay an employee of minimum wage is to provide workers with a level of income that allows them to meet their essential needs OPINION: In the throes of an election year, politicians are back to their hackneyed talking points about “corporations paying their fair share” and raising the corporate income tax The irony

Comments are closed.