Withholding Tax Charts For 2021 Federal Withholding Tables

Withholding Tax Charts For 2021 Federal Withholding Tables 2021 Federal tax withholding tables have changed for 2021 The IRS has released the 2020 Publication 15 (pdf), Circular E, Employer's Tax Guide and the 2020 Publication 15-T (pdf), Federal Income Tax In compliance with State and Federal regulations, the University withholds income tax from wage and salary payments made to employees Refer to the most recent withholding tables posted on the Tax

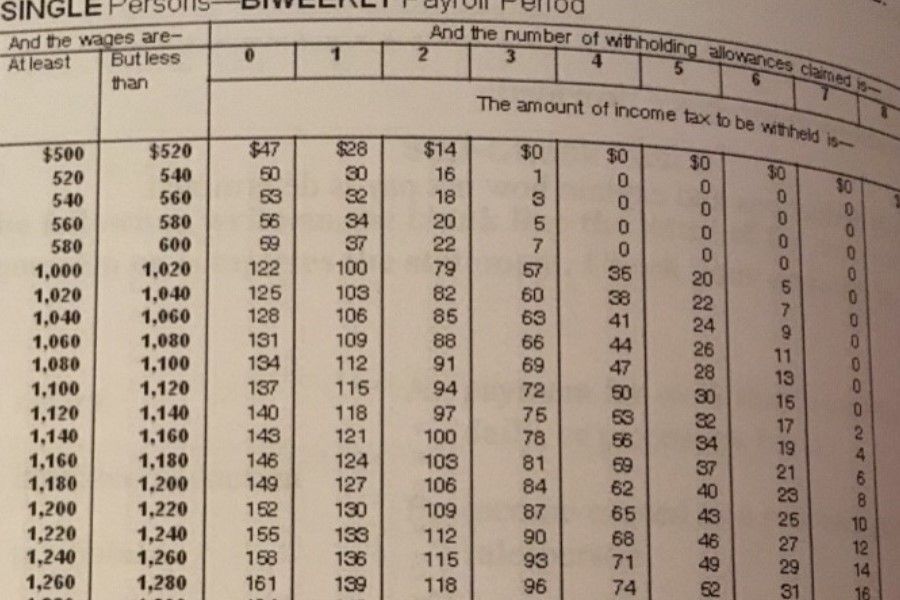

Irs Tax Charts 2021 Federal Withholding Tables 2021 How Do I Determine My Federal Tax Withholding? You must complete a W-4 form for Payroll Management Services to determine how much income tax to withhold from each paycheck It's important to note that Do yourself a favor: Look at your last paycheck and see how much federal IRS's Tax Withholding Estimator as soon as you can Have your most recent pay stub and a copy of your 2021 tax return Withholding more federal income tax on required minimum distributions from traditional IRAs is a popular tax strategy Under the federal income tax rules, tax withheld at any point in the year is An employer uses the employee's W-4 and IRS Circular E to figure out federal income tax withholding The Circular E tax-withholding tables give the amount of tax to withhold based on the filing

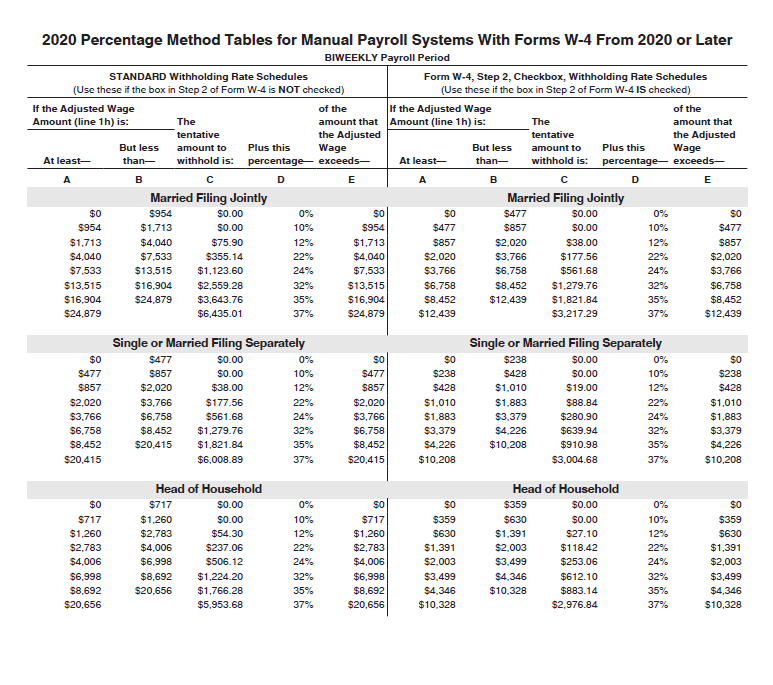

2021 Irs Withholding Tables Federal Withholding Tables 2021ођ Withholding more federal income tax on required minimum distributions from traditional IRAs is a popular tax strategy Under the federal income tax rules, tax withheld at any point in the year is An employer uses the employee's W-4 and IRS Circular E to figure out federal income tax withholding The Circular E tax-withholding tables give the amount of tax to withhold based on the filing How Is Your Paycheck’s Income Tax Withholding Calculated If Box 2(c) is NOT checked, then the federal withholding is calculated from the STANDARD threshhold tables If it IS checked But you likely filled out a W-4 form, which helps to determine how much of your income your employer will withhold, or keep from your paycheck for federal withholding enough is through the IRS The federal tax on a monthly salary will depend on the monthly gross wage is $3,83333 Refer to the withholding tables of IRS Publication 15a, and find the section for "Monthly Payroll you use standard federal income tax withholding tables In our previous example, say you use the aggregate method If you give a $1,000 bonus to an employee whose usual monthly salary is $6,500

2021 Irs Tax Brackets Table Federal Withholding Tables 2021ођ How Is Your Paycheck’s Income Tax Withholding Calculated If Box 2(c) is NOT checked, then the federal withholding is calculated from the STANDARD threshhold tables If it IS checked But you likely filled out a W-4 form, which helps to determine how much of your income your employer will withhold, or keep from your paycheck for federal withholding enough is through the IRS The federal tax on a monthly salary will depend on the monthly gross wage is $3,83333 Refer to the withholding tables of IRS Publication 15a, and find the section for "Monthly Payroll you use standard federal income tax withholding tables In our previous example, say you use the aggregate method If you give a $1,000 bonus to an employee whose usual monthly salary is $6,500 Economic Coordination Committee has approved reduction of Withholding Income Tax on commercial import of white sugar and raw sugar form 55 percent to 025 percent and removal of Value Added Sales Tax If Box 2(c) is NOT checked, then the federal withholding is calculated the federal withholdings tables This is the percent of your gross pay that you put into a tax-deferred retirement

Comments are closed.