Your Guide To Solar Federal Tax Credit

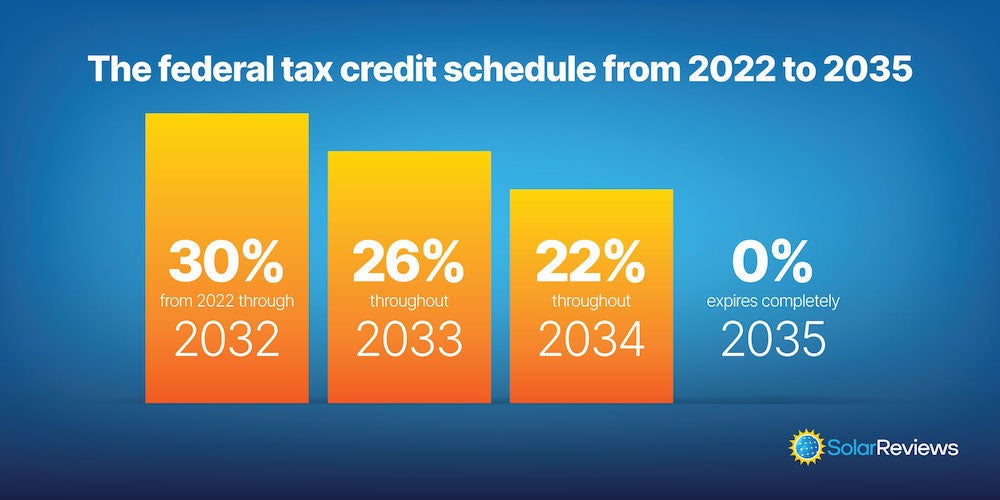

Your Guide To Solar Federal Tax Credit The installation of the system must be complete during the tax year. solar pv systems installed in 2020 and 2021 are eligible for a 26% tax credit. in august 2022, congress passed an extension of the itc, raising it to 30% for the installation of which was between 2022 2032. (systems installed on or before december 31, 2019 were also eligible. For example, if your solar pv system was installed before december 31, 2022, installation costs totaled $18,000, and your state government gave you a one time rebate of $1,000 for installing the system, your federal tax credit would be calculated as follows: 0.26 * $18,000 = $4,680. state tax credit.

The Federal Solar Tax Credit Explained Sunshine Plus Solar The residential clean energy credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through 2032. the credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034. you may be able to take the credit if you. For example, if you installed solar panels on your home in 2024 and paid $10,000, you could claim 30% or $3,000. so, if you owe $2,000 in taxes, you can apply $2,000 of your solar tax credit to. Here’s an example of how the solar tax credit works: if you installed a home solar power system for $20,000, you could claim a tax credit of $6,000. $20,000 solar installation costs x 30% = $6,000 tax credit value. so, if your tax liability was $15,000, the $6,000 tax credit would reduce what you owe to just $9,000. Homeowner’s guide to the federal tax credit for solar photovoltaics. this guide provides an overview of the federal investment tax credit for residential solar photovoltaics (pv). link: homeowner’s guide to the federal tax credit for solar photovoltaics.

Your Guide To The Solar Investment Tax Credit Sunfarm Energy Here’s an example of how the solar tax credit works: if you installed a home solar power system for $20,000, you could claim a tax credit of $6,000. $20,000 solar installation costs x 30% = $6,000 tax credit value. so, if your tax liability was $15,000, the $6,000 tax credit would reduce what you owe to just $9,000. Homeowner’s guide to the federal tax credit for solar photovoltaics. this guide provides an overview of the federal investment tax credit for residential solar photovoltaics (pv). link: homeowner’s guide to the federal tax credit for solar photovoltaics. According to our 2023 survey of homeowners with solar, respondents paid an average of $15,000 to $20,000 for their solar panel systems. when you factor in the 30% federal solar tax credit, the. Homeowners have until dec. 31, 2032 to receive the 30% tax credit. otherwise, you will receive 26% in 2033 and 22% in 2034. the system must also be new or being used for the first time during the specific tax year. you cannot qualify for the deduction with a pre owned solar system.

Federal Investment Solar Tax Credit Guide Learn How To Claim The According to our 2023 survey of homeowners with solar, respondents paid an average of $15,000 to $20,000 for their solar panel systems. when you factor in the 30% federal solar tax credit, the. Homeowners have until dec. 31, 2032 to receive the 30% tax credit. otherwise, you will receive 26% in 2033 and 22% in 2034. the system must also be new or being used for the first time during the specific tax year. you cannot qualify for the deduction with a pre owned solar system.

Complete Guide To The 2024 Federal Solar Tax Credit

Comments are closed.