Why You Should File Taxes Early

7 Reasons Why File Your Tax Return Early Aotax Youtube Faster tax refunds. one of the most common reasons to file taxes early is to receive a faster tax refund. filing your return electronically with direct deposit into your bank account is the fastest way to get your refund. it can take up to several weeks longer for paper returns, so it is always better to e file a return if you want to receive. Filing an extension for a given year could postpone the date on which you could file for bankruptcy to have that year’s taxes discharged. 3. allowing for delays in processing. the irs is known.

Here S Why You Should File Your Taxes Early In 2023 Key takeaways. if you are due to receive a refund, filing early lets you obtain your refund sooner. if you owe taxes, preparing your return early gives you more time to save money to pay your taxes. preparing an early tax return can let you know if you qualify to make a contribution to a tax advantaged plan and give you extra time to save for a. If you miss the mid april filing deadline, the irs could charge you a failure to file penalty equal to 5% of the unpaid taxes for each month (or part of a month) that your return is late. this. W 2 forms from wage earning jobs. 1099 forms from independent contractor or gig work.; 1099 forms from retirement, brokerage or dividend income. 1099 k forms if you received more than $20,000 and. Here are six reasons to get your act together early this tax season.. 1. early filers avoid processing delays. the irs had a dumpster fire on its hands during the 2023 tax season. at the end of may, the agency still had 2.4 million unprocessed paper tax returns. 2.

Reasons Why You Should File Your Taxes Early Your Money Mom W 2 forms from wage earning jobs. 1099 forms from independent contractor or gig work.; 1099 forms from retirement, brokerage or dividend income. 1099 k forms if you received more than $20,000 and. Here are six reasons to get your act together early this tax season.. 1. early filers avoid processing delays. the irs had a dumpster fire on its hands during the 2023 tax season. at the end of may, the agency still had 2.4 million unprocessed paper tax returns. 2. The irs will start accepting tax returns for the 2020 tax year on february 12, 2021. this is a little bit later than normal, as the agency usually opens the filing season at the end of january. Even though many taxpayers file their tax returns on or about april 15 each year, there is no need to put it off until the last minute. filing a tax return early can make sense for various reasons.

Why You Should File Your Taxes Early Lifehacker The irs will start accepting tax returns for the 2020 tax year on february 12, 2021. this is a little bit later than normal, as the agency usually opens the filing season at the end of january. Even though many taxpayers file their tax returns on or about april 15 each year, there is no need to put it off until the last minute. filing a tax return early can make sense for various reasons.

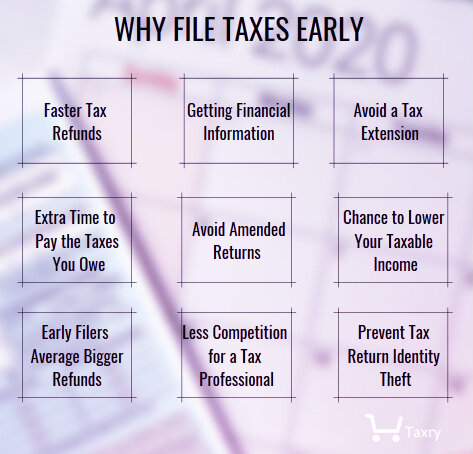

Why Is It Good To File Your Taxes Early вђ Taxry

Comments are closed.