Where Does Gas Tax Money Go

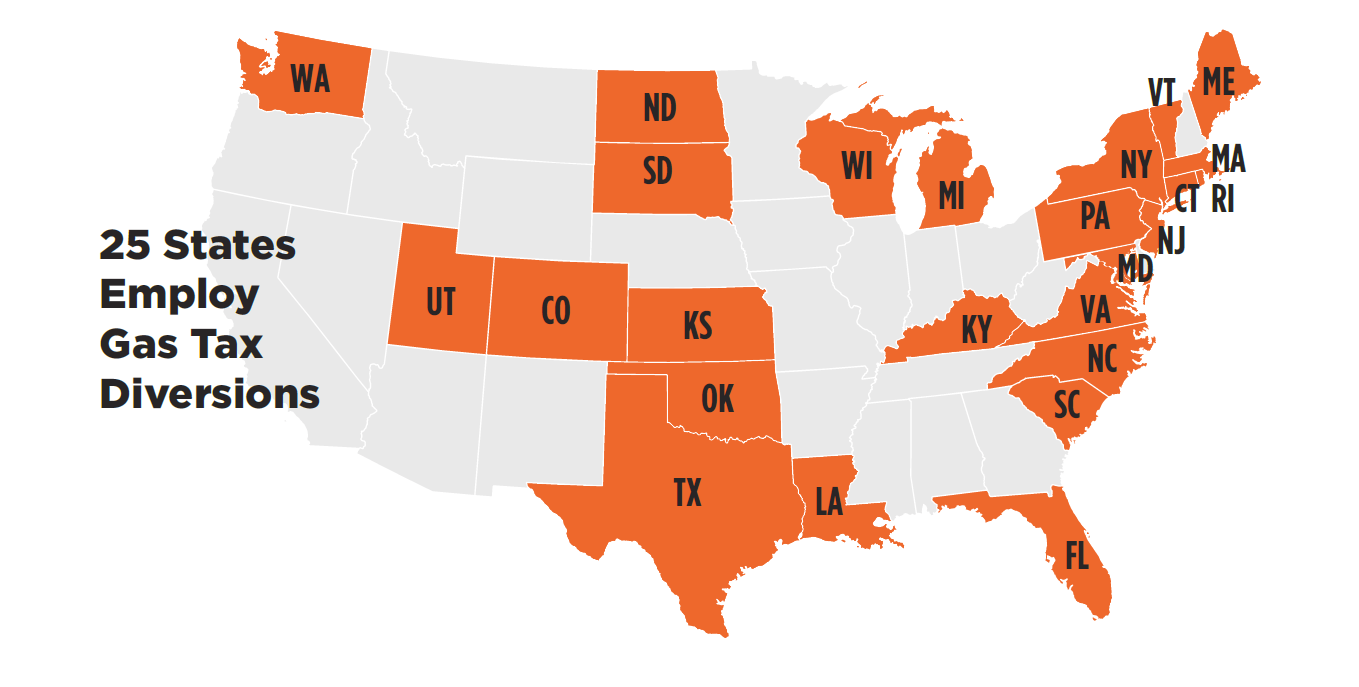

Gas Taxes Where Does Your Money Actually Go вђ East Bay Times For example, if gas tax money makes up 50 percent of a particular budgetary account (along with, say money from the federal government or other parts of the state budget), then we assume that for every dollar the fund spends on a given program, 50 cents come from the gas tax. in short: what you’re seeing here isn’t all state transportation. Diversions can leave roads and highways underfunded. the 10 states diverting the largest percentage of their gas tax money: new york diverts 37.5% of its gas tax revenue, rhode island diverts 37.1%, new jersey and michigan divert 33.9%, maryland diverts 32.5%, connecticut diverts 27%, texas diverts 24%, massachusetts diverts 23.9%, florida.

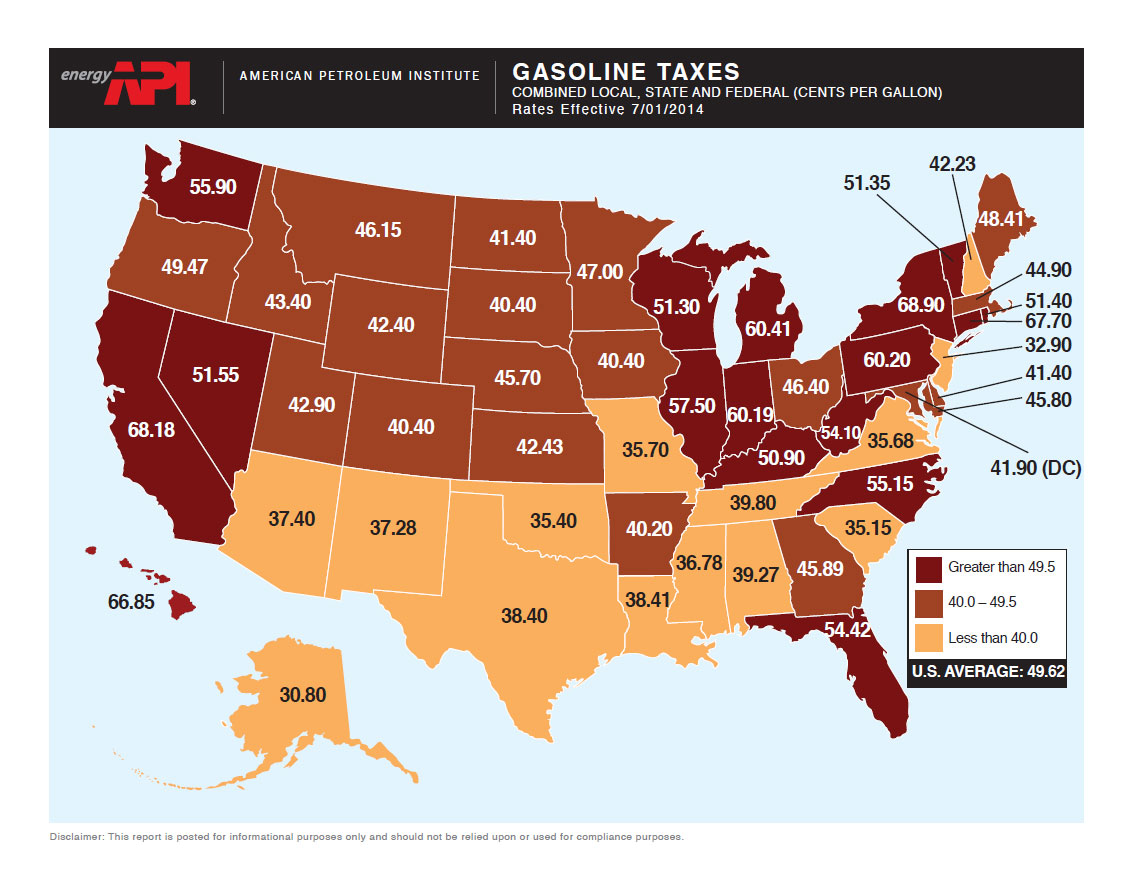

This Map Shows Where Gas Is Taxed The Most Time States with the highest gas taxes. according to the eia, the 10 states where drivers pay the highest average gas taxes in 2023 are: illinois: 85.8 cents. california: 83.5 cents. pennsylvania: 80.6 cents. indiana: 72.3 cents. washington: 70.8 cents. Updated: 4:03 pm pst november 15, 2019. seattle — the state of washington has the 4th highest gas tax in the country next to california, pennsylvania, and illinois. the current rate is 49.5. Gas taxes are largely used to fund infrastructure maintenance and new projects, but the amount of state and local road spending covered by gas taxes, tolls, user fees, and user tax es varies widely among states. it ranges from only 6.9 percent in alaska to 71 percent in hawaii. in the contiguous 48 states, north carolina relies the most on. When you add up all the taxes and fees, the average state gas tax stood at 32.26 cents per gallon on july 1, 2023, according to the u.s. energy information administration. throw in the 18.4 cents.

Where The Money Goes Road Commission For Oakland County Gas taxes are largely used to fund infrastructure maintenance and new projects, but the amount of state and local road spending covered by gas taxes, tolls, user fees, and user tax es varies widely among states. it ranges from only 6.9 percent in alaska to 71 percent in hawaii. in the contiguous 48 states, north carolina relies the most on. When you add up all the taxes and fees, the average state gas tax stood at 32.26 cents per gallon on july 1, 2023, according to the u.s. energy information administration. throw in the 18.4 cents. States also frequently use gas tax money to fund state level executive departments. michigan diverts 25.9 percent and texas diverts 24.7 percent of gas tax revenue to school aid funds. similarly, georgia diverts 13.1 percent of gas tax revenue to k 12 and secondary education. The gas tax money does not pay for light rail transit or for buses. that's a separate sales tax in the metro area. and money from counties and the federal government.

Where Does Gas Tax Money Go Youtube States also frequently use gas tax money to fund state level executive departments. michigan diverts 25.9 percent and texas diverts 24.7 percent of gas tax revenue to school aid funds. similarly, georgia diverts 13.1 percent of gas tax revenue to k 12 and secondary education. The gas tax money does not pay for light rail transit or for buses. that's a separate sales tax in the metro area. and money from counties and the federal government.

The State Gas Tax Money That Is Diverted Away From Roads And Highways

Comments are closed.