Whole Life Insurance Pros And Cons 18 Advantages And Disadvan

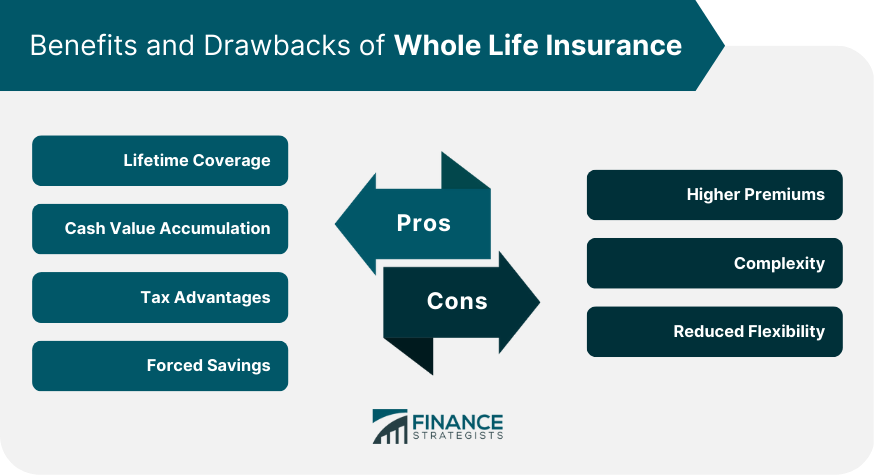

Whole Life Insurance Pros And Cons 18 Advantages And Di Living benefits. whole life insurance living benefits provide another level of security as the policy acts as buffer in a worst case scenario where you are diagnosed as terminally or chronically ill. terminal illness rider or accelerated death benefit. an accelerated death benefit typically is included in your policy at no additional cost. Pros and cons of using whole life insurance as an investment. whole life insurance can offer both advantages and disadvantages. here’s a quick rundown of the main pros and cons. pros: whole life.

Whole Life Insurance Definition Features Types Pros Cons Many people prefer whole life insurance because it is permanent and offers a cash value. buyers are also drawn to the policy’s predictability, since premiums and death benefits don’t change. Whole life insurance is one option for a buy sell agreement. disadvantages of a whole life insurance policy. expensive: whole life insurance policy tends to be an expensive way to buy coverage. Whole life insurance, by definition, covers you for your entire life, as long as you pay the premiums. it is sometimes referred to as "guaranteed whole life insurance," because companies promise to keep premiums the same the whole time you have the policy. if you die, and the policy hasn't lapsed, your beneficiaries will receive a payout. The cost of whole life insurance tends to be much higher than term life insurance. for example, a healthy 40 year old man can expect to pay an average annual premium of $7,440 for a $500,000.

Comments are closed.